Ripple Identifies 3 Key Drivers Behind Institutional Digital Asset Adoption Surge

0

0

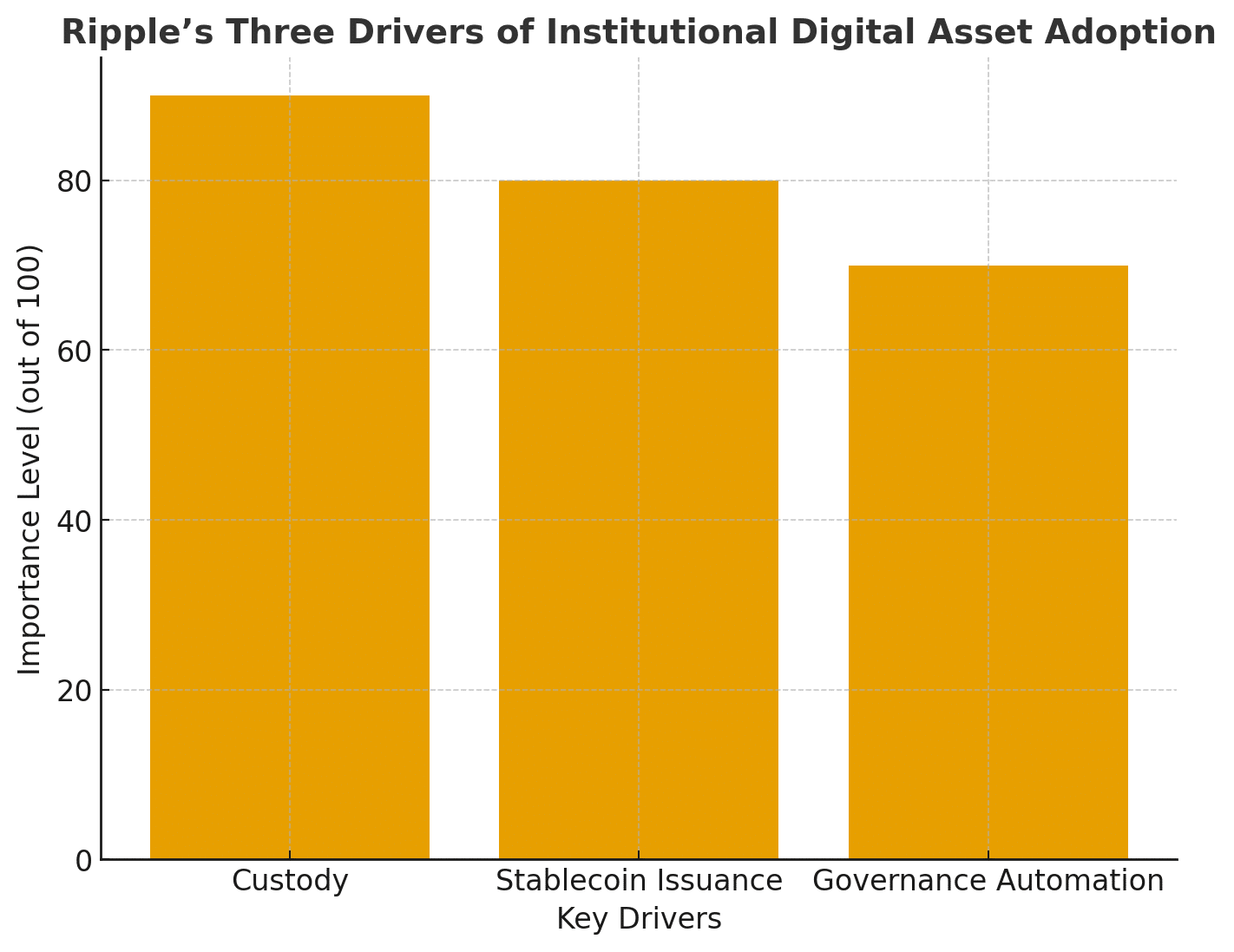

In an age when institutional digital asset adoption is no longer a pipe dream, but a reality in action, one organization has identified the key components driving the rise. Ripple has highlighted three key variables affecting institutional digital asset adoption with clarity and precision, a trifecta that is expected to propel adoption throughout conventional finance.

