0

0

This article was first published on The Bit Journal.

XRP is moving out of the shadow of larger coins and into the center of the institutional conversation. A leading crypto asset manager has launched a spot XRP exchange-traded fund on a major United States stock exchange and has also pushed XRP into the third-largest position in its flagship top ten crypto index fund. For many professional investors, that shift marks XRP as more than a speculative trade.

The firm has described XRP as a cryptocurrency with the potential to reshape how money moves worldwide, linking that claim to the structure of the XRP Ledger and a visible rise in demand for regulated XRP products.

The spot XRP fund began trading in November with a 0.34% management fee that is waived for the first month on the first $500 million in assets. It holds spot XRP in a custodial structure, so banks, advisers and funds can buy shares through familiar brokerage channels rather than dealing with wallets and private keys. Early data shows assets close to $200 million and an estimated 100 million XRP units held in the vehicle, supported by steady net inflows.

In parallel, XRP has become the third largest holding in the manager’s top ten crypto index ETF, behind only Bitcoin and Ethereum. XRP represents a little over 5% of that portfolio, which manages about $1.25 billion and screens assets for liquidity, custody and regulatory readiness. For many allocators, that weighting signals confidence in XRP’s durability.

The investment story rests on XRP’s role in payments. The XRP Ledger is built for high-throughput, low-cost transfers. Since launch, it has processed more than 4 billion transactions, with typical settlement times between 3 and 5 seconds and fees that usually remain well below $0.01. The network can move both digital assets and tokenized representations of fiat currencies, which makes it a candidate rail for cross-border settlement.

Analysts expect global cross-border payments to approach $250 trillion in annual volume in the next few years. Even a modest share routed through rails that rely on the XRP Ledger could increase demand for XRP liquidity and deepen market depth.

Investors who follow XRP inside these products tend to focus on a small set of core signals. Market capitalization ranks each asset by total value and helps decide index inclusion. Trading volume and order book depth across major venues reveal whether liquidity can absorb institutional size without large price swings. Price structure is tracked through support and resistance levels, the relative strength index and moving averages, which highlight overbought or oversold conditions.

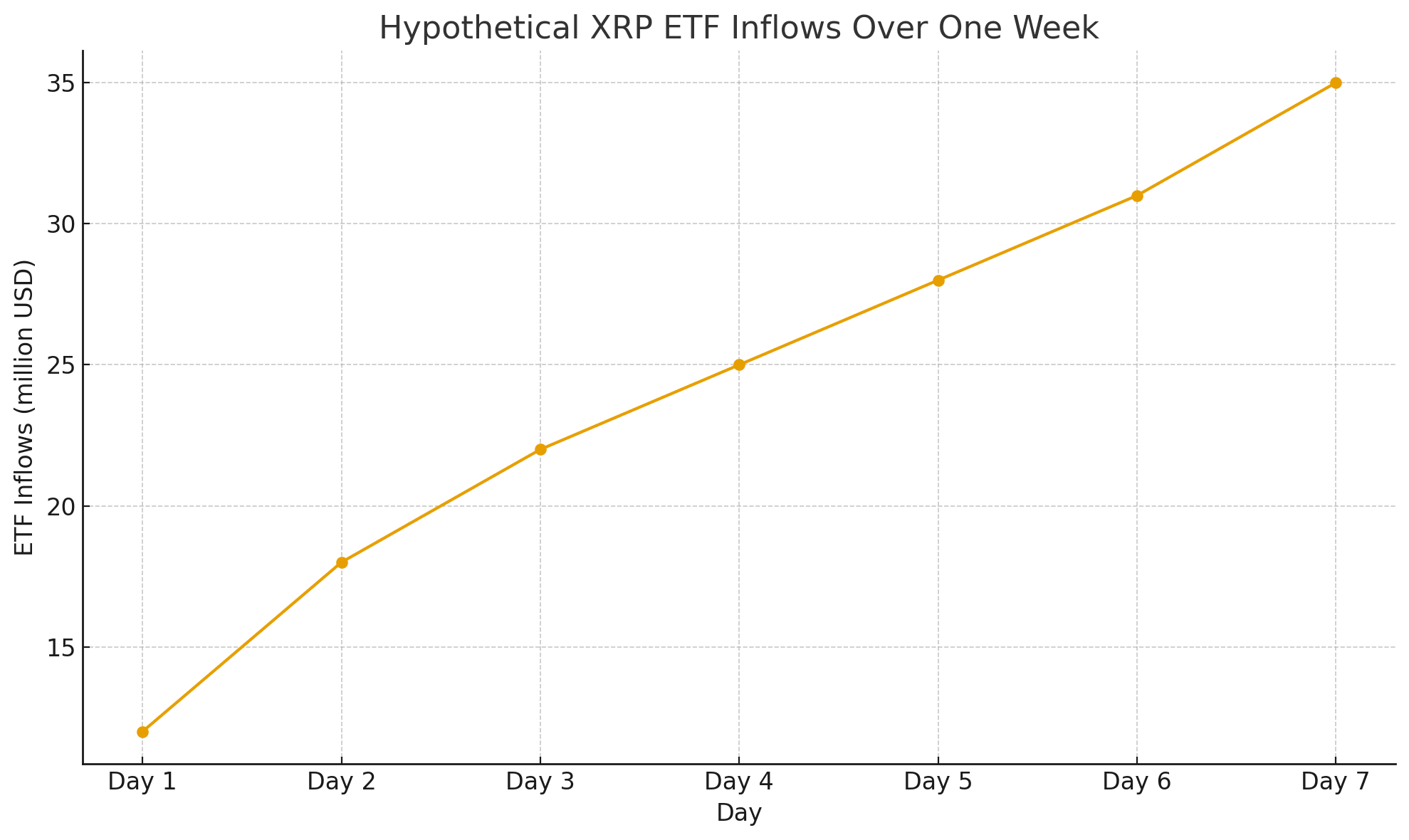

On-chain data, such as active addresses, daily transactions, and the ratio of network value to transaction volume, helps show whether real usage is growing. ETF specific indicators, including net inflows and total assets under management, give a clear view of how quickly traditional investors are adding or reducing exposure. Together, these metrics allow traders and allocators to judge both momentum and fundamental network health.

XRP still carries familiar crypto risks, from regulatory shifts to macro shocks and competition from rival settlement networks. Its price has not fully mirrored the recent upswing in regulated demand. Even so, a live spot ETF, a top three index weight and a ledger that settles value in seconds give XRP a distinctive profile in the current market. For traders and allocators who are watching digital assets move from story to utility, XRP now sits close to the heart of the payments debate.

What does the new XRP ETF tell investors?

It shows that a major asset manager sees sufficient demand and clarity to offer direct XRP exposure through a listed fund.

Why do ETF inflows matter for XRP?

Consistent net inflows suggest that institutions are building positions over time instead of trading only around short term headlines.

How fast are XRP payments?

Most XRP Ledger transactions settle in roughly 3 to 5 seconds, while many traditional cross border transfers can still take several days.

ETF

An exchange traded fund that holds assets such as cryptocurrencies and trades on a stock exchange.

Assets under management

The total value of assets that an investment manager oversees for clients.

On chain data

Information drawn directly from a blockchain, including transactions, addresses and value moved.

Read More: Bitwise Says XRP Is Ready To Transform Global Payments">Bitwise Says XRP Is Ready To Transform Global Payments

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.