Cardano Price Analysis: ADA Plunges 10% as Negative Funding Rate Fuel the Bearish Outlook

0

0

Highlights:

- ADA price has plummeted 10% in the past 24 hours, amid an intense market-wide sell-off.

- The derivatives data show a drop in open interest, as short positions accumulate.

- The ADA technical outlook shows intense bearish pressure as the RSI is oversold.

The Cardano price has decreased by 10% to $0.37 and is likely to approach its lowest 2025 daily close. This comes as the crypto market sees intense volatility, led by Bitcoin, which is down 5% to $85,973. Furthermore, short positions accumulate in the derivatives market when investor sentiment turns sour. Technically, ADA is exposed to additional losses as the Relative Strength Index (RSI) becomes oversold.

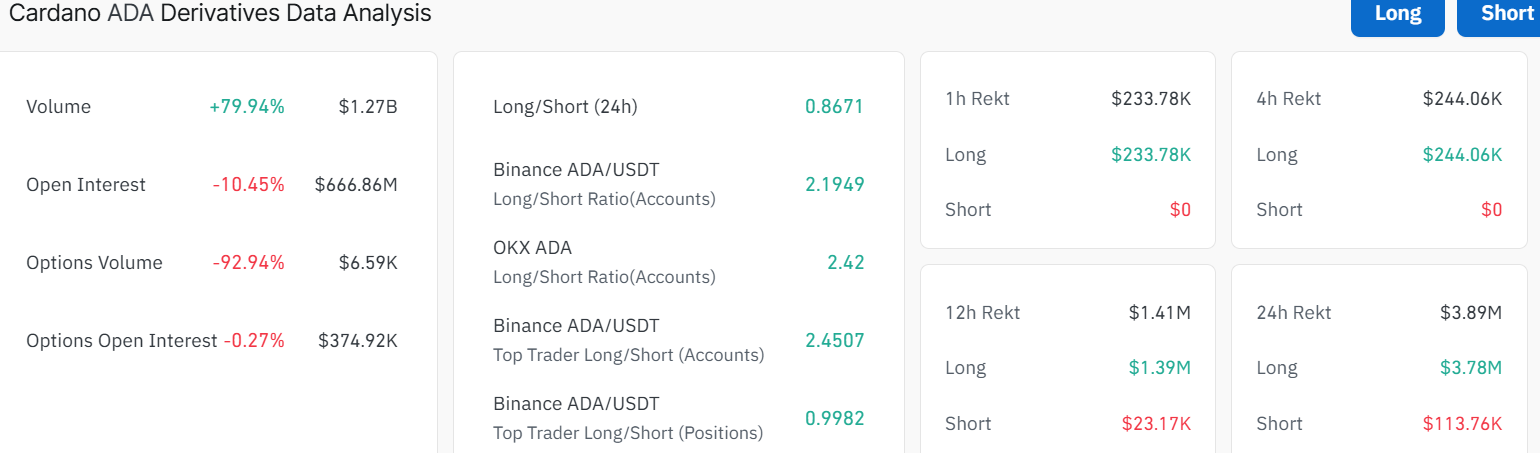

A quick look at the Cardano price derivatives market reveals a decline in trader interest. The ADA futures Open Interest (OI) has decreased by 10.45% in the past 24 hours and now is at 666.86 million. This unexpected drop in capital at risk for investors aligns with the broader crypto market sell-off.

