Dogecoin Price Faces Its Toughest Test — Every Bounce Below Key Level Could Fail

0

0

Dogecoin (DOGE) is up 1.4% today, but the recovery looks shaky. After a 20% drop over the past month, the Dogecoin price now faces its toughest near-term test — a zone that has stopped every recent bounce.

Everything below this zone faces strong selling pressure, keeping the DOGE price locked in its tightest range in weeks.

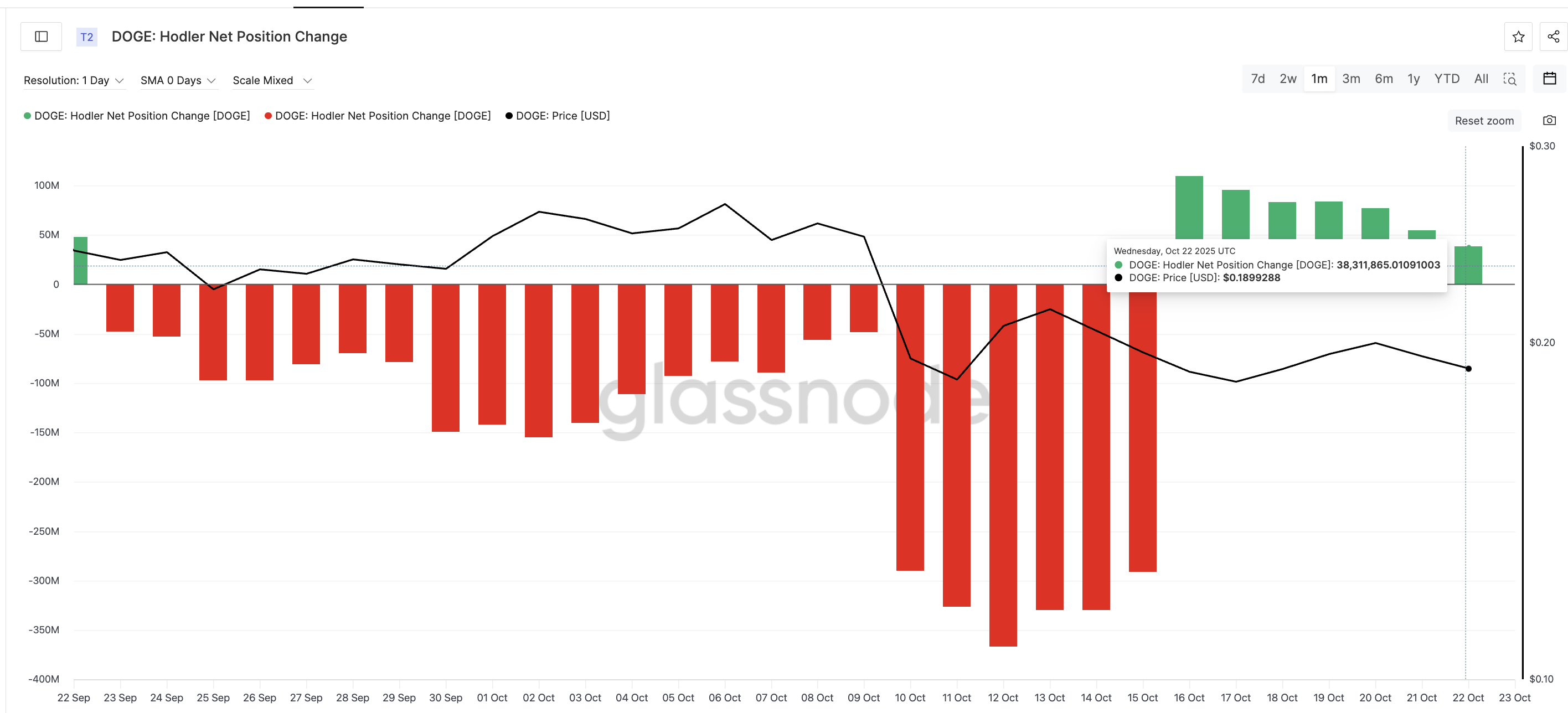

Long-Term Holders Step Back, Short-Term Buyers Step In

The Hodler Net Position Change, which tracks whether long-term investors are adding or selling, has turned bearish. On October 16, long-term holders added about 109.8 million DOGE to their balances.

By October 22, that figure had dropped to 38.3 million DOGE, a 65% decline in accumulation.

Dogecoin Holders Dumping: Glassnode

Dogecoin Holders Dumping: Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This shows that older investors have stepped back, trimming exposure after weeks of weakness. The Dogecoin price has been moving sideways since, down only 1.5% over the past seven days, showing that some buying support has kept it from breaking lower.

