SUI Hack: Root Cause, Bug Bounty, Censorship Backlash, Price Reaction

0

0

A massive hack on Cetus Protocol rattled the SUI ecosystem within the last 24 hours.

Unfortunately, the coin’s price is reacting negatively to this incident, causing investors to lose money. Almost 10% of the crypto asset gain in the last 24 hours has been lost.

Cetus Hack and the $6 million Bounty: Will This Entice the Hacker?

Just when the broader crypto sector is recovering from the Bybit hack, Cetus, designed as a Sui-based Decentralized Exchange (DEX).

With the breach, it lost over $220 million worth of cryptocurrencies in the incident on May 22.

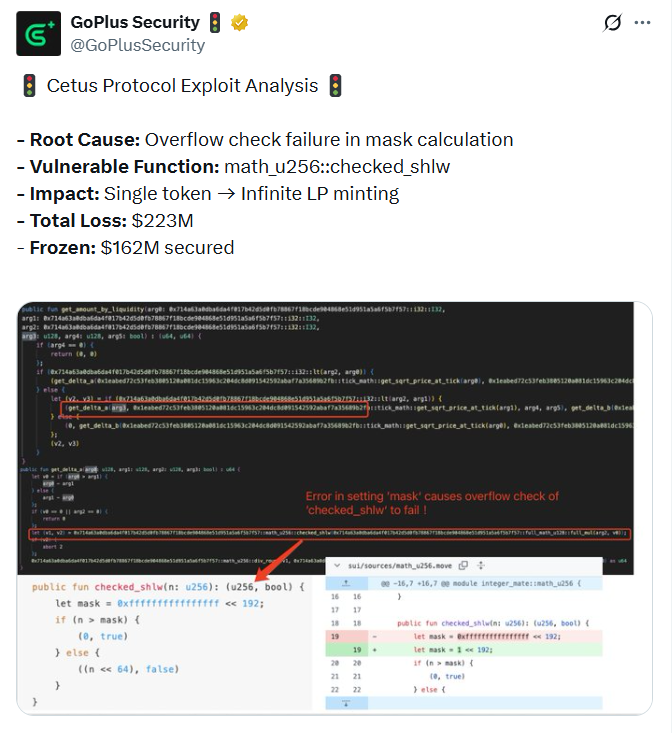

GoPlus Security on X said the hack was due to an “overflow check failure in mask calculation.”

As explained, Cetus and many other DEXs’ liquidity pools rely on precise mathematical formulas. This allows them to maintain a balance between token reserves and ensure fair pricing.

However, a challenge arises when a calculation involving a shift operation incorrectly collapses a large value into a tiny one.

The protocol is deceived into believing that the attacker’s deposit is worth far more than it is. In this case, excessive minting of the liquidity pool tokens begins, hence the $222 million loss.

After a few hours, Cetus halted trading and was able to freeze $162 million of the siphoned assets.

The protocol offered $6 million as a white hat bounty reward to further salvage the situation if the hacker returned the remaining crypto assets.

The yet-to-be-realized assets were around 20,920 Ethereum (ETH), estimated to be over $55 million.

“In exchange, you can keep 2,324 ETH ($6M) as a bounty, and we will consider the matter closed and will not pursue any further legal, intelligence, or public action,” Cetus wrote.

Offers like this have worked in the past where the hack is later regarded as a White hat event. However, there is no guarantee such will happen in the case of Cetus Protocol.

Origin of the Centralization Claims on SUI Crypto

If the Sui-native DEX fails to recover the lost assets, it noted that it will pursue legal actions against the hacker.

The Sui team is already considering implementing an emergency whitelist function.

If implemented, this would allow certain transactions to bypass security checks and recover funds linked to the hack.

Chaofan Shou, a software engineer at Solayer Labs, hinted at this move.

“It appears that the Sui team asked every validator to deploy patched code so they could take away @CetusProtocol hacker’s $160 million via an unsigned tx,” Shou noted.

It turns out that these validators held off on the deployment but began to deny transactions involving the hacker’s objects.

This emergency move from Sui Network has raised concerns among decentralization enthusiasts.

Some entities appreciated the prompt response, describing it as progress rather than an attack on decentralization.

One pseudonymous crypto sleuth, Matteo, described decentralization as the power to act together without needing permission.

To the other critic group, featuring entities like Justin Bons, the Sui team may be overstepping its bounds by trying to override the transactions.

In their opinion, such a move contradicts the principles of a decentralized permissionless network.

SUI Price Bears the Brunt

Amid the hack and talk of centralization, SUI price has seen a notable downtrend.

At the time of this writing, it traded at $3.63, corresponding to a 4.29% dip in 24 hours.

As it stands, the SUI crypto market cap and trading volume are equally recording massive losses.

Some analysts believe there is still room for a bullish run, mainly since the coin has recorded a 150% increase since hitting its lows on April 7.

SUI proponents have also noted that a failure to break above the $3.96 resistance would short-term invalidate the bullish scenario.

Under this setup, the SUI price is predicted to reach $10.

The post SUI Hack: Root Cause, Bug Bounty, Censorship Backlash, Price Reaction appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.