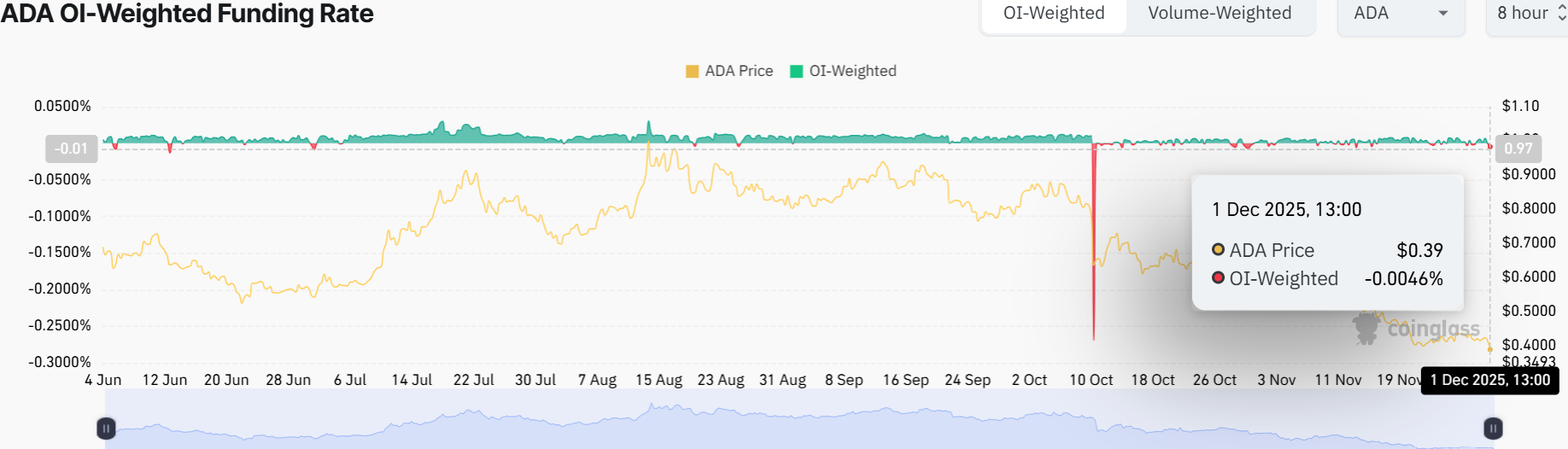

Additionally, the OI weighted funding rate is at -0.0046%, indicating greater confidence among bearish traders who are willing to pay a premium to retain short positions.

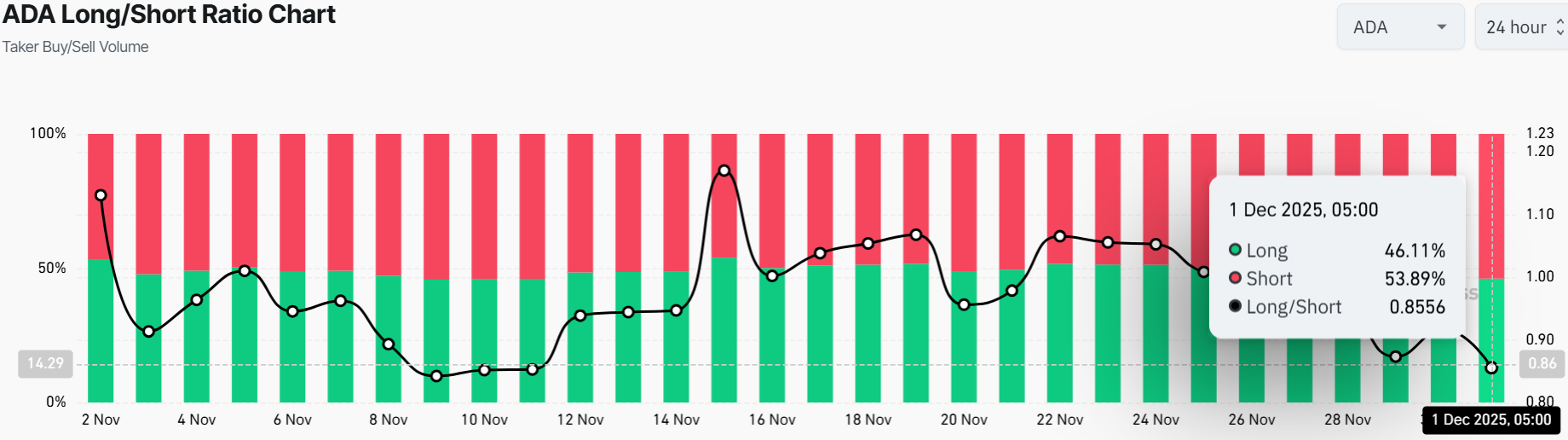

Adding to the rising selling pressure in the ADA market, the long-to-short ratio is at 0.8556. Moreover, short positions have accumulated to 53.89% of all derivatives contracts over the past 24 hours. It means that there is the sell-side domination in Cardano derivatives because traders believe that ADA prices will drop further.

ADA Price Slips as Bearish Momentum Mounts

The ADA/USD chart shows the altcoin on a 1-day timeframe. Currently, it is hovering around $0.37, with a 10% dip in the last 24 hours. The 50 Simple Moving Average (SMA) is at $0.55, while the 200 SMA is at $0.70, indicating that the Cardano price is currently in a bearish trend.

However, trouble is brewing as the Relative Strength Index (RSI) is plummeting and currently sits at 25.91. If the RSI remains below 30, the ADA token is at risk of further correction. The chart also shows a falling wedge setup, from which the price may break down further if the bulls fail to regain momentum.

The MACD’s orange signal line has dipped below the blue line, indicating some short-term strength. If the Cardano price breaks above $0.43 with conviction, the next target could be $0.55, aligning with the 50-day SMA. Meanwhile, the 50-day SMA is sloping down, and the blue 200-SMA is lagging, signalling a disconnect as momentum fades. Meanwhile, ADA’s volume is currently soaring, up 101% in the last day, which could indicate a fading bearish trend.

Looking at the bigger picture, a worst-case scenario would be a crash toward $0.32 if panic sets in. On the other hand, if bulls step in and push past $0.43, the Cardano price might dodge the bullet and aim for the $0.55 resistance zone.

Moreover, if the bulls ignite a buy-back campaign with the RSI at an oversold level, a rally towards $0.55 could be imminent. However, the ADA price drop is not a lock, but the chart is showing warning signs. Traders might want to keep an eye on that falling wedge breakout and RSI dip.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.