Chainlink Price Prediction – Why LINK Could Rally to $24 Soon

0

0

Highlights:

- LINK is currently trending towards $17.09, multi-week resistance

- A LINK rally through $17.09 could pave the way for a rally to $24

- A confluence of positive factors around LINK could make this possible

Chainlink (LINK) is one of the top gainers among the top 20 cryptocurrencies today. When writing, LINK was trading at $13.99, up by 4.89% in the day. Chainlink trading volumes are also rising by 56.3% in the day to hit $403 million. Such a surge in volumes on a day that the price is doing well indicates that money is flowing into LINK during the day. It means traders expect LINK to do even better in the short to medium term. The improving sentiment around LINK has a solid basis to it.

Ethereum Price Action Supports Chainlink Upside Momentum

One is that Ethereum is gaining upside momentum. Whenever Ethereum moves, Ethereum-based tokens also tend to move. This is quite evident in the price movement of Ethereum and many other ERC-20 tokens. Given that Ethereum is showing signs of a potential rally to $3000, the odds are high that Chainlink could continue to do well in the short term.

Being one of the strongest altcoins in the Ethereum ecosystem, Chainlink could be at the beginning of a parabolic bull run, sending it to new highs in the short to medium term. Besides the Ethereum aspect, Chainlink has a lot happening in its ecosystem that could make its price higher in the short term.

ETH SURGES TO $2,617 — UP +2.9% ON STRONG VOLUME!

AFTER HOURS SPIKE SHOWS SMART MONEY MOVING IN LATE.

FROM $2,531 TO $2,631 — BULLS ARE BACK WITH INTENT.IS THIS THE BREAKOUT BEFORE THE ALTCOIN WAVE?

DON’T BLINK.#Ethereum #Altseason pic.twitter.com/Pp0FBnCtlJ— Defi Linker Pro (@DefiLinkerpro) July 8, 2025

Chainlink Expanding Institutional Frameworks

One of them is Sergey Nazarov, the Chainlink co-founder, announcing that Chainlink is implementing institutional frameworks. Among the institutional frameworks that Chainlink is implementing is the Automated Compliance Engine. This is meant to make it easier for banks and other finance players to deal with compliance issues when dealing with regulated assets that are trading on-chain. Then there is the Cross-Chain Identity (CCID) framework. This is designed to help institutions and other verified entities work across blockchains.

INSIGHTS

: @Chainlink’s Automated Compliance Engine (ACE) launched, enabling compliant digital assets across #blockchains. This could unlock $100T+ in institutional capital, boosting $LINK demand as onchain finance grows. pic.twitter.com/2e8hCixWrF

— Collide

(@We_R_Crypto) July 7, 2025

Chainlink CCIP Continues to Grow

Chainlink also stands to keep growing thanks to its growing utility through CCIP. The CCIP payment abstraction allows Dapps to pay gas fees using any cryptocurrency they choose. This is creating demand for LINK, which is the intermediary cryptocurrency. Essentially, as more Dapps adopt CCIP, Chainlink price could go higher due to the buying pressure that comes with this adoption. The growth of Chainlink’s CCIP is also evident because it is now available on the Solana network. The impact is that it has unlocked more than $19 billion in assets on the Solana network.

Chainlink’s CCIP is gaining traction—RWA altcoins surged 60% driven by cross-chain flows.

SGC’s own cross-chain gateway ensures your art & crypto travels free and seamless.#CrossChain #ArtOnChain #SGC #SGT #Web3 #RWA #Crypto pic.twitter.com/mXOPcvJ3os

— Samsung Gold Chain|SGC

(@Samsung_Chain) July 9, 2025

Bitcoin Could Move LINK And Other Altcoins Higher

Chainlink also stands to benefit from a potential Bitcoin move up. Bitcoin has not experienced any major price action for weeks. However, this is happening when demand is rising, especially from institutional money. This means Bitcoin is headed to a point where the surge in demand will meet reduced supply.

A supply shock could push the price to $200k in such a case. In such a scenario, which is plausible due to institutional buying, the altcoin market could also go parabolic. Chainlink, one of the top altcoins with strong utility, could see its value rocket to new highs. A strong Bitcoin rally could make a Chainlink rally to $50 more possible.

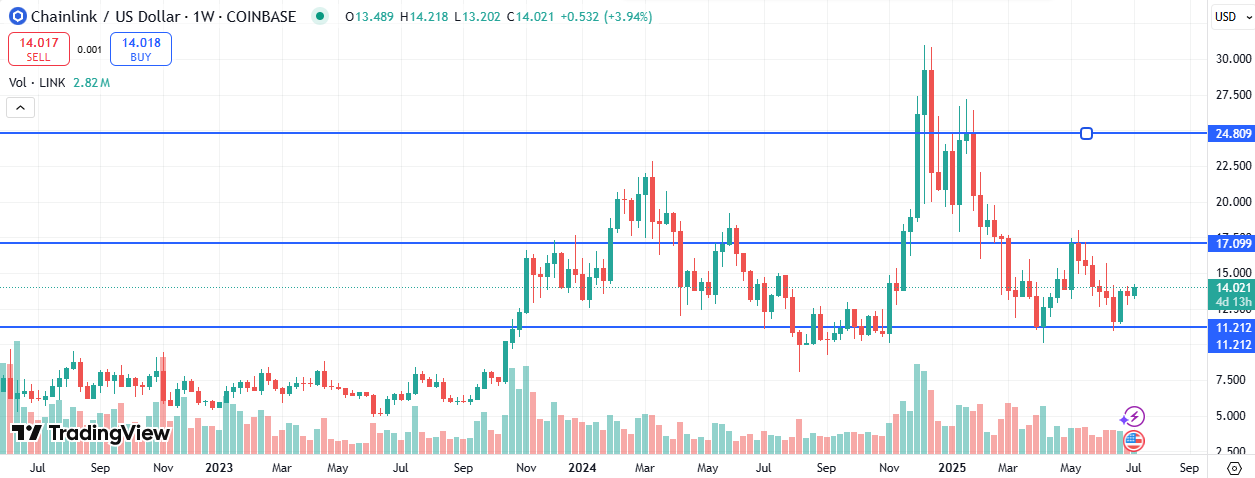

Technical Analysis – Chainlink Trading In a Multi-Week Consolidation

Chainlink is currently trading between the $11.21 support and $17.09 resistance. If bulls take control and push Chainlink through the $17.09 resistance, then a rally to $24.80, which is the first resistance level, could follow.

On the other hand, if bears take control and push Chainlink through the $11.21 support, then prices below $10 could become a reality in the short term. While any of these two scenarios can play out, the odds are higher for a rally to $24 in the short term due to adoption and a broader market that is sending bullish signals.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.