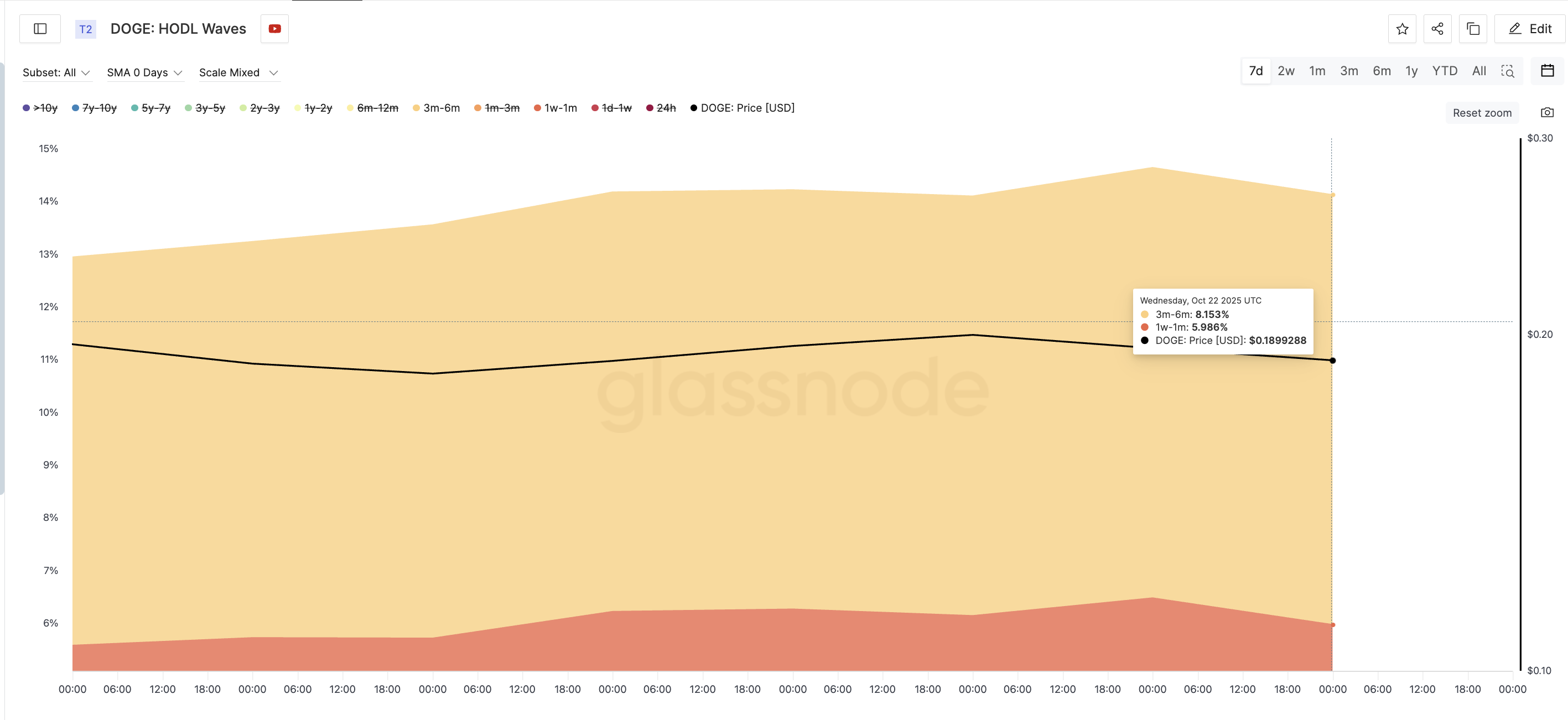

Short- and mid-term buyers are trying to hold the line here. According to HODL Waves, which tracks how much supply each holder group controls, two cohorts have added steadily.

The 1-week to 1-month group increased its share from 5.59% to 5.98% since October 15, while the 3-month to 6-month group rose from 7.36% to 8.15%.

Short-to-Mid-Term DOGE Buyers Active: Glassnode

Short-to-Mid-Term DOGE Buyers Active: Glassnode

This push-and-pull has formed a price ceiling near $0.20-$0.21, keeping the DOGE price confined in a narrow range. In most cases, additional buying from other groups — especially whales — can help break such ceilings. But something deeper could be limiting the upside this time.

