Bitcoin Cycle: Is the Current Trend Set for Explosive Growth Like the 2017 Bull Run?

0

0

BitcoinWorld

Bitcoin Cycle: Is the Current Trend Set for Explosive Growth Like the 2017 Bull Run?

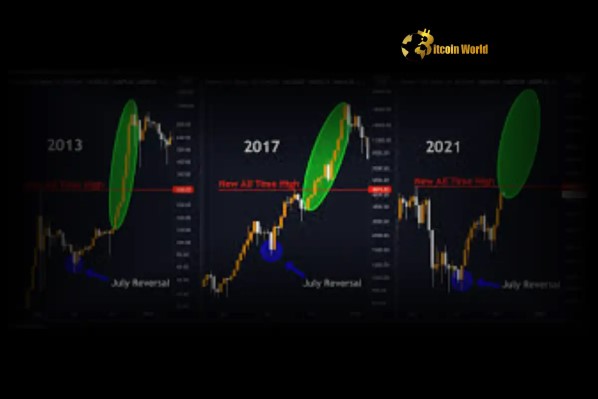

The world of cryptocurrency is always buzzing with excitement, especially when Bitcoin starts making significant moves. Long-time observers often look back at past market cycles to find clues about where things might be headed. Right now, there’s a growing conversation comparing the current Bitcoin Cycle to one of the most memorable periods in its history: the incredible surge of 2017.

Understanding the Bitcoin Cycle: A Look Back

Bitcoin markets tend to move in cycles, often influenced by events like the halving (which reduces the rate of new Bitcoin entering circulation) and shifts in market sentiment or adoption. These cycles typically involve a period of accumulation, a strong upward trend (a bull run), a peak, and then a downward correction (a bear market).

While no two cycles are exactly alike, identifying similarities and differences can offer valuable perspective. The 2017 surge is a prime example of a parabolic bull run that captured global attention.

The Legendary 2017 Bull Run: What Fueled the Surge?

Ah, 2017. For many in the crypto space, it was a time of unprecedented growth and excitement. Bitcoin’s price went from under $1,000 at the start of the year to nearly $20,000 by December. What drove this massive rally?

- Retail Frenzy: A huge influx of individual investors, often driven by FOMO (Fear Of Missing Out). Buying crypto became a mainstream topic of conversation.

- ICO Boom: The rise of Initial Coin Offerings (ICOs) drew massive speculation into the broader crypto market, with Bitcoin often acting as the gateway asset.

- Increased Awareness: More media coverage brought Bitcoin and cryptocurrencies into the public consciousness like never before.

It was a period characterized largely by retail enthusiasm and speculative fervor. The market was less mature, and infrastructure for institutional participation was minimal.

Comparing Cycles: How Does Today’s Bitcoin Cycle Stack Up?

According to Joe Burnett, Director of Market Research at Unchained, the current Bitcoin Cycle shows compelling parallels to that explosive 2017 Bull Run. While the 2020-2021 cycle also saw significant growth, it faced headwinds like China’s ban on Bitcoin mining, which temporarily dampened enthusiasm and market momentum.

Burnett suggests that the current environment is different, potentially setting the stage for a similar rapid price appreciation seen in 2017. But if it’s not just retail and ICOs, what’s driving the market this time?

What’s Different This Time? The Rise of Institutional Demand

This is where the current cycle diverges significantly from 2017 and even the 2020-2021 period. The primary catalysts today are coming from established financial players and corporations, representing robust Institutional Demand.

The Game Changer: Spot Bitcoin ETF Inflows

One of the biggest new factors is the approval and launch of spot Bitcoin ETF products in the United States. These exchange-traded funds allow traditional investors to gain exposure to Bitcoin’s price movements without directly buying and holding the cryptocurrency themselves. This has opened the floodgates for capital from:

- Hedge funds

- Wealth managers

- Pension funds

- Retail investors using traditional brokerage accounts

The sheer volume of inflows into these ETFs since their launch has been remarkable. Every day, these funds are buying thousands of Bitcoin on the open market to back the shares they issue. This creates constant, significant buying pressure that simply didn’t exist in 2017.

