Hedera (HBAR) Struggles to Build Bullish Pattern in Tight Range

0

0

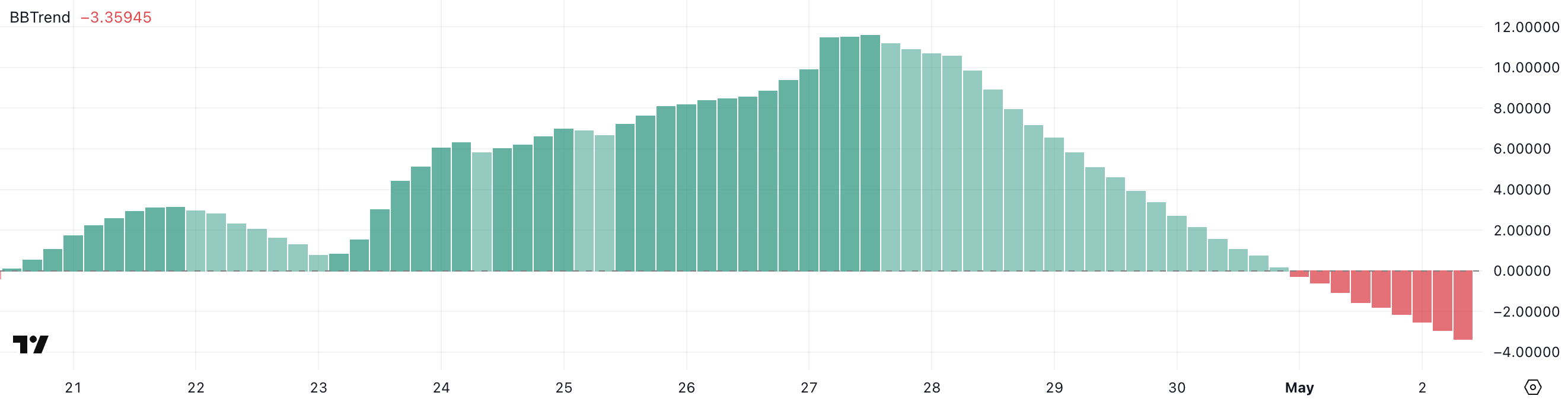

Hedera (HBAR) has fallen over 6% in the last seven days as key indicators point to shifting momentum. After 10 days of bullish strength, the BBTrend has turned negative at -3.35, suggesting growing downside risk.

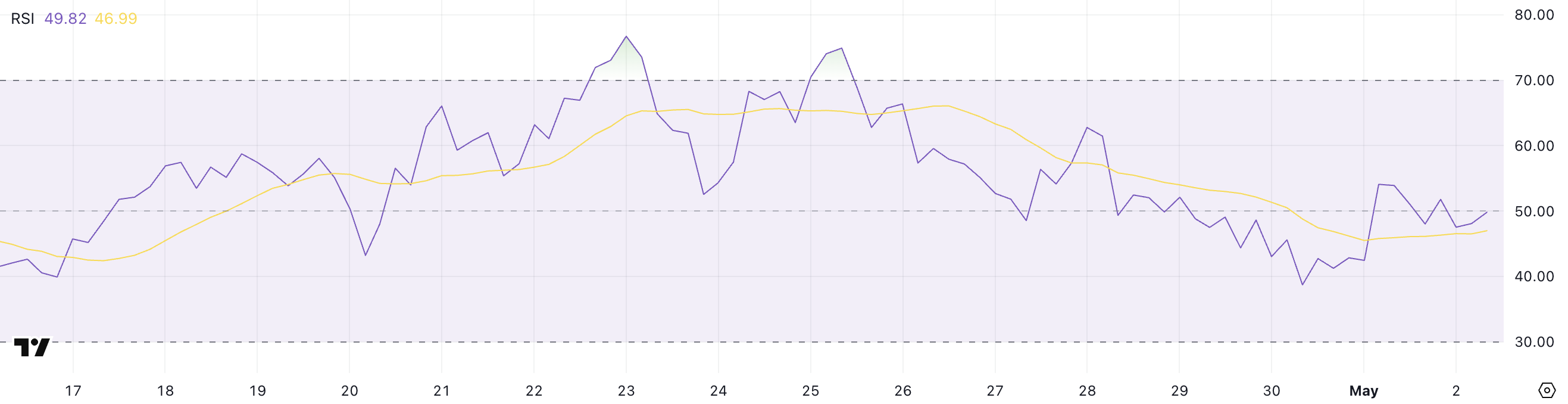

Meanwhile, the RSI has rebounded to 49.82 but remains below the critical 50 mark, signaling indecision. With HBAR trading in a tight range between $0.1849 and $0.189, a breakout in either direction could define the next trend.

HBAR BBTrend Turns Negative After 10-Day Run

Hedera’s BBTrend has just flipped negative after holding above zero for 10 consecutive days, suggesting a potential shift in momentum.

Currently, the BBTrend stands at -3.35, a sharp contrast from the bullish tone seen earlier this month. This reversal occurred two days ago and may reflect weakening upward pressure on HBAR’s price.

After showing consistent strength, the recent change raises caution among traders watching for early signs of a downtrend.

HBAR BBTrend. Source: TradingView.

HBAR BBTrend. Source: TradingView.

BBTrend, or Bollinger Band Trend, is a momentum indicator that measures price distance and direction relative to the Bollinger Bands.

When the BBTrend is above zero, it typically reflects strong bullish momentum, indicating the price is pushing toward or staying near the upper band. When it moves below zero, as it has now for HBAR, it often suggests growing bearish sentiment, with the price leaning toward the lower band.

A reading like -3.35 points to increased volatility and the potential for further downside, especially if other indicators begin aligning with this weakening signal.

Hedera RSI Rebounds but Stays Below Key Bullish Zone

Hedera’s RSI is currently at 49.82, rebounding from 42.45 yesterday after briefly touching 54 earlier in the session. This bounce suggests some recovery in buying interest, but the RSI remains below the key 50 threshold.

The recent movement indicates a tug-of-war between bulls and bears, with no clear dominance yet.

After sliding earlier in the week, this slight uptick could reflect a potential shift toward stabilization.

HBAR RSI. Source: TradingView.

HBAR RSI. Source: TradingView.

The Relative Strength Index (RSI) is a momentum oscillator that ranges from 0 to 100, used to assess overbought and oversold conditions.

Readings above 70 typically indicate an asset is overbought and may be due for a correction, while values below 30 suggest oversold conditions and a possible rebound. Levels between 30 and 70 are considered neutral, with 50 as a pivot point.

HBAR’s current RSI of 49.82 places it right on that line, signaling indecision, though the recent rise hints that momentum could tilt bullish if it breaks above 50 and holds.

Hedera Consolidates—Will Bulls or Bears Take Control?

Hedera price is trading in a tight range between resistance at $0.189 and support at $0.1849, with other key levels close by. If the $0.189 resistance breaks, it could open the door for a move toward $0.199 and $0.202.

A sustained uptrend could push HBAR to retest the $0.258 level, marking a significant bullish breakout.

For now, price action remains cautious as the market waits for a decisive move.

HBAR Price Analysis. Source: TradingView.

HBAR Price Analysis. Source: TradingView.

On the downside, if the $0.1849 support is broken, HBAR may fall toward $0.175 and $0.16.

A deeper downtrend could drag it as low as $0.124, erasing much of its recent gains. These levels represent critical turning points, and traders will watch closely for volume spikes or momentum shifts.

Until then, Hedera remains in consolidation, with pressure building on both sides.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.