Justin Sun’s $9M WLFI Transfer Sparks Blacklist Debate Over Decentralization and Governance

0

0

According to recent reports, the Justin Sun WLFI blacklist has shaken traders after a wallet linked to him moved $9 million worth of tokens. The decision by World Liberty Financial (WLFI) to block that address raised fresh questions about governance, liquidity, and trust in new crypto projects.

For many in the industry, it highlights how closely major investors influence price and sentiment.

Wallet Move Triggers Blacklisting

WLFI’s move to denylist the wallet came after the transfer of 50 million tokens to HTX exchange.

Analysts observed that the wallet still holds nearly 595 million unlocked WLFI tokens, valued at over $100 million. Blocking the address prevents future transfers, a method WLFI uses to mitigate what it considers disruptive market behavior.

A blockchain researcher commented, “This action highlights the tension between investor freedom and protocol control”, underscoring the fragile balance in token economies.

Read more: Why Justin Sun Wants $100M of TRUMP Tokens and Why It Matters

Justin Sun Responds

In a statement posted on X, Justin Sun said the transactions were only “deposit tests” and not intended to impact the market. He stressed that no tokens were sold and that movements between addresses were internal.

Blockchain analytics platform Bubblemaps supported his view, noting, “His latest statement looks legitimate.”

Market watchers remain divided. Some argue that Justin Sun WLFI blacklist protects WLFI holders from sudden liquidity shocks. In contrast, others see it as a concerning level of centralized control in a project that presents itself as community-driven.

WLFI Token Price Reaction

The news hit WLFI’s price hard. Within hours, the token dropped by nearly 20 percent, falling to around $0.18. This came just days after WLFI had carried out a burn of 47 million tokens in an effort to stabilize supply.

