Bitcoin and Ethereum ETFs Soar with $405M Inflows as ETH Profit Streak Hits 18 Days

0

0

Highlights:

- Bitcoin and Ethereum ETFs attracted combined net inflows worth approximately $405 million on June 11.

- BlackRock topped the net inflows chart for Bitcoin and Ethereum ETFs.

- Yesterday’s gains brought BTC funds inflows to a third straight day, while ETH ETFs gains entered their eighteenth consecutive day.

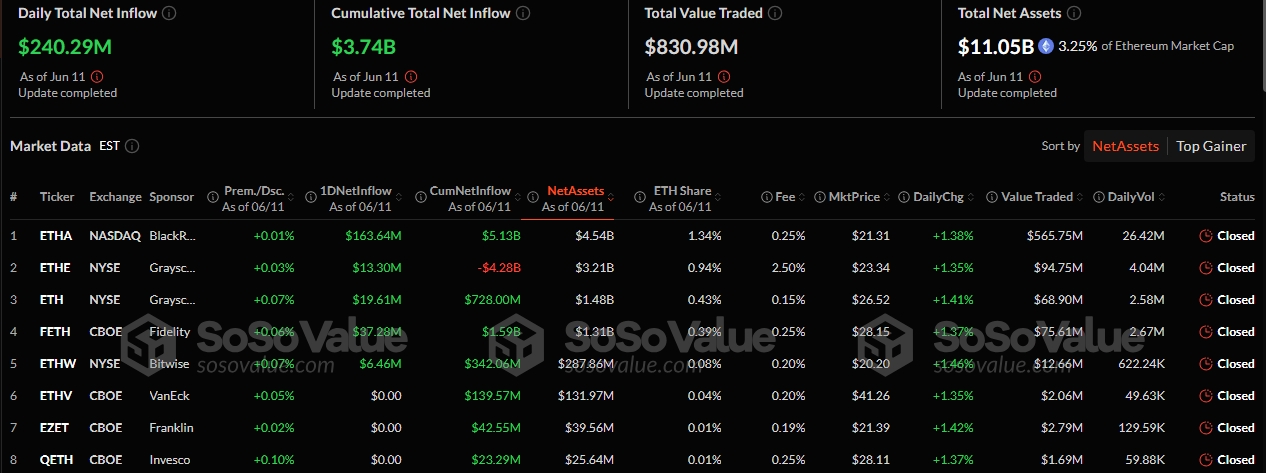

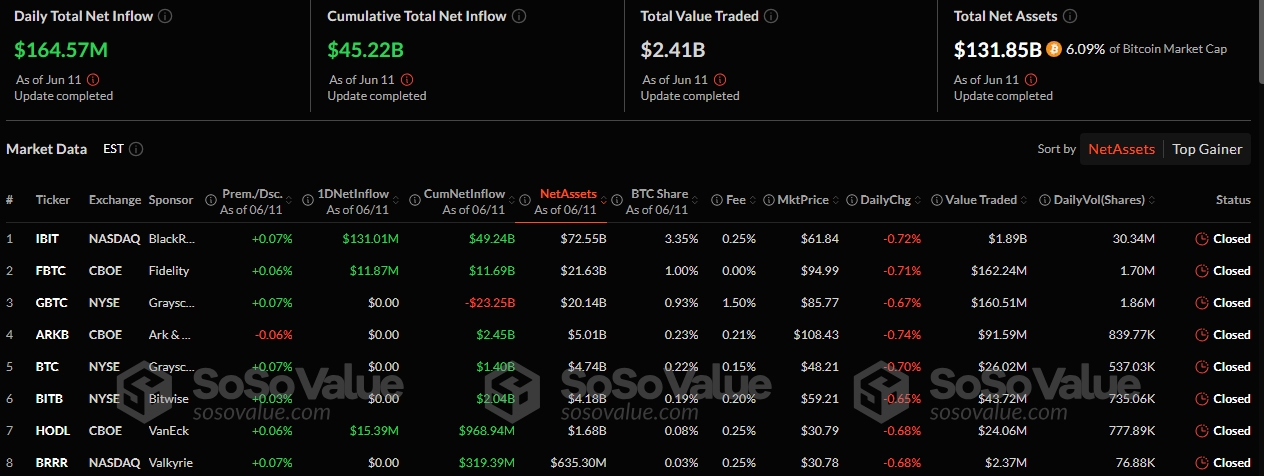

Popular on-chain Exchange Traded Fund (ETF) tracker SosoValue has publicized Bitcoin and Ethereum ETF statistics for June 11. The on-chain tracker reported that Bitcoin ETFs attracted $164.57 million, while Ethereum topped its impressive performance with a $240 million net inflow.

