0

0

This article was first published on The Bit Journal.

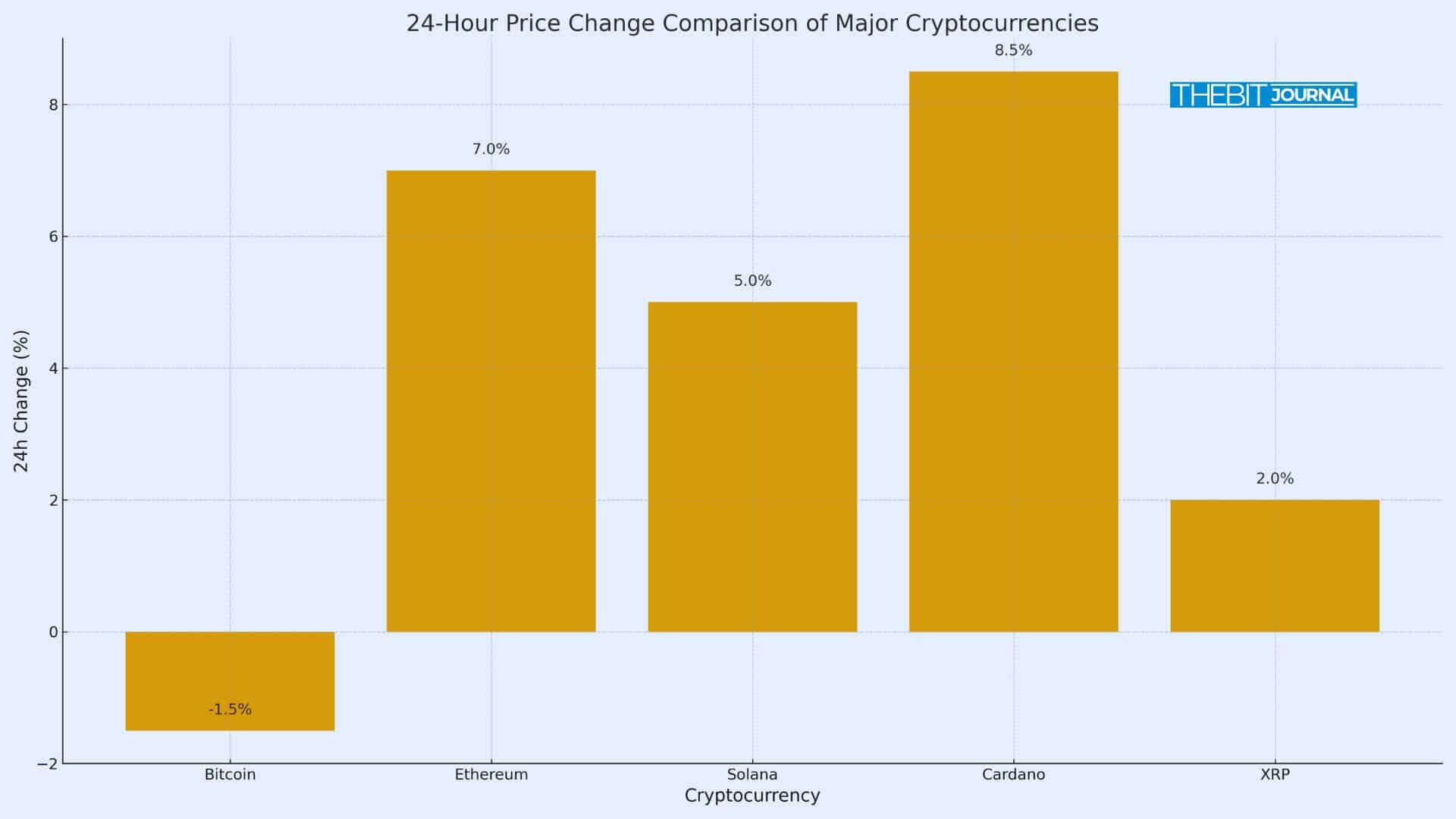

The crypto market outlook turned uncertain on Tuesday as Bitcoin hovered near 92,500 USD in Asian trading. Ethereum held around 3,320 USD, Solana traded near 105 USD and Cardano gained about 8.5 percent. Initial strength faded once volumes thinned, which signaled a fragile market mood ahead of the Fed decision.