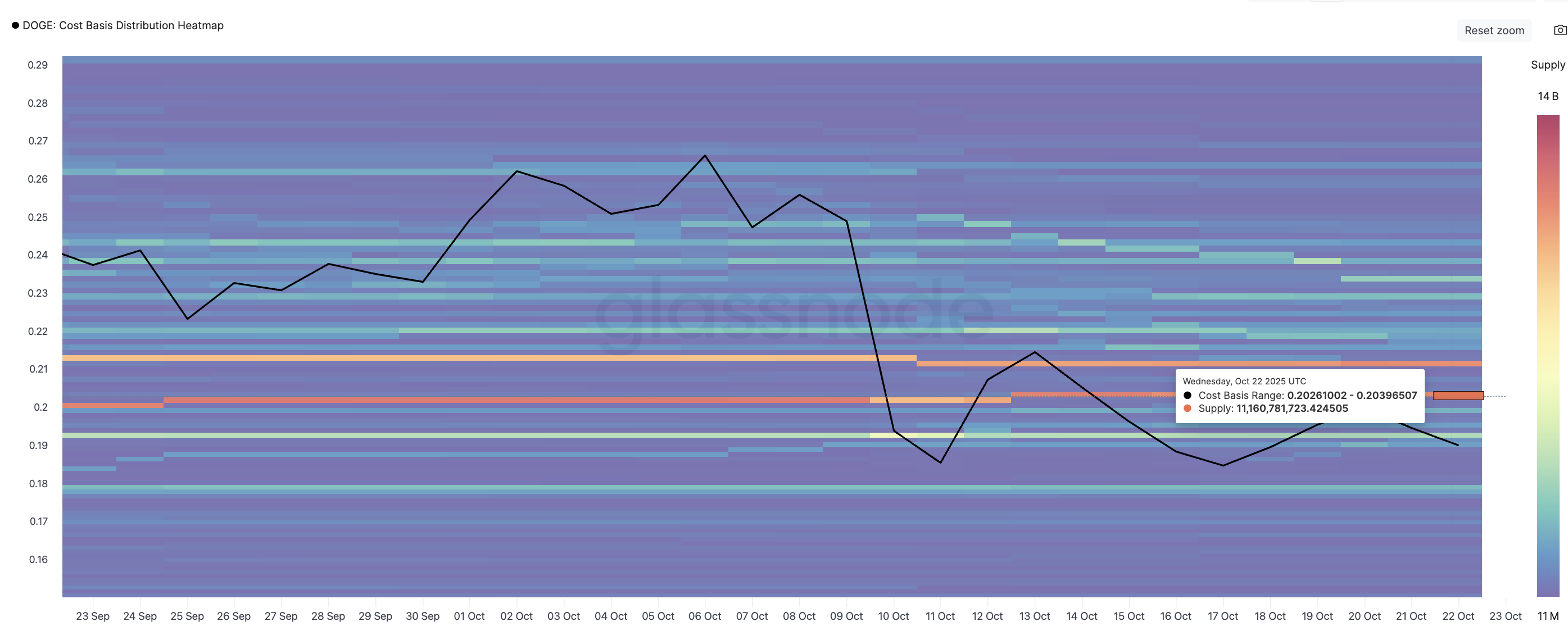

Cost Distribution Data Shows Why the Dogecoin Price Ceiling Holds

The Cost Basis Distribution Heatmap reveals why this OG meme coin can’t yet break out.

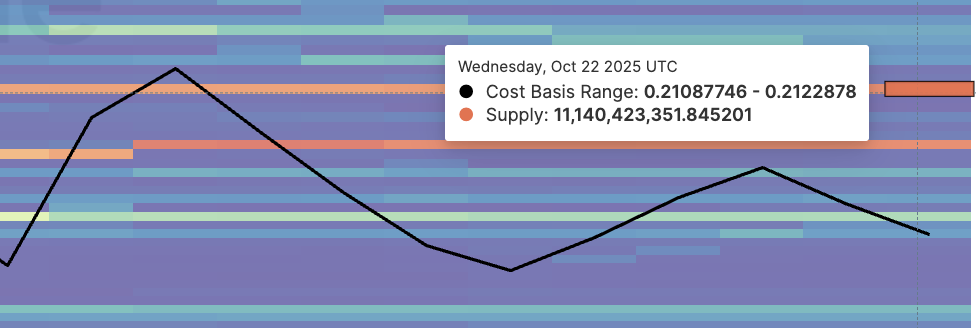

Two massive supply clusters — between $0.202–$0.206 and $0.210–$0.212 — hold roughly 11.16 billion DOGE and 11.14 billion DOGE, respectively. These are just the largest pockets; smaller clusters with fewer coins also exist across the range.

The Cost Basis Distribution Heatmap shows where most coins were last bought.

Dogecoin Price Heatmap: Glassnode

Dogecoin Price Heatmap: Glassnode

Together, they form one of Dogecoin’s strongest short-term barriers (resistance levels). Each rally into the $0.20–$0.21 zone faces immediate selling as holders exit near breakeven. That supply pressure has repeatedly stopped price advances since October 11, turning the area into DOGE’s most stubborn resistance zone.

Key DOGE Supply Cluster: Glassnode

Key DOGE Supply Cluster: Glassnode

If DOGE whales start buying more aggressively, they could absorb some of this supply and help push DOGE through resistance. Until then, the Dogecoin price will likely remain trapped inside its current band.

Dogecoin Price Analysis: TradingView

Dogecoin Price Analysis: TradingView

A breakout above $0.21 (about 12% from the current level) could open the door toward $0.27, while slipping below $0.17 risks sending it back toward $0.14.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.