Custody infrastructure that is both safe and seamless

Ironclad custody serves as the foundation for institutional digital asset adoption. Institutions are hesitant to cooperate until they can be confident that digital assets will be safely housed and maintained.

Ripple underlines that custody is more than just a storage solution; it is a trust anchor that allows institutions to confidently incorporate digital assets into their portfolios. Ripple lays the framework for a larger wave of institutional digital asset adoption by developing custody solutions that adhere to regulatory standards.

Stablecoin Issue: Bridging Traditional and Digital Finance

The ability to generate and administer stablecoins encourages institutional use of digital assets. Ripple’s infrastructure enables stablecoin minting, burning, and lifetime management across XRPL and EVM-compatible platforms.

This commitment is backed up by demonstrations of their RLUSD stablecoin settlement in over fifty global marketplaces. This stablecoin capacity minimizes costs, friction, and hurdles, allowing institutions to confidently move between fiat and crypto.

Governance Automation: Increasing Back-Office Efficiency.

Governance automation is the third driver driving institutional digital asset adoption. Ripple enables institutions to manage reconciliations, compliance, reporting, and settlements from a single digital asset platform. Ripple sets digital asset workflows to match institutional operational norms, strengthening confidence and scalability.

Strategic Context and broader Implications

Ripple isn’t standing still. Its acquisition strategy, which includes the $1.25 billion Hidden Road transaction and the $200 million purchase of stablecoin infrastructure firm Rail, reflects a larger aim to establish itself at the center of institutional digital asset usage.

Beyond infrastructure, Ripple is exploring further regulatory integration by filing for a US banking license and a Federal Reserve master account, which may turn stablecoin issuance and custody into real-world, on-chain financial rails.

Furthermore, institutional adoption is getting significant traction. Ripple’s On-Demand Liquidity (ODL) service handled $1.3 trillion in Q2 2025, lowering international transfer costs by up to 70% compared to SWIFT and gaining interest from big institutions.

Conclusion

Institutional digital asset adoption is accelerating, and it is built on three interconnected pillars: custody, stablecoin issuance, and governance automation. Ripple’s infrastructure, strategic acquisitions, and regulatory goals position it as a key driver of this transition. As finance develops, institutions that depend on these inputs can confidently traverse digital assets, while others risk falling behind.

Glossary of Key Terms

Institutional Digital Asset Adoption: Uptake of blockchain-based financial tools by established institutions, including digital assets, for strategic or operational use.

Custody: Secure storage and management of digital asset private keys and tokens under institutional-grade protocols.

Stablecoin Issuance: Creation and lifecycle management of blockchain-based tokens pegged to real-world assets, enabling stable value transfers.

Governance Automation: Integrated systems for handling settlements, compliance, operational reporting, and reconciliations within digital asset frameworks.

FAQs for digital asset adoption

What is institutional digital asset adoption?

Institutional digital asset adoption refers to mainstream financial entities, banks, asset managers, and corporations, integrating digital assets into their operations, investment strategies, and services.

Why is custody critical to this adoption?

Secure custody protects against loss, theft, and compliance breaches; without it, institutions cannot trust or scale digital asset strategies.

What role does governance automation play?

It streamlines back-office operations, automating reconciliation, reporting, regulatory compliance, and settlements, making digital assets viable within institutional infrastructure.

How is Ripple advancing its adoption strategy?

Ripple builds on its three pillars by acquiring key infrastructure (Hidden Road, Rail), pursuing bank charters, and scaling cross-border usage via ODL.

Read More: Ripple Identifies 3 Key Drivers Behind Institutional Digital Asset Adoption Surge">Ripple Identifies 3 Key Drivers Behind Institutional Digital Asset Adoption Surge

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.