ARK Invest Predicts Bitcoin Could Skyrocket to $2.4 Million by 2030

0

0

Highlights:

- ARK Invest predicts BTC could hit $1.5 million by 2030 with a 72% CAGR.

- Institutional investment and emerging market demand are key drivers for Bitcoin’s growth.

- Bitcoin’s market cap could reach $49.2 trillion, surpassing the US and China’s GDP combined.

Asset manager ARK Invest, led by CEO Cathie Wood, has predicted that Bitcoin price could hit $1.5 million by 2030, according to its latest Big Ideas 2025 report released on Thursday. The report presents a detailed modeling framework that considers Bitcoin’s total addressable market (TAM) potential, adoption trends, and assumptions about supply dynamics.

We’ve published our bitcoin price forecast through 2030. Read our research from @dpuellARK and share your thoughts.https://t.co/CH7y5EyUjY

— ARK Invest (@ARKInvest) April 24, 2025

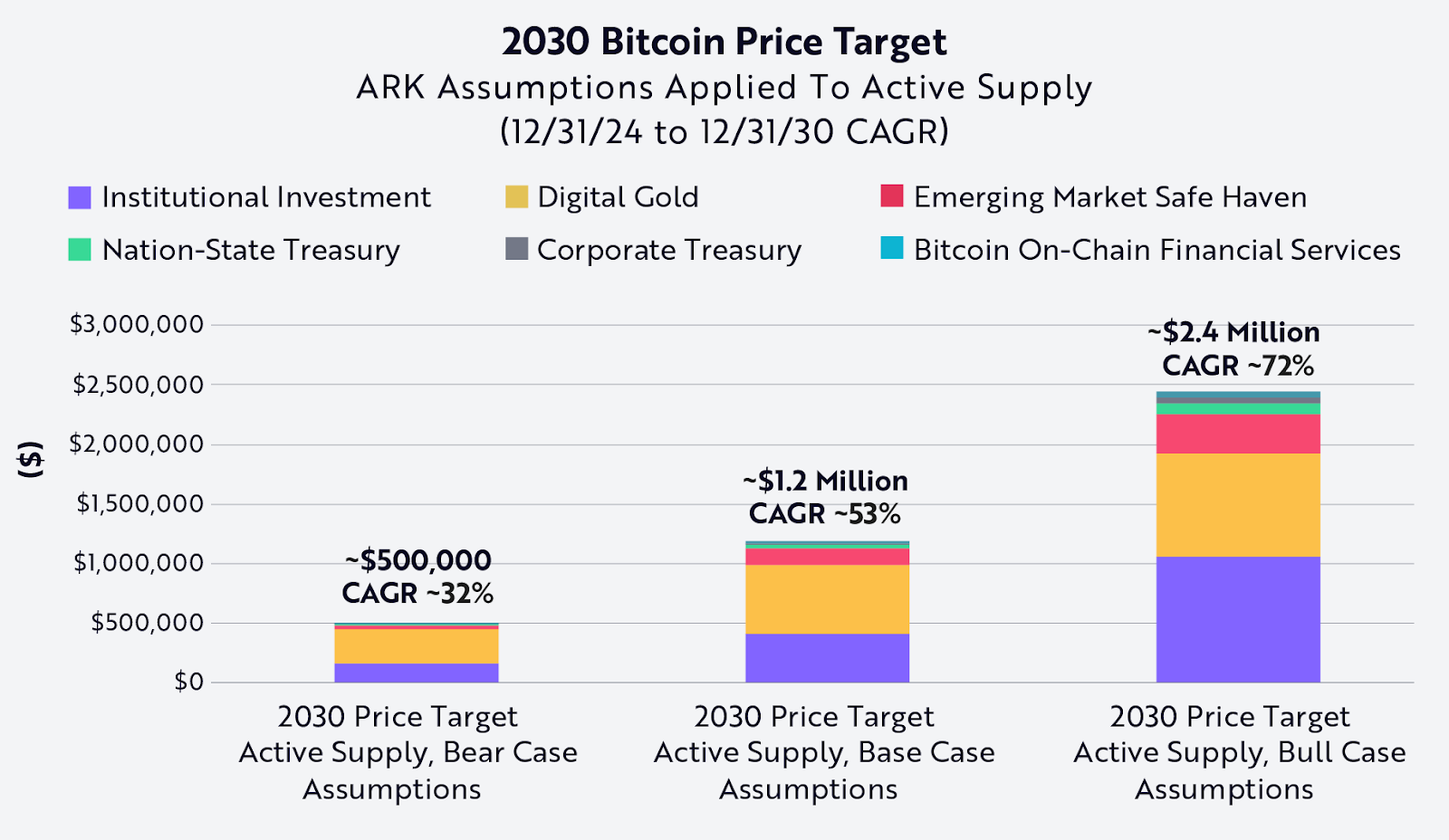

The updated target means that, if the prediction holds true, the value will grow by about 72% each year from December 31, 2024, to December 31, 2030. This is called the Compound Annual Growth Rate (CAGR). In contrast, ARK’s base case estimate is $1.2 million (with a CAGR of about 53%), while the bear case stands at $500,000 (with a CAGR of around 32%).

