Metaplanet Issues $50M 0% Bonds to Expand Bitcoin Portfolio

0

0

Highlights:

- According to an X post, Metaplanet’s latest bond issuance resulted in a $50 million fundraising.

- The company plans to use all the funds to expand its BTC portfolio, bringing it closer to its long-term target.

- At BTC’s current price, investing $50 million in the token will be enough to purchase over 450 coins.

According to a May 28 publication, Japanese crypto investment firm Metaplanet announced a fresh $50 million fundraising from its 16th series of ordinary bond issuance. Proceeds from the exercise will be used exclusively to boost Metaplanet’s BTC portfolio. The company’s Chief Executive Officer (CEO), Simon Gerovich, reacted to the announcement with the comment, “$50 million more BTC incoming.”

*Metaplanet Issues 50 Million USD in 0% Ordinary Bonds to Purchase Additional $BTC* pic.twitter.com/Fz3J7i22XJ

— Metaplanet Inc. (@Metaplanet_JP) May 28, 2025

An Overview of Metaplanet’s Newly Issued Bonds

As usual, the bonds will bear no interest rate with a face value of $1.25 million per bond. Redemption payments have been scheduled for November 27, 2028, at the rate of $1 for every $1 of the bond’s face value. Meanwhile, a bondholder can request early redemption by writing to the company five business days before the desired date.

Also, the company could decide to pay redemptions earlier if certain conditions are met. Metaplanet stated, “If the Company conducts a separate fundraising in the future and raises a multiple of $1.25 million, the Company may redeem a corresponding multiple of the bonds.”

The bonds will be unsecured with no collateral, guarantee, administrator or book-entry transfer institution, aligning with the company’s guiding principles. “The issuance of these bonds is expected to have a minimal impact on the Company’s consolidated financial results for the fiscal year ending December 2025,” Metaplanet added.

Metaplanet was the Most Bought Stock on Japan’s NISA Last Week

In one of its May 25 publications, Crypto2Community reported that Metaplanet ranked first in last week’s Japan Nippon Individual Savings Account (NISA) stock rankings. The impressive feat sparked excitement among Metaplanet’s executives, who shared the news on X.

However, Shinpei Okuno, Metaplanet’s Capital Strategy and Investor Relations, raised concerns about Metaplanet’s absence in the total balances ranking. He said Metaplanet must educate investors to start considering Metaplanet as a long-term investment option. He believes this could help improve the company’s total balance standing.

In an X post, Gerovich stated that Japanese investors are expanding their BTC portfolio by capitalizing on NISA’s zero-tax investment scheme. The CEO added that leverage features make the NISA BTC investment a wholesome and profitable experience for investors.

Metaplanet was the #1 most bought stock last week via NISA accounts at SBI Securities, Japan’s largest online broker.

Japanese investors are using NISA, a tax free investment scheme, to get exposure to Bitcoin without paying capital gains tax.

