0

0

Key takeaways:

Monero (XMR) stands out in the crypto space for its strong focus on privacy and decentralization of transactions, particularly within the monero network, making it one of the leading privacy focused cryptocurrencies. This makes it a popular choice for privacy advocates and those prioritizing security. The Monero ecosystem constantly evolves, marked by significant milestones like enhanced protocol upgrades and growing adoption across various sectors, which underscore its utility.

As Monero progresses, many wonder about its future price trajectory. Will its unique features drive significant value growth, as many traders speculate, and can a price prediction tool provide insights into this ? Can it sustain its competitive edge in the ever-evolving crypto market? Will the price of xmr recapture its ATH at $517.62 in the long term forecast?

| Cryptocurrency | Monero |

| Token | XMR |

| Price | $434.52 (+3.4%) |

| Market Cap | $8.01B |

| Trading Volume (24-hour) | $77.4M |

| Circulating Supply | 18.44M XMR |

| All-time High | $517.62 May 07, 2021 |

| All-time Low | $0.213, Jan 15, 2015 |

| 24-h High | $435.56 |

| 24-h Low | $418.06 |

| Sentiment | Bullish |

| 50-Day SMA | $411.83 |

| 200-Day SMA | $332.87 |

| Price Prediction | $463.39 (7.34%) |

| F & G Index | 16.32 (extreme fear) |

| Green Days | 15/30 (50%) |

| 14-Day RSI | 43.64 |

TL;DR Breakdown

On January 3, 2025, Monero price analysis revealed a bullish trend for the week as the price faced resistance above the $440 mark and declined to $420 before recovering. The altcoin’s price increased to $434 in the past 24 hours.

The one-day price chart for Monero confirms a downwards trend in the market, indicating a notable price change. XMR price declined rapidly after failing to breach the $480 resistance. The XMR/USD pair declined to $420 where it finds support. Now the price has risen back to $434.

The Moving Average Convergence Divergence (MACD) shows a decline in bearish momentum as the price returns to $434. The Relative Strength Index (RSI) is trading in the neutral region. The indicator’s value was recorded at 52.44 today. The upward curve on the RSI signifies a bullish presence at the level. Further volatility can be expected if the buying momentum intensifies and the $440 mark is breached.

The four-hour chart analysis of Monero shows rapid decline after a brief struggle at $440 mark. However, the price found support above the $420 mark that enabled it to climb back to $434.

The Moving Average Convergence Divergence (MACD) shows rising bullish momentum as price starts to recovers across the last few candles. The Relative Strength Index (RSI) indicator is trending towards the upper line of the neutral region. The indicator’s value increased to 57.27 over the past few candles, as the price found support. This suggests a support level forming while the diverging Bollinger Bands suggest increasing volatility.

| Period | Value | Action |

|---|---|---|

| SMA 3 | $ 367.29 | BUY |

| SMA 5 | $ 397.48 | BUY |

| SMA 10 | $ 422.48 | BUY |

| SMA 21 | $ 427.83 | BUY |

| SMA 50 | $ 411.66 | BUY |

| SMA 100 | $ 372.90 | BUY |

| SMA 200 | $ 306.89 | BUY |

| Period | Value | Action |

|---|---|---|

| EMA 3 | $ 425.07 | BUY |

| EMA 5 | $ 410.36 | BUY |

| EMA 10 | $ 378.70 | BUY |

| EMA 21 | $ 340.09 | BUY |

| EMA 50 | $ 313.62 | BUY |

| EMA 100 | $ 304.64 | BUY |

| EMA 200 | $ 284.45 | BUY |

Monero price analysis gives a bullish prediction regarding the ongoing market trends, as the coin’s price is increasing after price crashed to the $420 mark. If buyers hold the ongoing momentum, XMR’s estimated price might increase above the $440 level. However, if the bulls fail to breach the level, the price will fall back to $420 and lower levels.

Monero is an attractive investment because it emphasizes privacy and security, utilizing advanced cryptographic techniques to ensure transaction confidentiality, which has created a strong demand in the market . Its growing adoption across various use cases and a decentralized development model enhance its long-term potential.

With a limited supply and increasing investor interest, Monero offers a unique opportunity for those seeking financial autonomy and privacy to invest in cryptocurrency. However, investors should remain cautious of regulatory risks and market volatility when considering Monero as part of their portfolio, making it essential to seek investment advice.

Monero price analysis shows that XMR saw a sharp drop to $420 before finding support that enabled it to recover to the current $434 level.

Monero is expected to recover toward its all-time high of $518 by mid-2026 as the privacy chain continues to reduce its tech debt and progresses toward greater utility and privacy. However, the platform might have to overcome regulatory scrutiny and challenges before it can see mass adoption, as it remains highly speculative .

The Monero price prediction for 2031 suggests a minimum price of $922.68 and an average trading price of $1,000.34. The maximum forecasted price is set at $1,099.55.

The chances of Monero (XMR) hitting $1,000 hinge on various factors, which will influence its future price movements. The adoption of privacy transactions and technological advances could increase demand. Favorable regulations and market sentiment toward privacy coins would also help. Yet, regulatory risks, competition, and market volatility creating an atmosphere of extreme fear are challenges that Monero traders could face that could hinder significant growth. $1,000 is possible with favorable conditions, especially considering the current price but market dynamics and regulations will shape its path.

Monero (XMR) has the potential for a strong long-term future due to its focus on privacy and security, which makes it attractive to users seeking anonymity. However, many investors have concerns regarding privacy, regulatory scrutiny, and notoriety from being the favored medium for some past criminals, which impact the current Monero sentiment. Monero’s commitment to ring confidential transactions and the broader monero project gives it a solid foundation for long-term growth, but it must carefully navigate market and regulatory landscapes.