Key Drivers Behind ARK’s Bullish Bitcoin Outlook

ARK research analyst David Puell highlighted that institutional investment plays a key role in their bullish outlook for Bitcoin price. He estimated that, in the best-case scenario, Bitcoin could capture a 6.5% share of the $200 trillion financial market, excluding gold. Another key factor behind the optimistic forecast is Bitcoin’s growing recognition as “digital gold.” Puell predicts that in a bullish scenario, Bitcoin could secure up to 60% of gold’s $18 trillion market cap (based on 2024 figures) by the end of 2030.

Emerging market demand is also a significant factor. ARK believes this use case has the most potential for capital growth. It pointed out that BTC can protect wealth from inflation and devaluation in developing economies. The company estimates this segment could contribute 13.5% to the $2.4 million valuation, assuming a 6% penetration rate of emerging market monetary bases.

National treasuries, corporate cash reserves, and on-chain financial services are fueling growth. On-chain services are projected to grow at 60% annually, even with conservative estimates. Innovations like Layer 2 networks and Wrapped Bitcoin (WBTC) are driving this trend.

BTC’s $2.4 Million Price Could Make It the World’s Largest Asset

If Bitcoin hits a price of $2.4 million, its market capitalization would soar to $49.2 trillion, assuming a total supply of 20.5 million coins by 2030. This valuation would surpass the combined gross domestic product (GDP) of the US and China today. It would also position Bitcoin to potentially surpass gold, which currently has a market cap of $22.5 trillion, making it the world’s largest asset.

ARK concludes that many current valuation models do not account for Bitcoin’s scarcity and lost supply. This suggests there could be additional growth potential beyond their already ambitious forecast. In February 2025, ARK Invest predicted Bitcoin price could reach $1.5 million due to more institutional interest.

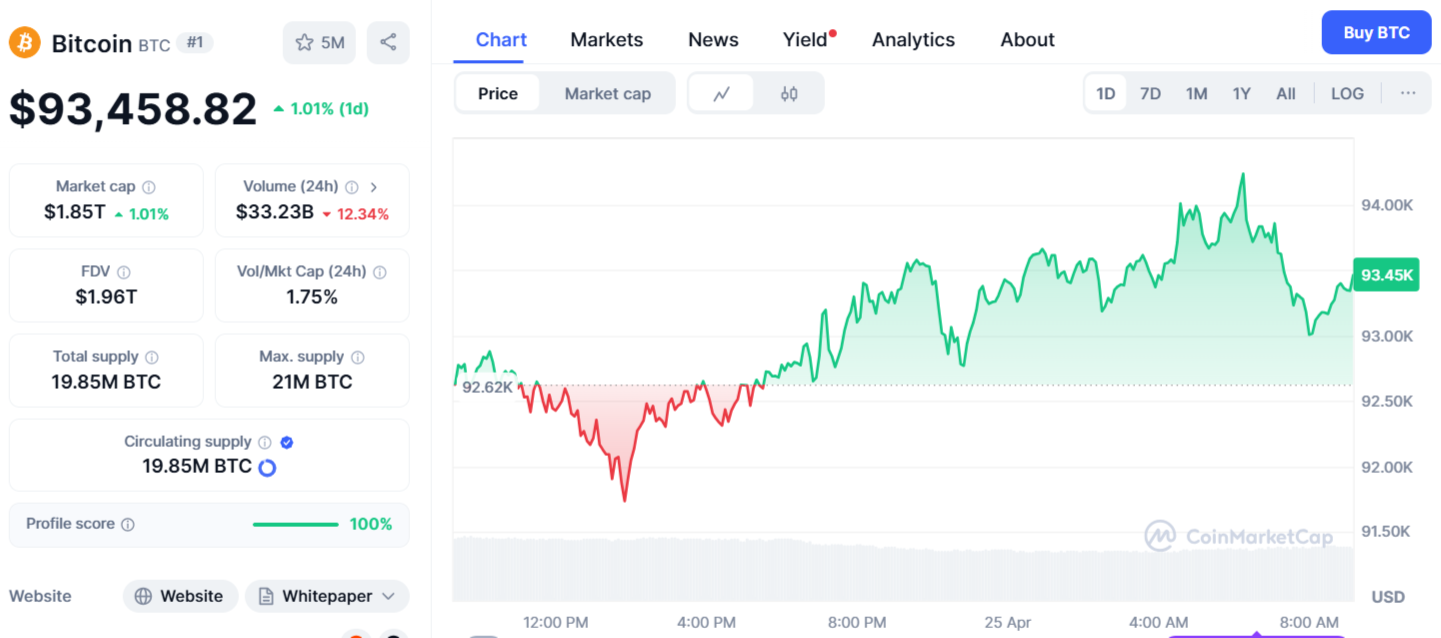

Currently, Bitcoin is priced at $93,458, showing a 1.01% increase. Over the last week, BTC has risen by 10%, and over the past month, it has increased by 7%. The 24-hour trading volume has dropped to $33.23 billion, a decrease of 12.34%. Recently, Bitcoin has now overtaken Google in market cap, placing it among the world’s top five assets, ahead of Amazon and silver.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.