XRP added roughly 2 percent during the last session but remains down 4 percent for the week. BNB, USDC and TRX stayed flat, showing limited interest in broader rotation.

| Coin | Approx Price | 24h Change |

|---|---|---|

| Bitcoin | 92,500 USD | –1 to –2% |

| Ethereum | 3,320 USD | +7% |

| Solana | 105 USD | +5% |

| Cardano | 0.40 USD | +8.5% |

| XRP | 0.62 USD | +2% |

Smaller tokens continued to show weak depth. Lower liquidity made small buy or sell orders more impactful. Social activity increased sharply during the brief rebound. Data from Santiment showed rising chatter as traders returned with expectations of higher prices.

The enthusiasm did not last. During the Asian session, Bitcoin fell below 93K USD and could not keep its previous growth. The retracement seemed to be a shakeout within the 86,000-94,000 USD similarly range rather than a clean breakout. This is how fragile the crypto market outlook has become leading up to this next Fed decision.

Bitcoin fell 1 to 2 percent, and was trading around 92,500 USD. Increased profit-taking following the recent gains were also behind the pullback, with low liquidity exaggerating the move. The token continues to trade in its tight 86,000-94,000 USD band as traders wait on the Fed.

Ethereum rose 7 percent to around 3,320 USD, extending its weekly gains. Stronger social sentiment and continued investor interest in network upgrades supported ETH’s rebound, making it one of the more resilient assets in the current crypto market outlook.

Solana was up 5 percent at around 105 USD. SOL’s bounce marked resurgence in interest by traders searching for altcoin plays, but it was on fairly meager volumes which highlighted wider market wariness.

Cardano outperformed with an 8.5 percent increase to 0.40 USD. The token’s jump was fueled by focused buying in a few high-volume trades, highlighting selective investor optimism in the midst of an otherwise cautious crypto market outlook.

XRP added 2 percent to 0.62 USD, but is still lower on the week. Its tepid recovery suggests there is little follow-through from buyers, suggesting that sentiment towards non-Bitcoin assets continues to be fragile in the lead-up to the Fed decision.

Research analyst Mark Pilipczuk noted a sharp rise in volatility. He highlighted that realized volatility moved above implied volatility for the first time in months. This pattern has appeared eight times in the past and resulted in a bottom in six of those cases.

Other experts remained cautious. A senior exchange executive said the market still lacks strong anchors. Bitcoin’s steady consolidation inside the 86,000 to 94,000 USD zone suggests that buyers and sellers continue to wait for clearer direction, especially with the Fed decision approaching.

These conflicting views increase tension in the crypto market outlook.

Chinese shares declined on the news that inflation in November had increased. Markets in Japan were down, with South Korea and Taiwan recording modest gains. Silver posted a fresh top and the US dollar was solid.

These uneven signals put additional pressure on risk assets. A negative reaction to the Fed decision could shift flows away from cryptocurrencies if global investors become more defensive.

Two factors continue to shape the crypto market outlook:

A supportive message from the Federal Reserve could lift risk sentiment. A cautious tone from the Fed decision could send Bitcoin toward the mid-80,000s. Until the Fed decision becomes clear, the market may remain unstable.

The crypto market outlook remains on a knife-edge. Prices show brief moments of strength, but thin liquidity and mixed global signals limit conviction.

It may depend how traders react to the Fed decision and if volumes rise into that event. For now, the perspective in the crypto market is to be patient and risk small.

The market snapped back just as fast, though, because traders who already had healthy profits took some off the table and liquidity remained poor.

Yes. Easing policy could spur demand for risk assets, including crypto.

They may offer gains, but they remain tied to Bitcoin’s mood and overall market liquidity.

At this stage, it looks more like a bounce, given weak support and global uncertainty.

Read More: BTC, ETH, SOL, ADA and XRP Outlook Ahead of the Fed Decision">BTC, ETH, SOL, ADA and XRP Outlook Ahead of the Fed Decision

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.