Ethereum Consolidation Signals Potential Breakout Ahead

0

0

The Ethereum price is regaining attention again, indicating a possible price breakout. Ethereum (ETH) is sustained in a close-range trading after several weeks, and analysts are convinced that it can be about to take a big step.

Technical indicators and market sentiment imply that ETH is going to experience an upward pull. These changes have investors keenly tracking for the possible indications of a breakout.

Ethereum’s Price Poised for Upward Momentum

Ethereum price has been accumulating over some weeks, and now it demonstrates the movement. Such a market shift can be the indicator of a significant price movement. Higher volatility is historically driven during the phase of consolidation.

Ethereum is not the single cryptocurrency that is recording positive signals. The general state of the market is getting better and Bitcoin maintains price stability, and altcoins such as Ethereum follow the same trend.

Market Sentiment and Ethereum Price Forecast

The dynamic of Ethereum markets is connected to the market sentiment. With the resurgence of confidence in the crypto market, sentiment among numerous observers shifts towards an imminent recovery in Ethereum as well. Ethereum has demonstrated strong price volatility in the past following consolidation periods.

Also read: Ethereum Closes Holesky Doors: Will Hoodi Deliver?

Bitcoin stability may drive the price of Ethereum. Though Bitcoin is relatively steady, it can easily be followed by other altcoins such as Ethereum. Such a connection may be one of the motivators in the further price dynamic of Ethereum.

ETF Outflows and Their Impact on Ethereum Price

Ethereum-linked ETFs have been impacted by heavy outflows despite this positive trend that has been growing over the past few months. Ethereum index ETFs posted $952 million in withdrawals this week in five days.

Friday recorded the greatest single-day withdrawal with over $446.71 million outflowing ETH-linked funds. These outflows are contrary to the operation of Bitcoin ETFs which experienced inflows of $246.4 million of money in the same period.

Ethereum ETFs outflows are sparking concern of investor sentiment. Although this trend is worrying, it has not demolished the long term growth of Ethereum. The analysts are closely monitoring these outflows because they may reflect an shift in the capitalist confidence, and this would have an impact on the Ethereum price.

Ethereum Price and Technical Indicators

As of press time, the Ethereum price is trading at $4,301, experiencing a 3.82% decline over the past week. Key resistance levels are set at $4,360 and $4,420. A breakthrough at these levels could signal a strong upward movement.

However, the Ethereum price faces critical support at $4,220. A drop below this level could lead to further declines toward $4,200 or even $4,160, adding to the uncertainty around Ethereum’s immediate price direction.

Regulatory Factors Impacting Ethereum Price

Regulatory certainty is a factor that has positively influenced the Ethereum performance in the recent past. The enactment of the GENIUS Act has brought sufficient directives to institutional investors. This law which limits the payment of the interest by the stablecoin issuers has affected Ethereum positively.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| September | $4,278.67 | $4,711.63 | $5,144.58 |

30.9%

|

| October | $3,853.85 | $4,310.80 | $4,767.74 |

21.3%

|

| November | $3,761.28 | $4,026.63 | $4,291.98 |

9.2%

|

| December | $3,302.29 | $3,737.82 | $4,173.35 |

6.2%

|

Transparency provided by the GENIUS Act will likely push Ethereum increase in price. The growth of the institutional interest may rise now due to a higher level of transparency in the regulatory system. With Ethereum price as stable as it is today due to these regulatory advancements, investors are becoming increasingly confident in this coins future.

Economic Conditions and Their Effect on Ethereum

The cryptocurrency market still faces economic uncertainty. The weak US job data has raised the fear of a possible recession. Such concerns are impacting risky labels such as Ethereum. Ethereum price has nonetheless stayed comparatively steady because the underlying market mood is good.