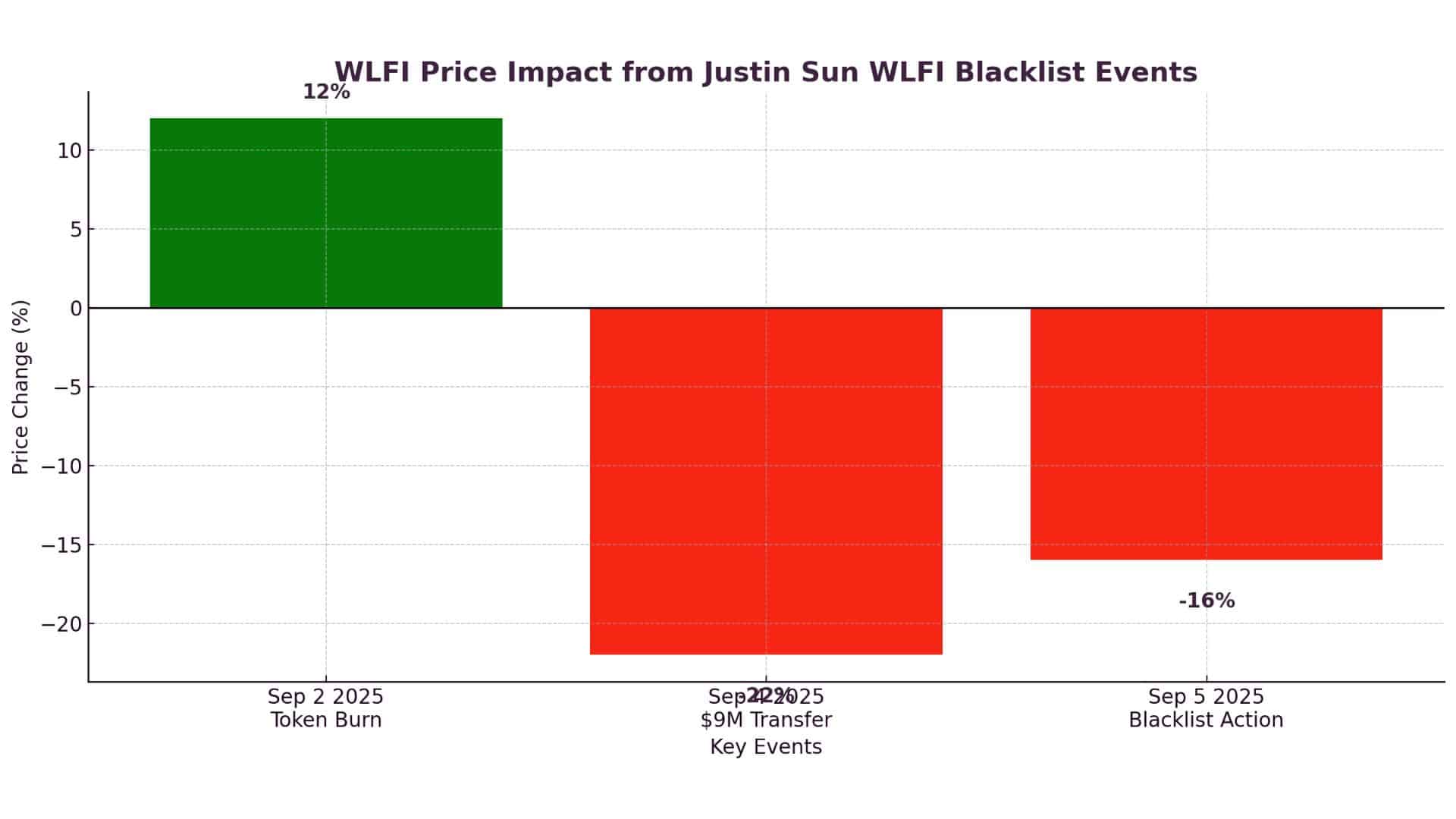

| Date | Event | WLFI Price Impact |

|---|---|---|

| Sep 2, 2025 | Token burn of 47M WLFI | Price lifted 12% |

| Sep 4, 2025 | $9M transfer to HTX exchange | Price dipped 22% |

| Sep 5, 2025 | Justin Sun WLFI blacklist action | Price down 16% |

The table illustrates how quickly prices can fluctuate in response to wallet movements and governance decisions.

Why This Matters for Crypto Investors

The Justin Sun WLFI blacklist highlights two important lessons. First, large investors hold significant power over token projects, and their activity can cause sharp price swings. Second, issuers like WLFI can exercise surprising control over wallets, even after distribution.

For seasoned traders, the event shows that technical safeguards such as blacklisting may help protect token value but also raise doubts about decentralization.

Conclusion

Based on the latest research, Justin Sun WLFI blacklist underscores the risks and complexities of holding tokens tied to influential investors. While Sun’s defense appears credible to some analysts, WLFI’s decision to blacklist his wallet reflects deeper concerns over market manipulation.

For crypto readers, the episode demonstrates how governance tools can stabilize a project while also reshaping investor trust.

Read more: Trump-Backed WLFI Token Hits Market: Bullish and Bearish Predictions Ahead

Summary

The Justin Sun WLFI blacklist followed a $9 million transfer from his wallet to HTX exchange, sparking a sharp price drop. Sun explained the moves were only deposit tests, not sales. WLFI defended its decision as protection for holders, though it raised concerns over decentralization. With his wallet holding over $100 million in tokens, the event highlights the power of large investors and governance in shaping token markets.

Glossary of Key Terms

- Blacklist: Blocking a wallet address from transferring tokens within a project.

- Token Burn: Permanent removal of tokens from circulation to reduce supply.

- Liquidity Shock: A sudden imbalance in token availability that impacts price.

FAQs for Justin Sun WLFI Blacklist

Q1: Why was Justin Sun’s wallet blocked?

His wallet transferred $9 million in WLFI tokens to the HTX exchange, which raised concerns about a potential market impact.

Q2: Did Justin Sun sell the tokens?

He said the transfers were only deposit tests and not actual market sales.

Q3: How much WLFI did his wallet hold?

Reports show the wallet contained nearly 595 million unlocked tokens worth over $100 million.

Q4: What happened to WLFI’s price?

The token dropped by around 16 to 22 percent following the blocklist announcement.

Read More: Justin Sun’s $9M WLFI Transfer Sparks Blacklist Debate Over Decentralization and Governance">Justin Sun’s $9M WLFI Transfer Sparks Blacklist Debate Over Decentralization and Governance

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.