Metaplanet Hits 13,350 BTC, Launches $208M Bond Plan for More Purchases

0

0

Highlights:

- Metaplanet now holds 13,350 BTC after buying 1,005 BTC for $108 million.

- The firm issued $208 million in 0% bonds to buy more Bitcoin and cancel debt.

- Its stock jumped 9% Monday and is up over 350% since the start of 2025.

Japanese Bitcoin treasury firm Metaplanet has purchased an additional 1,005 BTC for approximately $108 million, paying an average price of $107,601 per coin. This brings the company’s total holdings to 13,350 BTC, now worth around $1.4 billion based on current market value.

*Metaplanet Acquires Additional 1,005 $BTC, Total Holdings Reach 13,350 BTC* pic.twitter.com/a6aNMV9weD

— Metaplanet Inc. (@Metaplanet_JP) June 30, 2025

Metaplanet’s recent Bitcoin acquisition has positioned it as the fifth-largest publicly listed corporate holder of the cryptocurrency, based on data from BitcoinTreasuries.net. This latest move places Metaplanet ahead of Galaxy Digital, which holds 12,830 BTC, and CleanSpark, with 12,502 BTC.

Simon Gerovich, CEO of Metaplanet, stated on X that three months ago, the company had reached 3,350 BTC during its shareholder meeting. Since then, it has added 10,000 more, bringing the total to 13,350 BTC. Earlier this month, the company also shared its updated goal to hold over 210,000 BTC by the end of 2027.

Metaplanet has acquired 1,005 BTC for ~$108.1 million at ~$107,601 per bitcoin and has achieved BTC Yield of 348.8% YTD 2025. As of 6/30/2025, we hold 13,350 $BTC acquired for ~$1.31 billion at ~$97,832 per bitcoin. $MTPLF pic.twitter.com/TdHEEjF5af

— Simon Gerovich (@gerovich) June 30, 2025

Metaplanet Issues $208M in Zero-Interest Bonds to Fund Bitcoin Buys

On the same day, Metaplanet shared a plan to raise money through bonds. As part of this plan, it issued 30 billion yen ($208 million) in 0% interest bonds using its EVO fund to buy more Bitcoin. The company also said it will buy back and cancel older bonds worth 1.75 billion yen ($12 million), which had a 0.36% yearly interest. This move gives Metaplanet an interest-free loan and extra cash to invest in more Bitcoin. “Funds raised through the issuance of the new bonds will be partially allocated to the buyback and cancellation, with the remainder used for the purchase of Bitcoin,” the disclosure stated.

*Metaplanet Issues 30 Billion JPY in 0% Ordinary Bonds to Purchase Additional $BTC* pic.twitter.com/tfzi17CX8Y

— Metaplanet Inc. (@Metaplanet_JP) June 30, 2025

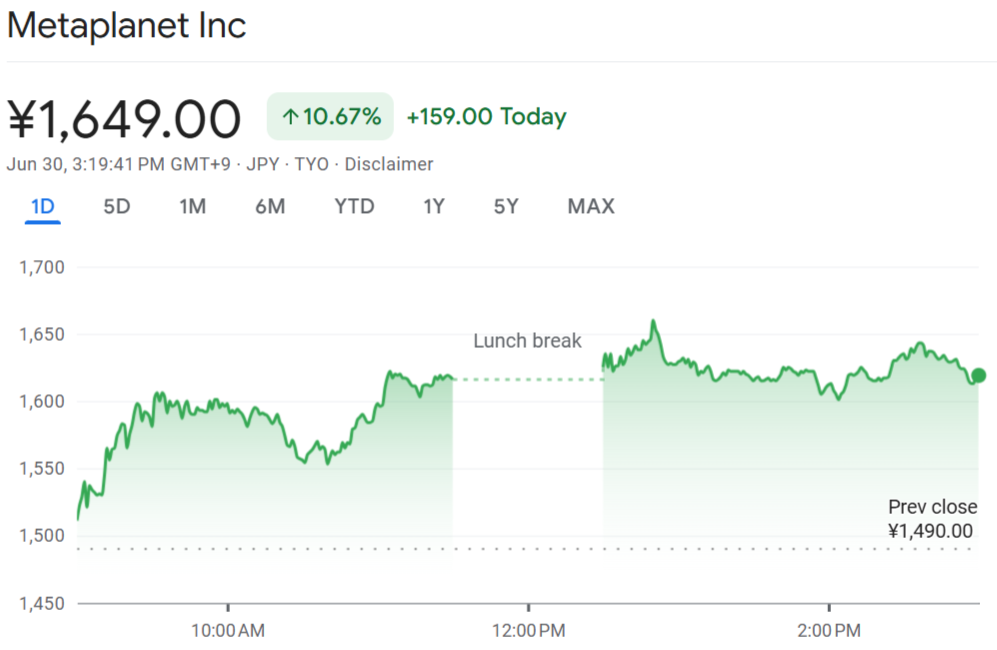

Metaplanet Stock Rebounds 9% After New Bitcoin Buy

Metaplanet Inc (3350.T) shares initially dropped after the company announced its “Accelerated 2025–2027 Bitcoin Plan.” The plan involves issuing 555 million new shares to raise $5.4 billion, to hold at least 210,000 BTC by 2027. However, the stock rebounded following news of the company’s latest BTC purchase.

As of writing, shares are up 10% on Monday, trading at 1,649 yen. The 24-hour price range sits between 1,507 and 1,625 yen. According to Yahoo Finance, the stock has surged more than 51% over the past month and is up 360% so far this year.

Meanwhile, Bitcoin’s price has risen over the past 24 hours, now trading 0.87% higher at $108,022. The 24-hour low was $107,251, while the high reached $108,798.

Public Companies Keep Adding Bitcoin as MicroStrategy Stays on Top

Metaplanet’s recent purchase comes during a growing trend of Bitcoin accumulation by publicly listed companies. According to data from bitcointreasuries.net, over 140 publicly traded firms currently hold Bitcoin in their reserves.

MicroStrategy, led by Michael Saylor, remains the top corporate holder of Bitcoin globally, with total holdings reaching 592,345 BTC after adding 245 BTC last week. Saylor posted his usual weekend update, which may mean a Bitcoin buy on Monday. This pattern has happened in the past weeks, too. Saylor, while sharing the chart, mentioned that people may wish they had bought more Bitcoin in 21 years.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.