Yesterday’s gains imply that Bitcoin funds have recorded only profits this week after recording net losses in the past two weeks. On its part, Ethereum ETFs’ profitable streak extended into an eighteenth consecutive day amid growing institutional and investor interest.

On June 11, spot Bitcoin ETFs saw a total net inflow of $165 million, marking three consecutive days of inflows. Spot Ethereum ETFs recorded a total net inflow of $240 million, extending their streak to 18 consecutive days.https://t.co/ueXcZjuIVU

— Wu Blockchain (@WuBlockchain) June 12, 2025

BkackRock Drives Ethereum ETFs Gains

Only five ETFs were active on July 11. All recorded gains, as the remaining five were inactive. BlackRock Ethereum ETF (ETHA) attracted cash inflows worth $163.64 million. Fidelity Ethereum ETF (FETH), Grayscale Mini Ethereum ETF (ETHE), Grayscale Ethereum ETF, and Bitwise Ethereum ETF (ETHW) were the remaining ETFs that had profits. They gained $37.28 million, $19.61 million, $13.3 million, and $6.46 million.

Ethereum ETFs’ net inflows increased by $240 million from $3.5 billion. Similarly, the total net assets valuation added $400 million, reaching $11.05 billion from its previous $10.65 billion. On the contrary, the total value dropped to approximately $830.99 million after forfeiting $18.09 million.