Lee Clagett recently made the proposal to continue working full time on Monero.

The XMR price prediction for January 2026 suggests a minimum value of $364.94 and an average price of $431.70. The price could reach a maximum of $469.74 during the month.

| Month | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| January | 364.94 | 431.70 | 469.74 |

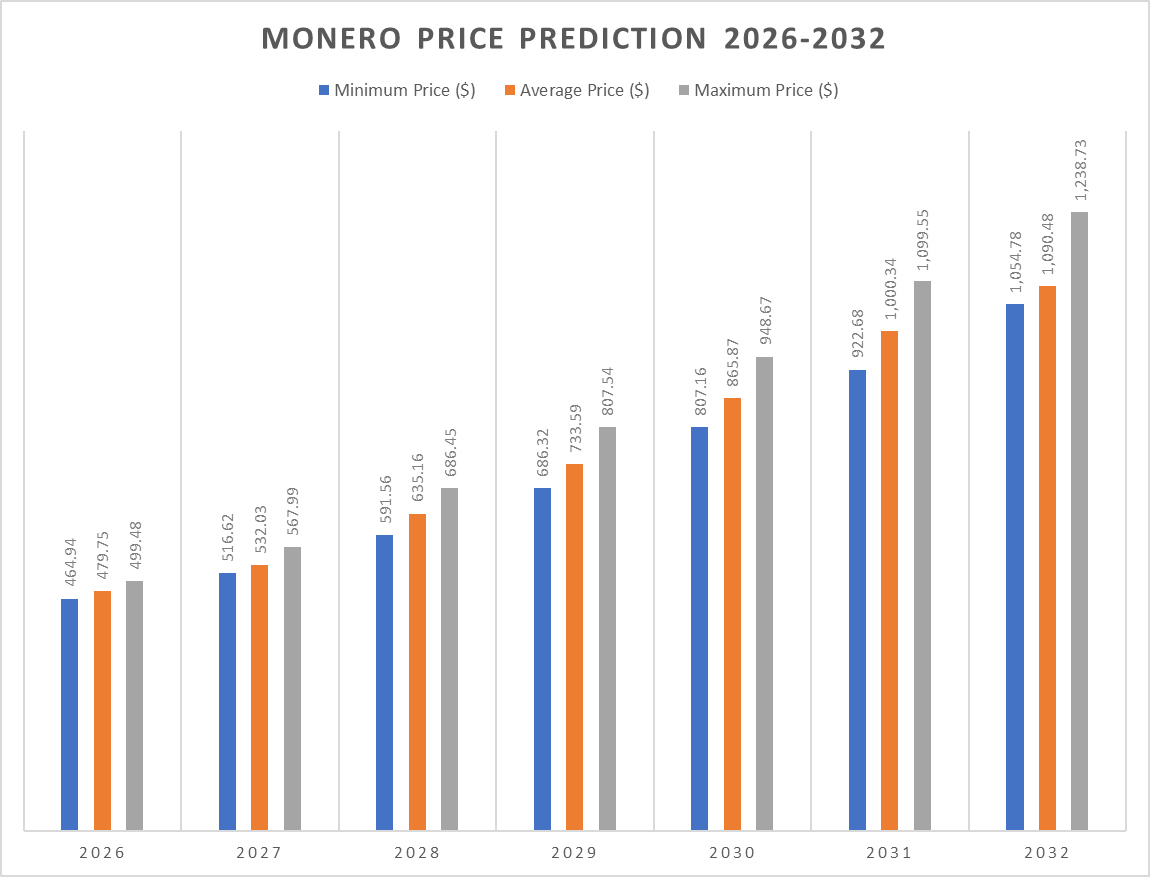

The Monero price prediction for 2026 anticipates a potential increase driven by growing adoption, with a maximum price forecasted at $499.48. Based on current analysis, investors can expect an average trading price of $479.75, while the minimum price could be around $464.94.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | 364.94 | 479.75 | 499.48 |

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2027 | 516.62 | 532.03 | 567.99 |

| 2028 | 591.56 | 635.16 | 686.45 |

| 2029 | 686.32 | 733.59 | 807.54 |

| 2030 | 807.16 | 865.87 | 948.67 |

| 2031 | 922.68 | 1,000.34 | 1,099.55 |

| 2032 | 1,054.78 | 1,090.48 | 1,238.73 |

In 2027, Monero’s value is expected to continue its upward trend, with a minimum price of $516.62, an average price of $532.03, and a maximum price of $567.99.

For 2028, Monero is anticipated to trade at a minimum of $591.56, with an average price of $635.16, and a maximum price reaching $686.45.

The price outlook for 2029 suggests Monero will maintain a minimum value of $686.32, an average of $733.59, and a maximum of $807.54.

By 2030, Monero is forecasted to achieve a minimum trading price of $807.16, with an average price of $865.87 and a potential peak of $948.67.

In 2031, Monero’s price is expected to reach a minimum of $922.68, while averaging $1,000.34. The maximum projected value is $1,099.55.

In 2032, Monero is projected to continue its growth trajectory, with a minimum trading price of $1,054.78, an average price of $1,090.48, and a maximum price reaching $1,238.73.

| Firm | 2026 | 2027 |

| CoinCodex | $585.80 | $611.97 |

| Digitalcoinprice | $499.48 | $567.99 |

Cryptopolitan’s Monero price forecast suggests a bullish outlook for XMR’s future should the market recover. According to expert analysis, Monero could reach a maximum price of $499.48, record a minimum price of $464.94, and trade at an average price of $479.75 by the end of 2026.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.