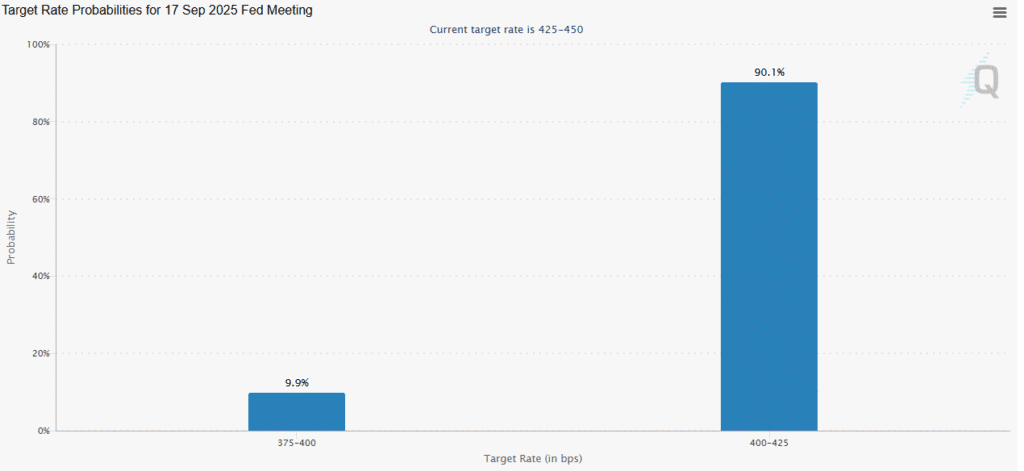

Investors are now valuing the 25 basis point rate cut by the Federal Reserve as certainty with a high probability of happening (90.1%) in value. This has impacted the behavior of the market and Ethereum and other cryptocurrencies can be the benefactors of reduced interest rates.

Conclusion

The price of Ethereum is on the operating frontiers with the technical indicator and the market sentiment intimating potential explosion. The price of the cryptocurrency has been under influence in the recent past, however there could be a bullish break to follow.

The support and resistance levels are receiving keen attention by the investors, as most investors anticipate a possible price blow, soon. Such elements like market sentiment, ETF flows and economic conditions will probably determine the direction by which Ethereum will operate in the short term.

Also read: Can Grayscale’s New Ethereum Covered Call ETF Redefine Crypto Income Investing?

Summary

After weeks of consolidation, the Ethereum price has been resuming some momentum, and market observers testify to a potential breakout. The exceptional market mood, the recovery of the overall crypto confidence, and the significant technical markers indicate the likelihood of an Ethereum upward trend.

However, ETF outflows notwithstanding, the long-term picture of Ethereum can be considered as a positive one due to the positive changes in terms of its regulation and the state of economy circumstances. Key levels of support and resistance are the focus of investors; Ethereum could turn into a highly volatile instrument, which provides a sign of possible growth.

Appendix: Glossary of Key Terms

Consolidation: A period where a cryptocurrency’s price moves within a narrow range, indicating indecision in the market, often leading to a breakout.

Volatility: The degree of price fluctuation in the market, often associated with higher risk but also potential for significant returns.

Bullish Momentum: A market trend where prices are expected to rise, driven by positive investor sentiment and strong market fundamentals.

Technical Indicators: Tools used by traders to analyze market trends and predict future price movements based on historical price data.

Resistance Level: A price point where selling pressure is expected to be strong enough to prevent the price from rising further.

Support Level: A price point where buying pressure is strong enough to prevent the price from falling lower.

FAQs for Ethereum price

1: What is causing Ethereum’s price to potentially rise?

Ethereum’s price is showing signs of upward momentum after a period of consolidation, supported by positive market sentiment and technical signals.

2: How do consolidation phases affect Ethereum’s price?

Consolidation phases typically lead to increased volatility, often resulting in significant price moves, either upward or downward.

3: Why is overall market sentiment important for Ethereum?

A rising market sentiment, with Bitcoin holding steady, can help Ethereum follow the same positive trend, potentially driving its price upward.

4: What role do technical indicators play in Ethereum’s price movement?

Technical indicators like resistance and support levels help predict potential price trends, signaling whether Ethereum is set for a breakout or further decline.

Read More: Ethereum Consolidation Signals Potential Breakout Ahead">Ethereum Consolidation Signals Potential Breakout Ahead

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.