Corporate Treasuries: A New Source of Demand

Another key difference is the increasing adoption of Bitcoin as a treasury reserve asset by publicly traded companies. Firms like MicroStrategy have famously acquired substantial amounts of Bitcoin, holding it on their balance sheets as a long-term store of value and an alternative to cash.

This trend signals growing corporate confidence in Bitcoin as a legitimate asset class and adds another layer of sustained buying pressure from entities with significant capital reserves. This kind of corporate accumulation was virtually non-existent during the 2017 Bull Run.

Comparing Market Drivers: 2017 vs. Today

Let’s look at a simplified comparison of the main forces at play:

| Factor | 2017 Bull Run | Current Bitcoin Cycle |

|---|---|---|

| Primary Driver | Retail Speculation, ICOs | Institutional Demand, ETFs, Corporate Treasuries |

| Market Maturity | Early Stage, Less Regulated | More Mature, Developing Regulatory Framework |

| Access for Institutions | Limited Infrastructure | Significant Infrastructure (ETFs, Prime Brokers) |

| Global Headwinds (During Cycle) | Less Significant | Macro Economy, Geopolitics, Regulatory Uncertainty (varied by region) |

| Supply Side Event (Halving) | Occurred 2016 (Pre-run) | Occurred 2024 (During current cycle buildup) |

This table highlights that while both periods involve strong upward price movement, the foundation supporting the current rally appears to be more institutional and potentially more sustainable in the long run compared to the predominantly retail-driven surge of 2017.

Potential Headwinds and Challenges

Even with strong tailwinds from Institutional Demand and the Bitcoin ETF, the market isn’t without potential challenges:

- Regulatory Uncertainty: While the US approved spot ETFs, regulatory stances vary globally and can change.

- Macroeconomic Factors: Interest rates, inflation, and global economic stability can influence investor appetite for risk assets like Bitcoin.

- Market Corrections: Bull markets are rarely linear. Sharp pullbacks are normal and can be triggered by various events.

- Exchange Risks: While ETFs mitigate some risks, the underlying infrastructure still involves exchanges and custodians.

Understanding these potential challenges is crucial for any market participant.

What Could This Mean for the Bitcoin Price?

If the parallels to the 2017 Bull Run hold true, and the current drivers like Bitcoin ETF inflows and Institutional Demand continue, it could indeed set the stage for another period of significant price appreciation for Bitcoin. The consistent buying pressure from these large players absorbs supply, especially post-halving when new supply is already reduced.

While predicting exact price targets is impossible, the fundamental shift from primarily retail-driven growth to significant institutional participation suggests a maturing market with potentially stronger, more sustained demand than in previous cycles. This structural change is a key reason analysts like Burnett see potential for a rapid rise.

Actionable Insights for Navigating the Market

So, what should you take away from this analysis?

- Do Your Own Research: Understand the drivers and risks. Don’t invest based solely on historical comparisons or price predictions.

- Focus on the Long Term: Bitcoin’s history is one of volatility. Many long-term holders who navigated previous cycles have seen significant returns.

- Understand the New Landscape: Recognize that the market structure has changed with the advent of ETFs and corporate adoption. This is a fundamental shift.

- Manage Risk: Only invest what you can afford to lose. Volatility remains a key feature of the crypto market.

Conclusion: Is Another Rapid Ascent on the Horizon?

Joe Burnett’s comparison of the current Bitcoin Cycle to the historic 2017 Bull Run highlights potentially explosive growth potential. While the retail frenzy of 2017 was a major factor then, the current market is increasingly driven by powerful forces like significant Bitcoin ETF inflows and growing corporate Institutional Demand. These new drivers represent a more mature and potentially more sustainable source of buying pressure.

While challenges and volatility remain, the structural changes in market participation suggest that the current cycle has robust support. If these trends continue, the stage may indeed be set for the Bitcoin Price to experience another period of rapid ascent, echoing, but not necessarily perfectly replicating, the incredible journey of 2017.

To learn more about the latest Bitcoin Cycle trends, explore our article on key developments shaping Bitcoin price action.

This post Bitcoin Cycle: Is the Current Trend Set for Explosive Growth Like the 2017 Bull Run? first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.