XMR price dips 12% as Qubic pool seizes control of Monero network

0

0

Digital tokens traded in the red on Tuesday as the cryptocurrency market cap plunged 2% in the past day to $3.94 trillion.

While most coins demonstrated resilience, Monero’s XMR saw a significant 12% 24-hour dip.

XMR plunged as the Monero blockchain faced a successful 51% attack.

Multiple sources have highlighted that the Qubic mining pool has amassed massive dominance over Monero’s hashrate for months.

According to SlowMist founder Charles Guillemet, the buildup has hit a crucial threshold, with Qubic now commanding the privacy network’s mining power.

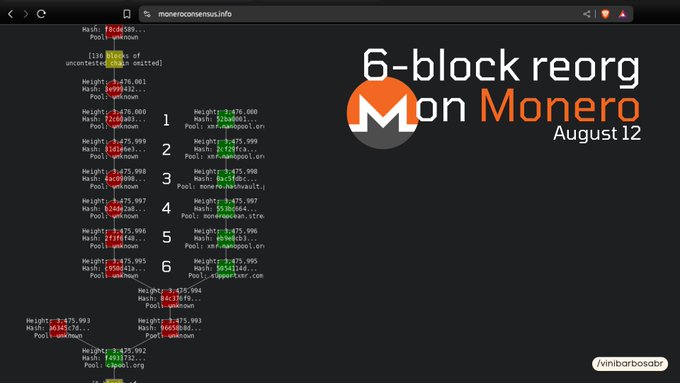

The incident triggered a significant chain reorganization, suggesting that Monero is no longer running under an unbiased consensus.

The current dominance allows Qubic to theoretically and practically double-spend, rewrite the blockchain, and censor transactions.

For context, Quibic revealed plans to dominate Monero’s hashrate late last month to demonstrate its AI-powered mining potential.

While Qubic’s move focuses on economic incentives, not a usual exploit, fears of undermining decentralization have materialized as the 51% attack succeeded.

XMR has plunged from $277 to an intraday low of $245 following these revelations. That translates to a more than 12% plunge within a day.

Monero is in jeopardy after Qubic’s takeover

Multiple trading platforms, including OKX, banned Monero due to its privacy nature, which makes it useful for illicit activities like money laundering.

However, it has displayed resilience, remaining as the top privacy cryptocurrency with $4.55 billion market cap.

Monero’s stability is now in danger. Qubic’s control allows it to orphan blocks mined by competitors, limiting miner profitability.

With little to no financial gains, independent miners will likely exit, a move that would strengthen Qubic’s grasp.

The twist has raised eyebrows across the cryptocurrency sector.

Qubic has a market capitalization of around $290 million and is taking over a billion-dollar project.

Such imbalances highlight how small miner pools can threaten the security of established blockchain projects.

A costly dominance

The attack costs Qubic a fortune, with estimates indicating that it should spend about $75 million per day to sustain it.

While the economic gains of transaction censorship and double-spending could be lucrative, the risk is immensely high.

Such incidents would dent confidence in Monero, possibly crashing XMR’s value beyond recovery while rendering Qubic’s move financially futile.

XMR price outlook

The native token trades at $248, with the daily chart indicating dominant selling pressure.

Meanwhile, XMR’s decline has been somewhat modest considering the intensity of mining dominance.

The altcoin’s future remains uncertain. Other miners should rally to challenge Qubic.

Failure to do that will leave XMR under the control of a single mining entity. That’s against decentralization principles.

The post XMR price dips 12% as Qubic pool seizes control of Monero network appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.