Stacks (STX) Price Rise Saturates, Reversal Likely

0

0

Stacks (STX) price has noted an impressive rise over the last couple of days but this could be coming to an end soon.

The reason behind this is the lack of consistent rise, which is potentially increasing concerns among investors.

Stacks Investors Could Bank Out

STX price is currently at $1.88, finding bullishness from the market, which it is failing at. For the last three weeks, the altcoin has noted stellar growth, which has made it a good choice for investment.

The Sharpe Ratio indicates that STX is currently a good choice to add to the portfolio. This metric, which measures risk-adjusted returns, suggests that the asset has been performing well relative to its volatility.

STX Sharpe Ratio. Source: Messari

STX Sharpe Ratio. Source: Messari

However, there are signs that STX may be approaching saturation. As the investment matures, the potential for significant returns may diminish, signaling that investors should be cautious.

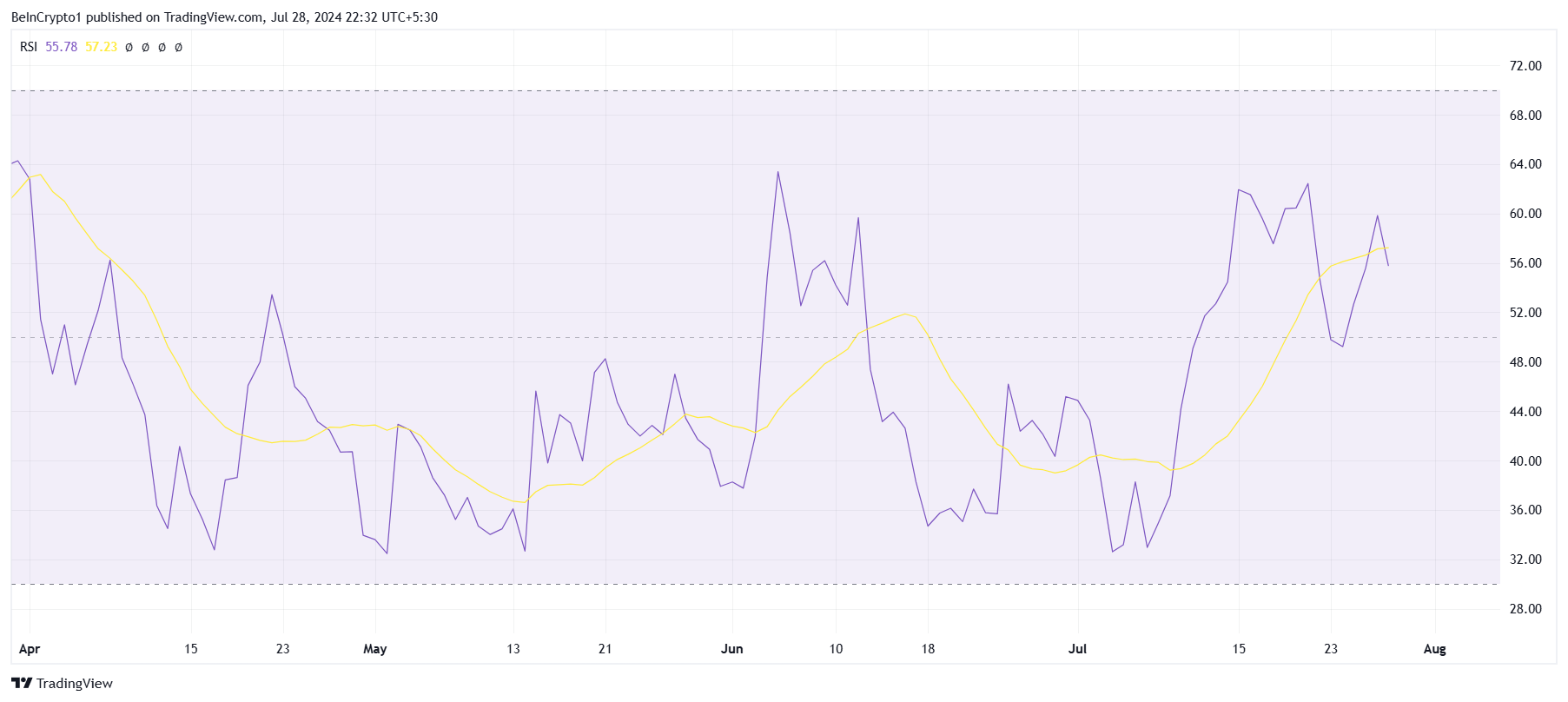

Another important indicator is the Relative Strength Index (RSI), which remains in the positive zone. This is a bullish signal, suggesting that STX still has some upward momentum.

Despite the positive RSI, it is important to note that this momentum might not last indefinitely as RSI inches closer to the overbought zone. Investors should be aware that STX may have only a little more room to grow before a potential reversal occurs.

Read more: What Are Decentralized Exchanges and Why Should You Try Them?

STX RSI. Source: TradingView

STX RSI. Source: TradingView

STX Price Prediction: Consolidation Ahead

STX price is fighting to remain afloat above the $1.80 support level which might get even more difficult now. As noted in the aforementioned indicators, the investors could soon move to sell and secure their gains if the price remains halted.

This could result in a drawdown, or if the $1.80 support remains intact, it could lead to consolidation. The upper limit for this consolidation would be the resistance at $2.06, which could be a while before it is breached.

Read more: Top 10 Aspiring Crypto Coins for 2024

STX Price Analysis. Source: TradingView

STX Price Analysis. Source: TradingView

On the other hand if the support is lost, a decline to $1.53 is possible. Testing this price as support would wipe the recent gains, invalidating the bullish thesis.

0

0