Dogecoin Faces Renewed Selling Pressure Amid Cautious Market Activity

0

0

- Dogecoin faces renewed selling pressure with price dropping 2% to trade at $0.1628.

- Derivatives data shows reduced market activity but rising options open interest by 130%.

- Technical indicators suggest limited bullish momentum with RSI at 46.88 and weak MACD signal.

Dogecoin (DOGE) is witnessing new selling pressure after a brief price recovery, as on-chain and derivatives data reflect cautious trading behavior in the market. The meme coin’s recent price movement has been shaped by market volatility and weakened buying interest, with its price falling by over 2% in the past 24 hours. Trading at $0.1628, DOGE is struggling to sustain its previous bullish momentum, according to data from CoinMarketCap.

Source: CoinMarketCap

The latest price trend shows that Dogecoin briefly advanced to a daily high of $0.1672 during early trading hours on April 13. However, the upward move was short-lived as the price faced rejection and reversed its gains throughout the day. DOGE fell to an intraday low near $0.1620, highlighting ongoing bearish control in the market.

Over the past month, DOGE experienced price fluctuations, with a local peak in late March followed by heavy selling pressure. This downward pattern extended into early April, pushing the price to its lowest level. Despite this volatility, the supply of DOGE on exchanges remained stable, indicating the absence of panic selling among long-term holders.

The trading activities in DOGE shrunk in the last 24 hours after it was dragged down by a 6.72% dip in trading volume to $ 788.68 million. Relative to all other cryptocurrencies, it has a total market capitalization of $24.24 billion and is ranked eighth one in terms of market capitalization.

On-Chain Data Shows Reduced Speculative Interest

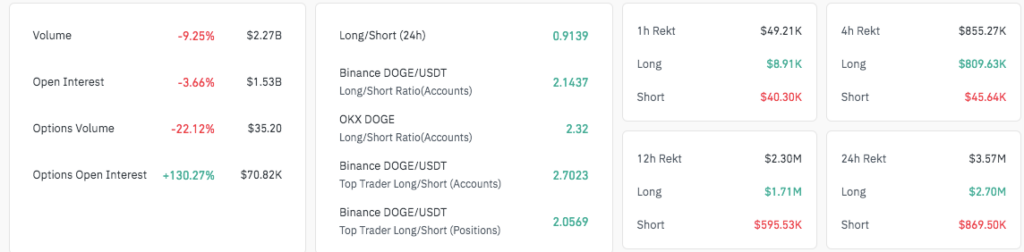

Analyzing derivative markets, we came across a distaste in the speculation of DOGE. Trade turnover in derivatives declined by 9.25% in the last 24 hours, equaling $2.27 bln. Open interest in these contracts declined by 3.66% to $1.53 billion in an indication that trading activities had slowed down.

However, DOGE options open interest rose by 130.27% to $70.82K, signaling that some traders are positioning for possible volatility in the coming sessions. Meanwhile, the overall long/short ratio for DOGE stands at 0.9139, indicating a slight dominance of short positions.

The pattern is the same for exchanges like Binance and Okx, where overall indicators of bullishness are higher. The Current DOGE/USDT daily bars long/short ratio is 2.1437 on Binance and 2.32 on OKX, indicating that the long position is more dominant than the short position despite the recent sharp downward movement.

Analyzing liquidations by Rekt, it is seen that 24 hour positions in DOGE value $3.57 million were liquidated. Longs liquidations stood at $2.70 million, while short liquidations were $869.5K, which means that bulls have lost a considerable amount during the recent correction.

Technical Indicators Suggest Limited Bullish Momentum

Technical analysis points to an expected consolidation phase for DOGE. The Relative Strength Index (RSI) stands at 46.88, slightly below the neutral 50 mark, while trending upwards from a low of 41.69. This signals a small recovery in buying pressure.

The MACD is currently indicating a bullish crossover because the MACD line has crossed above the signal line at -0.00711 to be positioned at 0.00154. However, this bullish signal is not very strong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.