Polymarket Gives Bitcoin 62% Odds of Hitting $120K by Month-End

0

0

Retail might be last to this bull market but we’re seeing big money pointing up for BTC ▲4.05% in real time. Institutions, quant traders, and crypto-native markets are all starting to echo the same call: Bitcoin 2025 price to $150,000 and fast.

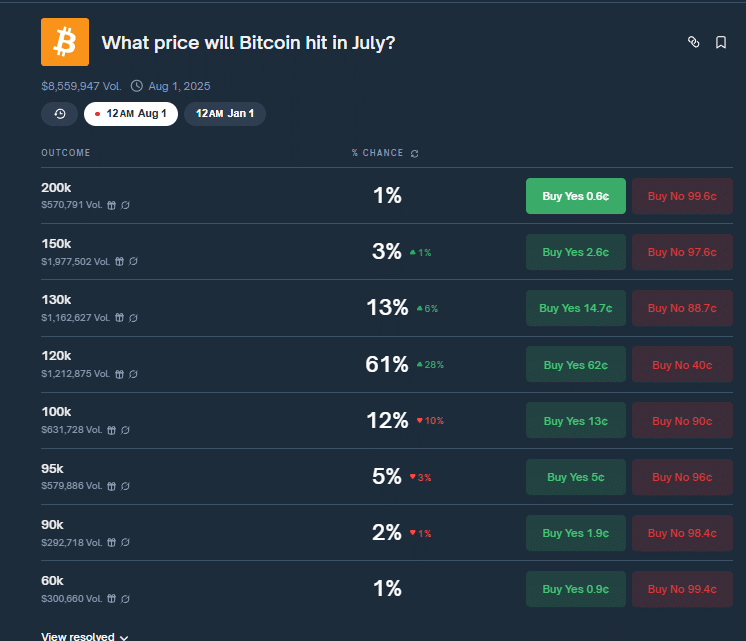

In fact, Polymarket just rewired its forecast, giving BTC a 61% chance of touching $120K before the month closes. That’s a forecast that, until last week, was reserved for a far-off future. Here’s what you should know:

$180,000 Bitcoin is “Very Much in Play”

Adding fuel to the fire, VanEck’s head of digital asset research, Matthew Sigel, laid out what he called the “perfect storm” forming for Bitcoin. According to Sigel, Bitcoin’s upside is being driven by:

-

“Persistent U.S. debt and deficit problems”

-

“A weakening dollar and demographic tailwinds”

-

“Rate cut momentum and potential Fed leadership change”

BREAKING

President Trump just EXPOSED the FED. It’s time to FIRE Jerome Powell immediately pic.twitter.com/V7tNWfhMGZ

— MAGA Voice (@MAGAVoice) July 8, 2025

Sigel isn’t alone. 99Bitcoin’s analysts across the space see monetary easing, a growing appetite for decentralized assets, and global instability as creating the ideal backdrop for crypto to outperform.

VanEck has publicly stated that $180,000 Bitcoin is “very much in play” in 2025.

The key shift is that corporate treasuries are buying Bitcoin, not retail investors, as in 2021. Companies are quietly accumulating BTC, signaling deeper institutional conviction. Meanwhile, the U.S. House is preparing for “Crypto Week,” and stablecoin regulation is expected to be the first real shot at federal crypto legislation.

Technical Setup Points to $150K If Bulls Hold the Line

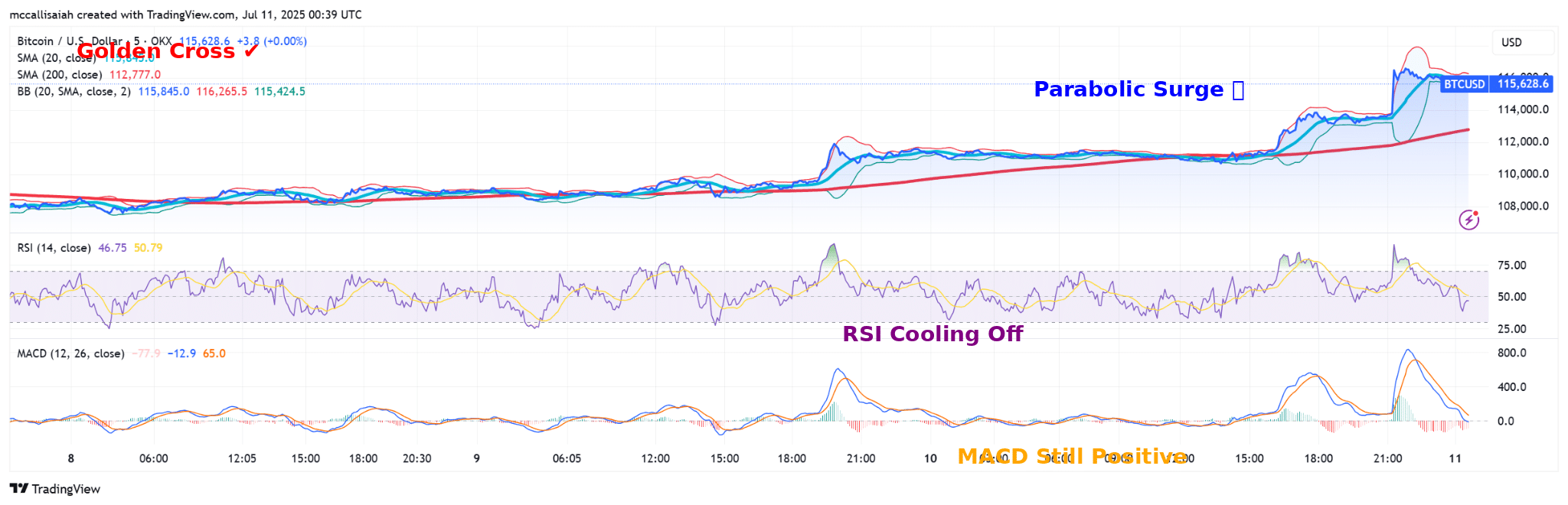

A textbook golden cross just landed for BTC with the 20-period SMA over the 200, and that’s no small signal. This is often a setup that often marks the start of larger macro shifts.

After consolidating in a narrow zone, the move up to $116,000 was violent and volume-supported.

Meanwhile, RSI pulled back from the edge of overbought. Watch for consolidation at these levels.

According to Cointelegraph and 10x Research’s Markus Thielen, BTC now has a 60% probability of gaining another 20% over the next two months. That would push it past $135,000. Others, like Kyle Reidhead of Milk Road, see a move to $150,000 as the next logical target.

The chart setup supports that theory. BTC recently cleared resistance at $110,530, setting up for a potential breakout to the inverse head-and-shoulders pattern target of $150,000.

Polymarket Bets Big on July Rally

Polymarket traders are betting big on the short term. Their forecast now sees a 61% chance of $120,000 BTC by end of July, suggesting retail traders are far from taking profits. That’s a major shift in sentiment from just weeks ago.

Volume on Polymarket has jumped significantly, showing that participants are willing to put real capital behind this short-term bullish thesis. This could be a crazy summer y’all.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Institutions, quant traders, and crypto-native markets are all starting to echo the same call: Bitcoin 2025 price to $150,000 and fast.

- Polymarket traders are betting big on the short term. Their forecast now sees a 61% chance of $120,000 BTC by end of July

- All eyes are on Powell this month. As inflation lingers and labor metrics soften.

The post Polymarket Gives Bitcoin 62% Odds of Hitting $120K by Month-End appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.