Bitcoin + zero tax + leverage =… https://t.co/kAI4ephVM2

— Simon Gerovich (@gerovich) May 25, 2025

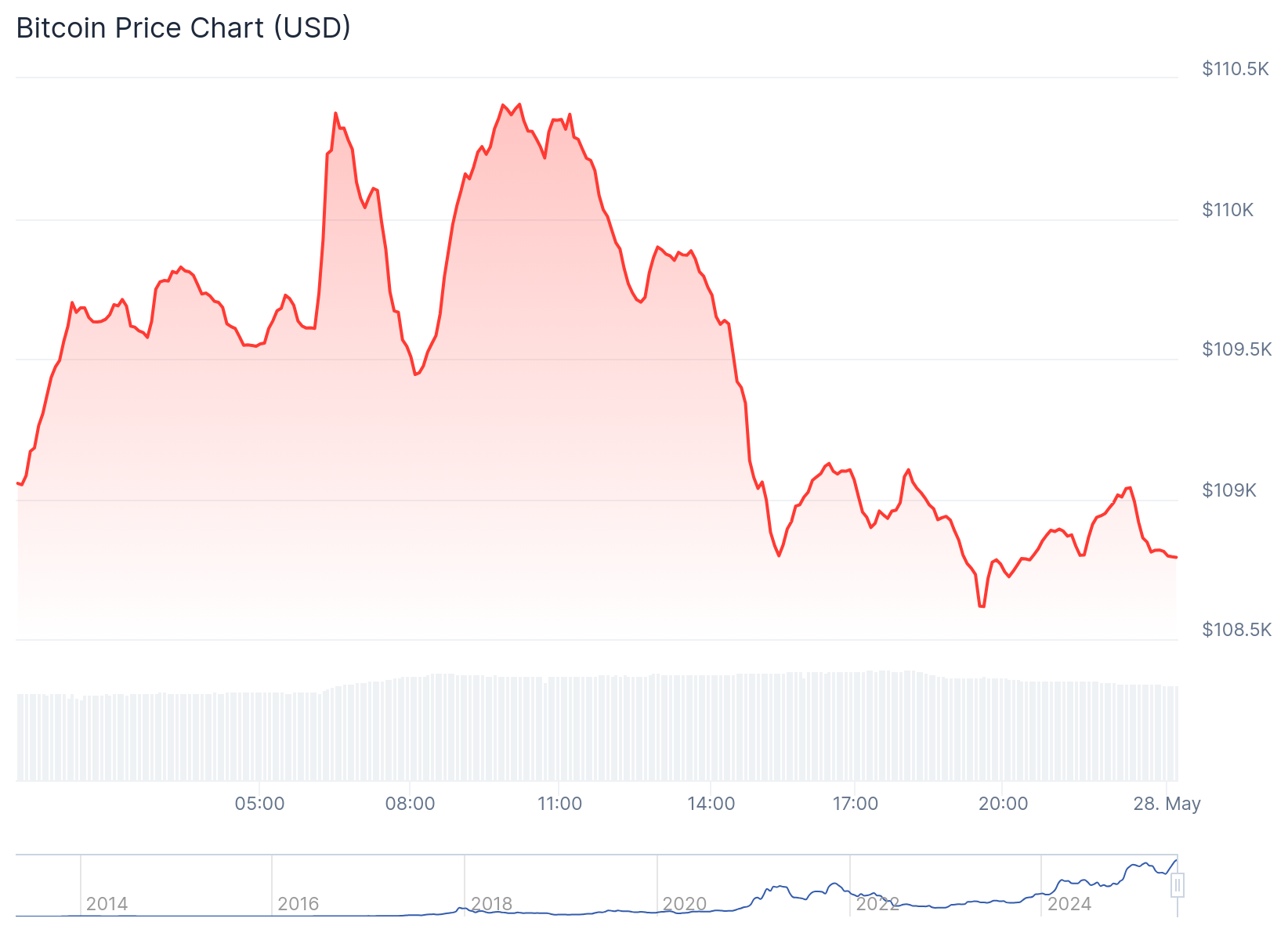

Bitcoin’s Price Surges Slightly

Bitcoin is up 0.1% in the past 24 hours, trading at approximately $109,000 and fluctuating between $108,616 and $110,407. Bitcoin’s 7-day-to-date data reflected a 1.6% upswing, oscillating between $106,229 and $111,807. This price range highlights the token’s remarkable price actions over the past week.

Other extended period price change variables reflected upswings, highlighting BTC’s remarkable resurgence. For context, BTC spiked 5.1% 14-day-to-date, 15.9% 30-day-to-date, and 60.9% year-to-date. After breaking above $100,000, BTC’s market capitalization and fully diluted valuation have consistently remained above $2 trillion.

At BTC’s current price, the $50 million raised from Metaplanent’s latest bond issuance will purchase approximately 458.7 BTC, increasing the company’s holdings from 7,800 BTC to about 8,258.7 BTC, and edging it closer to its 10,000 BTC investment target. In related news, Strategy added 4,020 BTC for $427.1 million. Saylor announced the purchase in a May 26 tweet, noting that Strategy paid roughly $106,237 per BTC with a 16.8% year-to-date yield.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.