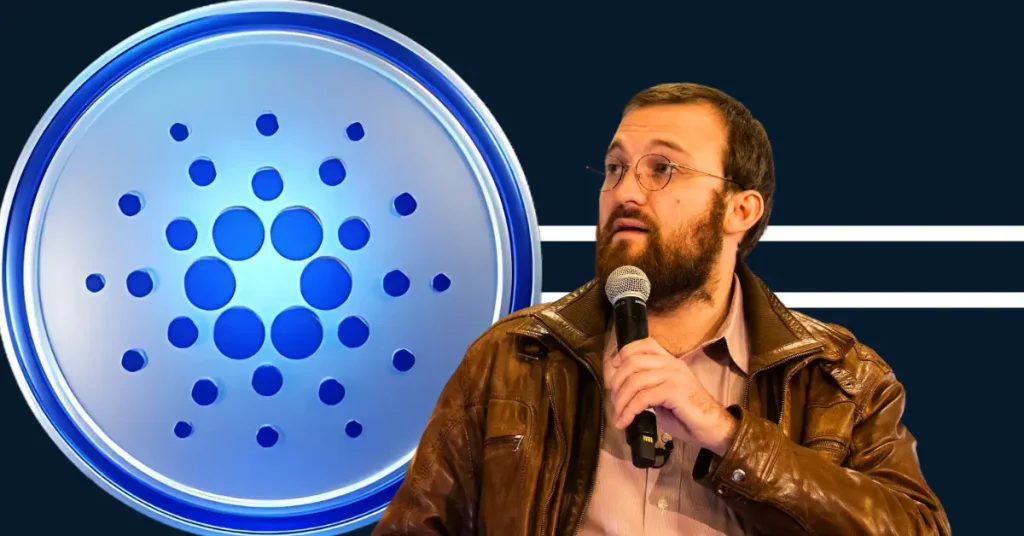

Charles Hoskinson says, “Cardano is Mocked While Leading Real Innovation”

0

0

The post Charles Hoskinson says, “Cardano is Mocked While Leading Real Innovation” appeared first on Coinpedia Fintech News

Charles Hoskinson says Bitcoin DeFi presents the biggest opportunity for Cardano right now. However, while he is waving the flag for Cardano’s future, he’s also waving a warning. The founder believes Cardano has a real shot at becoming the backbone of Bitcoin DeFi, thanks to its powerful tech stack and growing ecosystem. But there’s one big problem, and there is no one leading the conversation.

With projects like Minswap planning to tap into Bitcoin’s massive $2 trillion liquidity and tools like USDM and Lace Wallet gaining traction, Cardano is setting the stage for growth. But founder Hoskinson says without strong leadership to drive this narrative, the platform may struggle to fully capitalize on the opportunity.

A Big Opportunity, But Poor Management

Hoskinson thinks Bitcoin DeFi is Cardano’s golden opportunity, as it could boost liquidity and bring in new users. He points to projects like Minswap (Cardano’s top DEX), the Lace Wallet, and the USDM stablecoin, which are all gaining ground. Minswap is even preparing to integrate Bitcoin, aiming at a whopping $2 trillion liquidity pool. Combine that with tech innovations like Leios, Hydra, and the Midnight Glacier Drop, and Cardano has the tools. But without a strong executive presence or a compelling narrative, the crypto world isn’t catching on.

In a candid post on X, Hoskinson said Cardano is missing an “executive voice” and a capable foundation to drive its vision into the crypto mainstream. He’s been personally trying to fill that gap, but it’s come with challenges, including personal attacks and ADA theft accusations. He calls the effort “brutal and expensive.”

Cardano’s Game Plan Moving Forward

Input Output Global (IOG), Hoskinson’s company, is still pushing the story forward. But he believes the broader community and ecosystem need to step up. With the Rare Evo crypto conference on the horizon, Cardano has big plans to fix its internal structure, like updating its constitution, tackling governance issues, and even launching a sovereign wealth fund to fund its Bitcoin DeFi ambitions. However, they still need a strong voice to take it to the heights.

[post_titles_links postid=”476691″]Cardano Current Market Snapshot

Cardano (ADA) is down 35% this year but still up 56% over the past year. With 35.36 billion ADA already in circulation out of a 45 billion cap, there’s still a large supply that could pressure prices if demand doesn’t rise. Its 2% annual inflation rate, higher than Bitcoin’s 0.82%, adds to the challenge. To counter this, Cardano plans to convert 5–10% of its treasury (about 140 million ADA) into Bitcoin or stablecoins using a TWAP strategy, similar to what Michael Saylor does for BTC buys, to avoid market shocks. Hoskinson hopes future gains from BTC or stablecoins could fund ADA buybacks, potentially supporting its price long-term.

[article_inside_subscriber_shortcode title=”Never Miss a Beat in the Crypto World!” description=”Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.” category_name=”News” category_id=”6″]Bitcoin DeFi (BTCFi) refers to decentralized finance applications and protocols that leverage Bitcoin’s security and liquidity. It allows users to use their Bitcoin holdings for activities like lending, borrowing, trading, and yield generation, expanding Bitcoin’s utility beyond just a store of value.

Charles Hoskinson suggests Cardano needs a dedicated “executive voice” and a capable foundation to drive its vision into the mainstream. While IOG pushes the narrative, the community and ecosystem need to step up. Future plans include governance updates and a sovereign wealth fund to fund Bitcoin DeFi initiatives.

Cardano has the technological tools (e.g., Minswap, Lace Wallet, USDM, Leios, Hydra). However, it needs a strong “executive voice” to lead the narrative, fix internal governance, and effectively communicate its vision to the broader crypto world for this ambition to materialize.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.