0

0

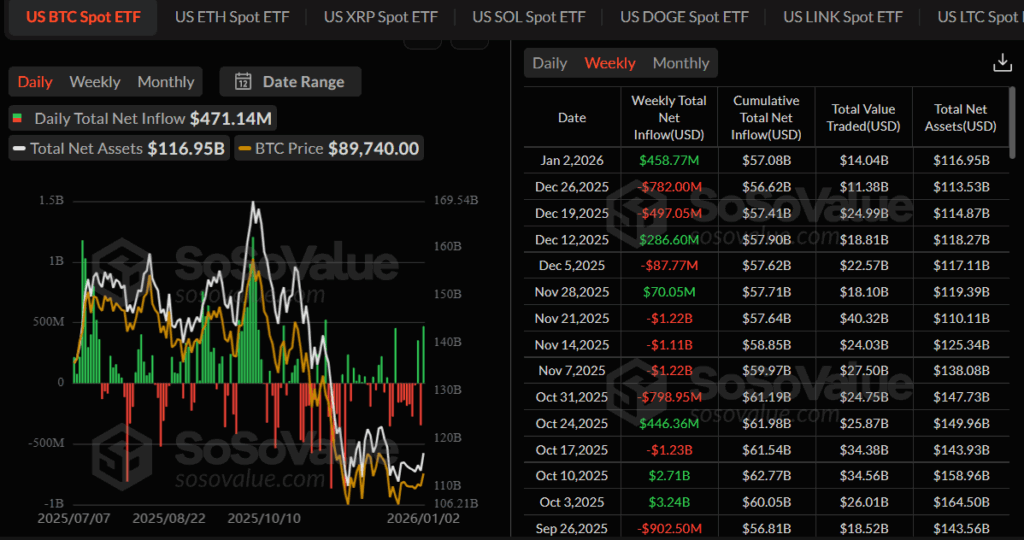

U.S. spot exchange-traded funds of BTC, ETH, XRP, SOL, and DOGE all saw a positive flow as the new year began, indicating a strong institutional demand for crypto funds.

With that, Bitcoin ETFs, which have been in a record decline in the last two months, where there have been no inflows, last week, posted around $458.77 million total inflow. As per SoSoValue data, last Friday, Jan 02nd, BTC ETFs saw $471.14 million, which brings the cumulative total net inflow to approximately $57.08 billion.

BlackRock’s IBIT alone attracted $287.4 million in net inflows on Friday, the highest single-day inflows since Oct. 8, when it received $426.2 million. IBIT’s inflow strength spread across multiple Bitcoin ETFs, with Fidelity’s FBTC attracting $88.1 million from investors and Bitwise’s BITB drawing $41.5 million on the day. The remaining Bitcoin ETFs generated $54.3 million in inflows. Notably, none of the Bitcoin ETFs experienced any negative flows.

The January effect, in which investors rearrange their portfolios at the start of the year after Bitcoin’s relatively poor performance in late 2025, has contributed to the rise in Bitcoin ETF inflows.

Also, the Ether ETFs saw inflows of about $174.43 million, ending the last two-month stretch of outflows. Even the newly launched XRP, SOL, and DOGE-linked ETFs reported positive flows, signaling broader positive ETF momentum.

As BTC is currently trading at $92,710 at the time of writing, it has increased around 6.16% over the past week. As its 24-hour trading volume increased 30.34% and stands at $34.88 billion, signals a bullish trend after a prolonged decline, as it is still down 26.37% from its All-time high. With that, rising crypto prices and renewed institutional interest brought ETF activity back into focus, underscoring Bitcoin’s role in broader investment portfolios

Highlighted Crypto News Today:

Virtuals Protocol Price Jumps 22% in 24 Hours, Reclaims $1 Level

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.