Chainlink Price Surge Might Be a Trap: On-Chain Data Says So

0

0

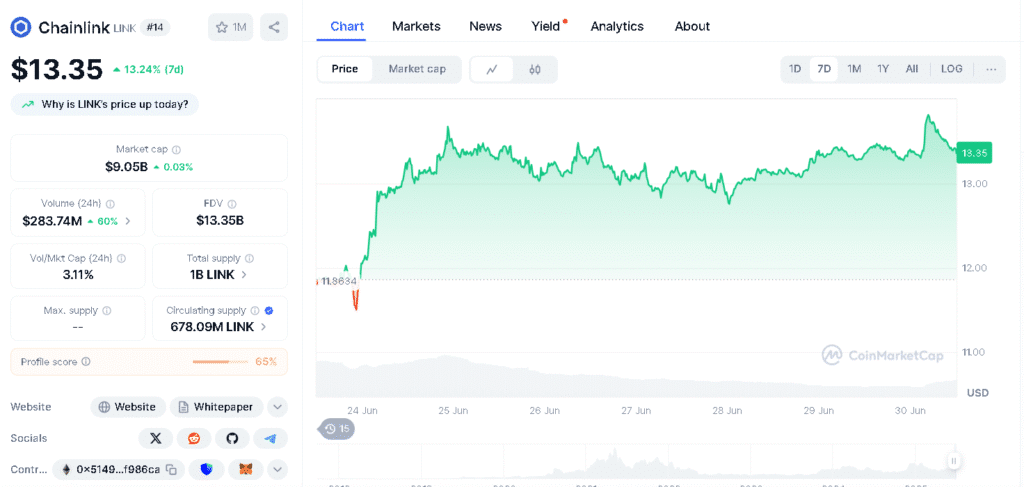

According to AMBCrypto, Chainlink price prediction 2025 suggests that the price might possibly hit a short-term high near $13.4, which could be a warning sign for LINK bulls due to rising selling pressure.

Even though LINK has increased recently, important data from the blockchain and exchange activity show that this rally might not last, and the price might start falling again soon.

LINK is trading near $13.30 with strong resistance at $13.86 and $14.36. If it fails to break these levels, the price may retest $13.00 or slide toward $12.80.

While long-term forecasts remain cautiously bullish, experts say LINK needs to reclaim momentum to reach the $25–$32 range in 2025.

Rising Caution Amid Short-Term Gains

Even though LINK recovered by 13.2% in a week, its position is still uncertain. After falling to $10.94, Chainlink surged but struggled to move above the strong resistance at $13.4 raising fresh concerns in the Chainlink price prediction 2025 outlook.

This rise failed to generate long-term confidence among investors, as Chainlink technical analysis today shows that investors were more focused on short-term exits than holding for the long term.

According to Santiment data, there has been no strong increase in developer activity or new wallet growth, which is a sign usually seen during strong bullish phases

On-Chain Metrics Signal Selling Intent

Lately, there have been sudden increases in dormant circulation, which means LINK has moved towards the support and resistance zone. On March 14 and June 20, there was a noticeable shift in token movement across wallets.

This usually means holders were preparing to sell. This metric usually happens before a price drop. There hasn’t been much new buying of LINK across the network, as reflected by the unchanged mean coin age.

This suggests that most holders are not increasing their positions or holding for the long term, which is typically a sign of weak investor confidence, which make this an important factor outlining Chainlink price prediction 2025 in a cautious light.

Instead, many are selling to take profits during price jumps or reacting quickly when prices drop, which suggests a low trust in the market.

| Metrics | Value |

| Current Price | $13.35 |

| 24H High Price | $13.84 |

| 24H Low Price | $13.26 |

| Resistance Level | $13.86-$14.36 |

| Support Level | $13.00- $12.90–$12.80 |

| 24 Hour Trading Volume | $283,835,059.73 |

| All Time High (May 2021) | $52.88 |

Exchange Position Change Turns Bearish Again

One of the most important indicators of market sentiment is the exchange net position change, which recently turned positive again. This means more LINK tokens are moving into exchange wallets, which usually suggests selling pressure.

Glassnode data shows a similar pattern in late 2024 and early 2025, where every price rise was followed by more tokens being sent to exchanges. This time, too, the trend appears to be repeating, signalling growing selling pressure from investors.

Market analyst Jordan Frey said it is usually a bad sign when more LINK is moved to the exchange during a price rise. It means holders are preparing to sell, which can stop the price from going higher.

He explains how increased exchange inflows often reflect plans to sell, which might slow down Chainlink’s short-term growth. And even short-term downside in the Chainlink price prediction 2025 outlook.

Critical Resistance Zones Ahead

Chainlink is currently trading around $13.24. Its technical analysis shows that the $13.4 to $14 range is a strong supply zone. This range has been difficult for LINK to break in the past and usually causes the price to reverse.

Even though the overall market is recovering from global tensions and Bitcoin’s recent price swings, LINK is still struggling below this resistance, suggesting that its upward momentum may be weakening leading to cautious Chainlink price prediction 2025.

Traders are closely watching the $12 support level. If LINK drops below this level, it might lead to a bigger price fall. The technical outlook stays neutral to bearish, especially since on-chain data still shows that holders lack strong confidence.

Conclusion

Chainlink price prediction 2025 shows growing uncertainty. Although LINK has recovered in the short term, increased exchange inflows, active movement of old tokens, and a lack of strong buying interest all signal growing bearish pressure.

The resistance zone near $13.4 has held strong, and with no strong buying momentum, the possibility of LINK forming a local top has increased.

Summary

The Chainlink price prediction 2025 suggests that LINK is facing strong resistance near $13.4, which raises doubts about further gains. On-chain data shows many holders are selling during the price surge, with little long-term buying activity.

Exchange inflows have increased, which signals growing selling pressure. Market experts warn that if LINK fails to break this resistance, it may fall toward $12.80. For now trend looks uncertain and slightly bearish.

FAQs

1. Will Chainlink price stay above $13 in July 2025?

According to the latest Chainlink price prediction 2025, Chainlink is struggling to hold the $13 level.

2. Why can’t Chainlink break above $13.4?

$13.4 resistance and low demand support a cautious Chainlink price prediction 2025.

3. Has developer activity grown in 2025?

No. Developer activity on Chainlink remains flat, limiting bullish momentum.

4. Is Chainlink exchange inflow increasing?

Yes. More LINK is moving to exchanges, hinting at possible sell-offs.

5. What if LINK breaks above $13.86?

A break above $13.86 could boost the bullish Chainlink price prediction 2025.

Glossary

Chainlink- A crypto project that delivers real-world data to smart contracts.

Developer Activity- Tracks Chainlink’s technical development. Low activity signals limited growth momentum.

EMA- A price trend tool. Falling below EMAs indicates bearish sentiment.

Exchange Inflow- Movement of LINK to exchanges, often a sign of selling intent.

Mean Coin Age- Shows how long tokens are held. Flat trends suggest no new accumulation.

Sources

Read More: Chainlink Price Surge Might Be a Trap: On-Chain Data Says So">Chainlink Price Surge Might Be a Trap: On-Chain Data Says So

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.