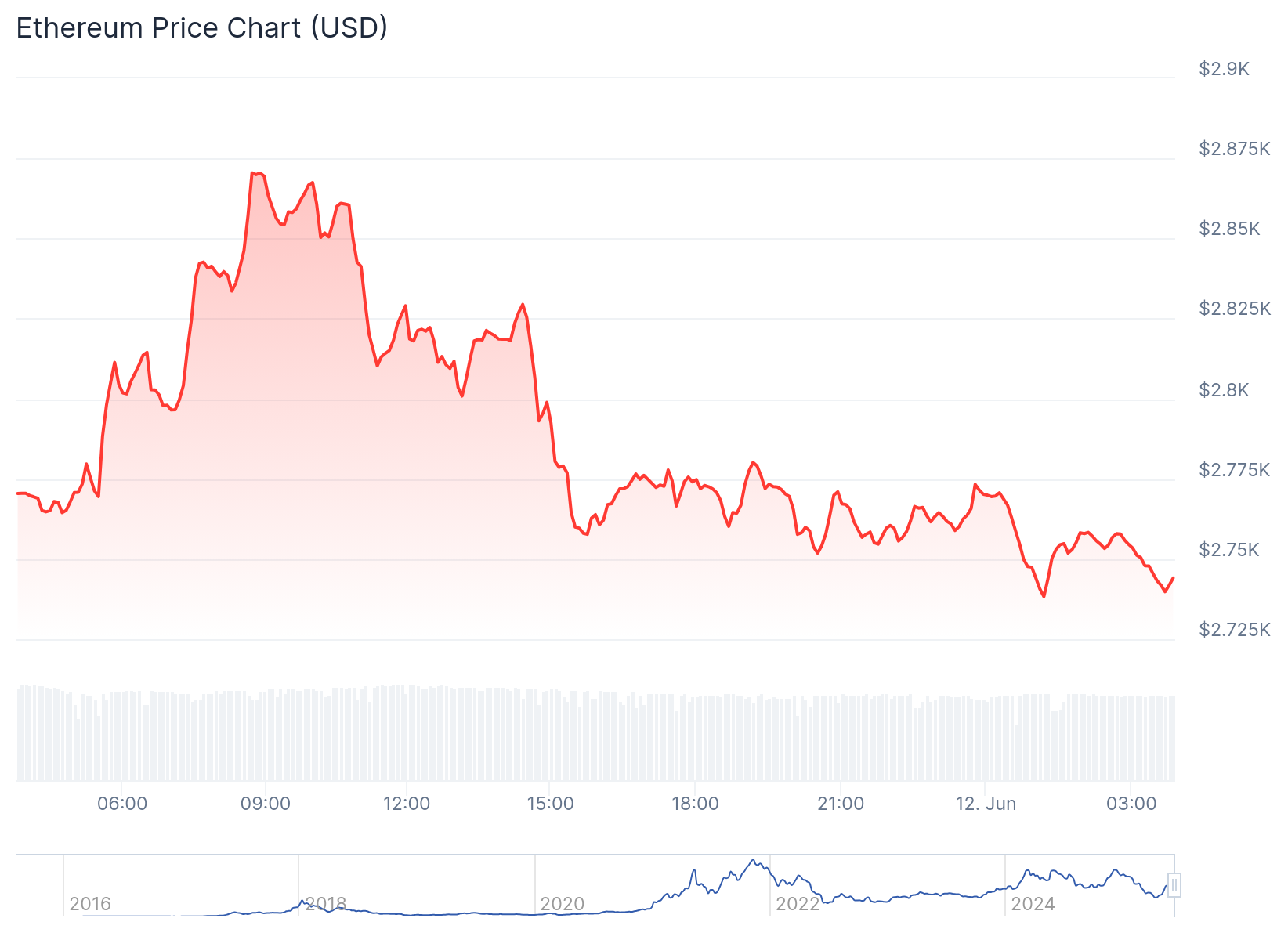

Interest in Ethereum Soars as the Token Nears $3,000

ETH is down 0.5% in the past 24 hours, trading at $2,750. Within the same time frame, the world’s most valuable altcoin has fluctuated between $2,738.28 and $2,870.51. Other extended-period variables showed subtle increments. For context, ETH 7-day-to-date and month-to-date price change data reflected upswings of 5.6% and 12%, respectively.

Meanwhile, interest in Ethereum has continued to wax stronger. In one of its most recent tweets, Spotonchain a renowned on-chain crypto transactions tracker, reported that a smart institution that gained about $30.45 million from ETH investments has remained bullish on the token.

Spotonchain stated:

“On June 10, the whale sold 30,000 ETH for $78.63M via an OTC deal with Wintermute at an average price of $2,621, locking in a $6.72M profit (+8.91%) after 15 days of holding.”

The on-chain tracker noted that since April 27, this investor’s total profits from investments have amounted to $30.45 million. The smart institution has repurchased an additional 16,500 ETH from Wintermute after the sell-offs on June 10. Spotonchain added that the investor spent $46.5 million purchasing ETH tokens at an average cost of $2,818 per token.

The smart institution that made $30.45M from $ETH is still bullish—buying back just a day after selling!

On June 10, the whale sold 30,000 $ETH for $78.63M via an OTC deal with #Wintermute at an avg. price of $2,621, locking in a $6.72M profit (+8.91%) after 15 days of holding.… https://t.co/pWRsPHtSUM pic.twitter.com/bbe9Z1Mvqp

— Spot On Chain (@spotonchain) June 12, 2025

In a separate tweet, Lookonchain, another renowned on-chain tracker, reported a similar acquisition trend. The on-chain tracker stated: “Whale 0xc097 withdrew 13,037 ETH ($35.5M) from Binance. Abraxas Capital withdrew 44,612 ETH ($123M) from Binance and Kraken”.

Bitcoin ETFs Detailed Flow Statistics

Like Ethereum, BlackRock Bitcoin ETF (IBIT) also topped Bitcoin funds inflows on June 11. The ETF attracted $131.01 million, increasing its cumulative net inflows to about $49.24 billion. Three other funds were active with gains yesterday, as the remaining eight experienced neither inflows nor outflows.

Other profitable ETFs were VanEck Bitcoin ETF (HODL), Fidelity Bitcoin ETF (FBTC), and Franklin Bitcoin ETF (EZBC). They gained $15.39 million, $11.87 million and $6.30 million, respectively. As a result of these gains, Bitcoin ETFs’ cumulative net inflows added $160 million, increasing to $45.22 billion. However, the total value traded and total net assets suffered slight declines. The former dropped from $2.63 billion to $2.41 billion, while the latter depreciated from $132.83 billion to $131.85 billion.

