MSTR Stock Soars as MicroStrategy Bitcoin Holdings Hit $59 Billion

0

0

The post MSTR Stock Soars as MicroStrategy Bitcoin Holdings Hit $59 Billion appeared first on Coinpedia Fintech News

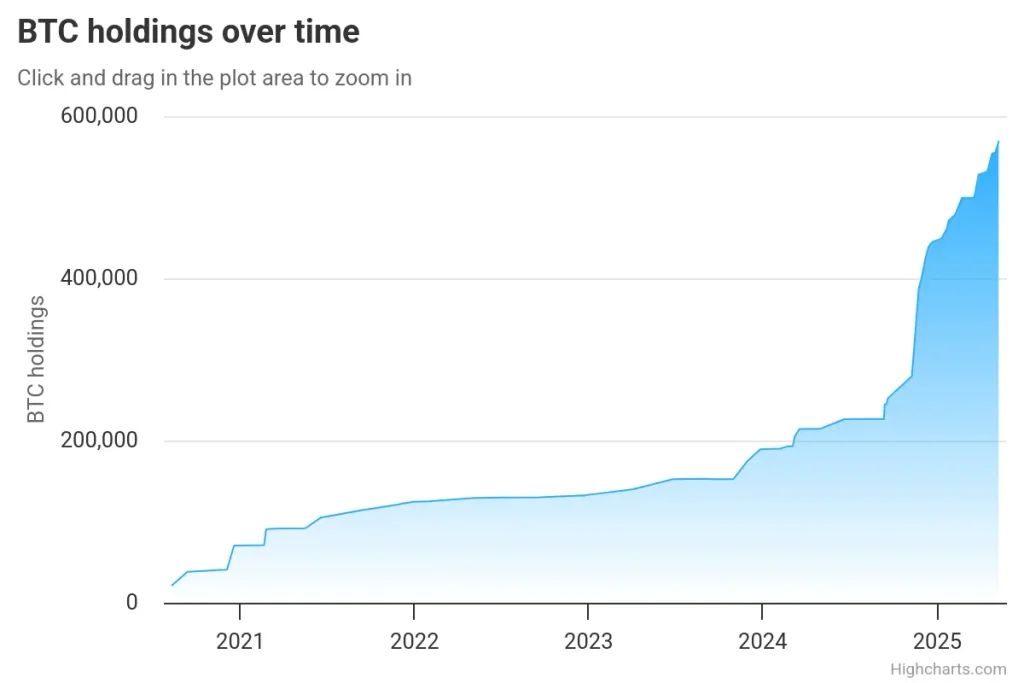

MicroStrategy is doubling down on Bitcoin. In its 12th acquisition of 2025, the company has purchased an additional 13,390 BTC for approximately $1.34 billion. This boosts its total holdings to a staggering 568,840 BTC—equivalent to 2.7% of Bitcoin’s circulating supply.

With over $39.4 billion invested, MicroStrategy’s BTC stash is now valued at $59.23 billion, generating unrealized profits of nearly $19.83 billion.

Corporate Bitcoin Adoption: MicroStrategy Leads the Charge

MicroStrategy stands tall among public companies holding Bitcoin, outpacing major players like Tesla, Coinbase, Galaxy Digital, and Metaplanet. The company’s aggressive accumulation strategy has made it the largest corporate holder of BTC worldwide.

Since January, MicroStrategy has added 122,440 BTC across 12 separate purchases. Its most recent acquisition occurred on May 12, 2025, when it spent $1.34B to acquire 13,390 BTC—marking yet another bold move in its long-term crypto investment plan.

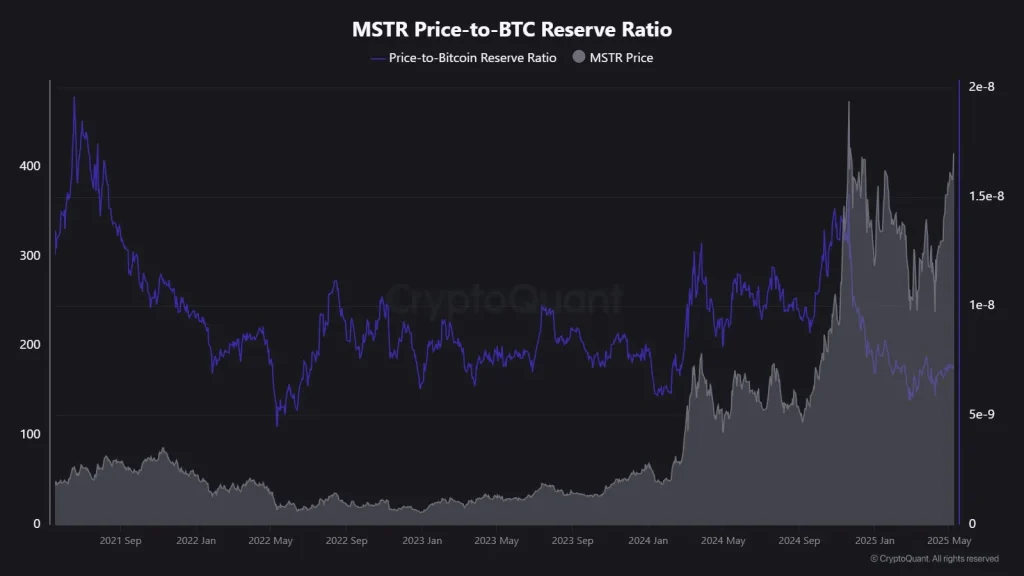

MSTR Price-to-BTC Reserve Ratio: What It Reveals

The Price-to-BTC Reserve Ratio for MicroStrategy currently stands at 7.27. This means investors are paying $7.27 for every $1 of Bitcoin the company holds. MSTR stock is trading around $404.90, having surged 34.92% year-to-date and 3.21% this month alone—fueled by bullish sentiment around Bitcoin and corporate crypto exposure.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.