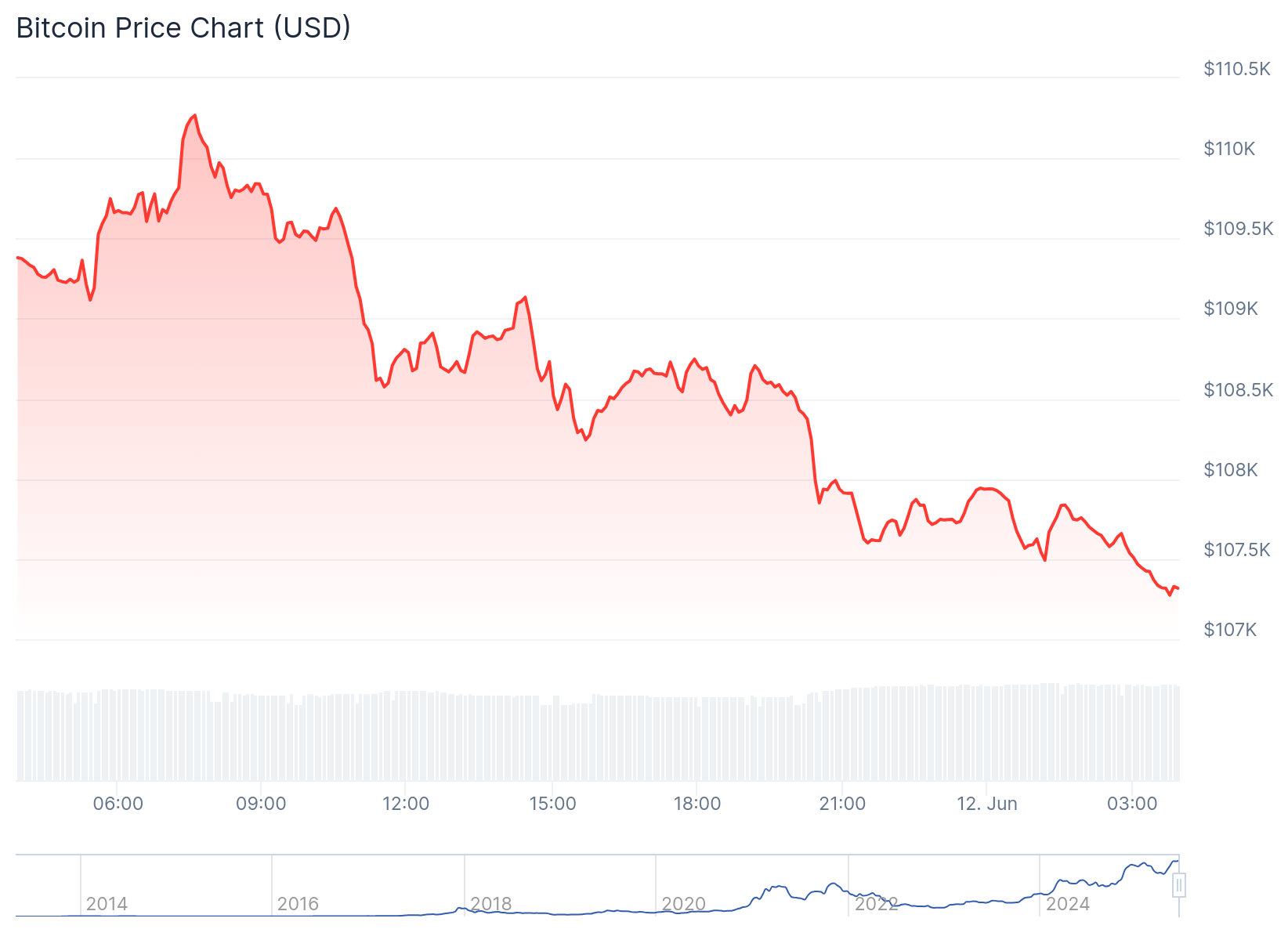

Bitcoin’s Price Faces Slight Correction

Bitcoin price is 1.6% down in the past 24 hours, trading at approximately $107,500 at the time of drafting this report. The flagship crypto has fluctuated between $100,984 and $110,266, following a 2.7% upswing in the past 24 hours. BTC’s month-to-date and year-to-date price change variables showed increments of 4.7% and 59.6%, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.