Ethereum Price Holds at $2,666 as SharpLink’s $425M Investment Fuels Bullish Sentiment

1

0

Highlights:

- The Ethereum price has dropped 1% to $2666, as trading volume drops 14%.

- A robust Ethereum derivatives market shows high trader participation and bullish sentiment.

- ETH price could surge towards $2858 if the immediate resistance at $2698 is broken.

The Ethereum price has dropped 1% to $2666, as its trading volume slips 14% in the past 24 hours. With Ethereum now up almost 90% from where it was recently, the market looks very positive for the token. Crypto analyst Ted Pillows shared this news, saying the rally is on and Ethereum might see impressive growth this time.

$ETH keeps on heading higher.

It's up nearly 90% from the bottom, and it feels like the rally is just getting started.

Sparklink Gaming announced a $425M raise to buy ETH, which feels like the "Microstrategy" moment.

As I said earlier, $10,000 ETH will happen this cycle. pic.twitter.com/AUM60faOtg

— Ted (@TedPillows) May 28, 2025

The increase in optimism is due in large part to SharpLink Gaming, which announced a $425 million private placement focused on obtaining Ethereum. With this move, the company begins to use Ethereum as its main form of reserve asset.

A company called 'SharpLink Gaming' has announced a $425 million strategic Ethereum reserve strategy

ConsenSys is the lead investor with @ethereumJoseph joining the board of the company.

The ticker is ETH! pic.twitter.com/DKVjaxRHdM

— sassal.eth/acc

(@sassal0x) May 27, 2025

Consensys is driving the investment, while Ethereum co-founder Joseph Lubin joins SharpLink’s board as a sign that large investors are seeing positive long-term value in Ethereum.

Ethereum Price Technical Outlook

With improvements happening and interest from experts increasing, Ethereum’s price is in a period of holding steady. Ethereum has reached trading prices around $2,660, holding close to the 200-day moving average at around $2,700, which may limit greater gains for now. RSI indicates that at 69, the altcoin is showing strong momentum, but not too much, buying energy.

At the same time, bearish forces are indicated by the MACD indicator, since the MACD line drops slightly below the signal line. That indicates that buyers and sellers are not separating too much, and it’s easier for the market to move sideways. As the price of Ethereum is still banding within a supported range, it seems the long-term trend is still bullish, even though volatility and strong resistance keep preventing any big breakout.

Ethereum Derivatives Show Robust Activity Amid Price Consolidation

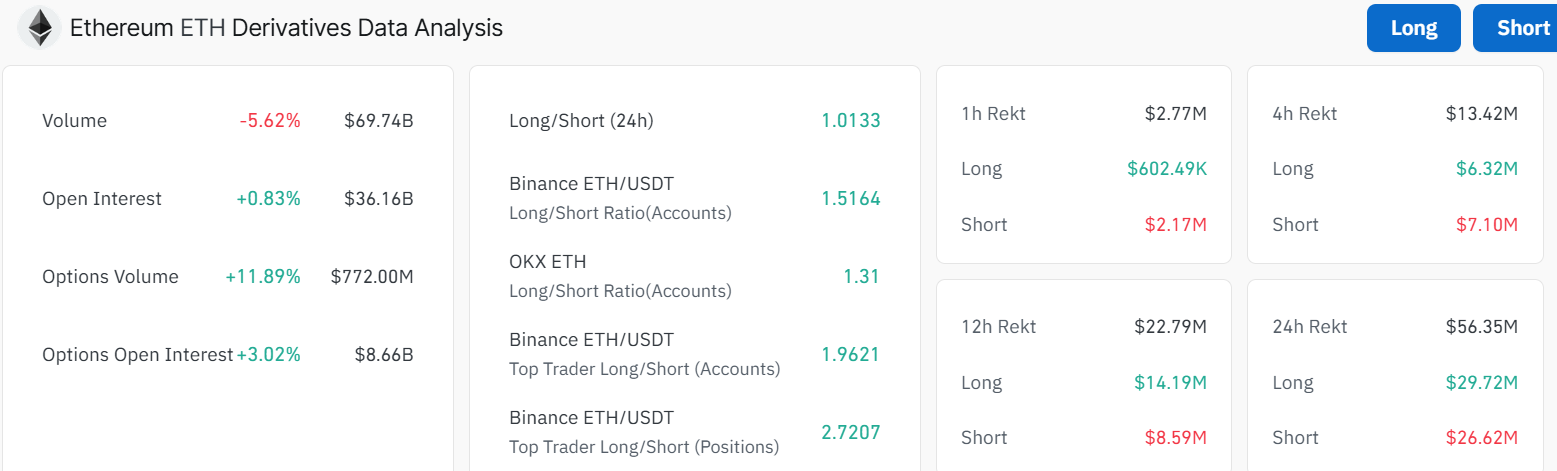

There is significant movement on Ethereum’s derivatives market despite a recent period of price consolidation. Volume in ETH derivatives slightly declined by 5.6% to about $70B. Even so, open interest, which measures the value of all existing contracts, rose by nearly 1% to over $36B, indicating that more people are taking part in the market.

Trading volume in options increased by about 12% to reach nearly 800 million, and open interest rose by 3% to $86B. Experienced traders on Binance are bullish, keeping their long-to-short ratio above 2.7. ETH’s ongoing popularity in derivatives trading shows that experienced traders’ sentiment points toward the Ethereum price going up.

Institutional Moves and Market Dynamics Set Stage for Ethereum Growth

Given that ConsenSys is gathering massive amounts of ETH and many crypto forecasters predict future cycle highs, Ethereum could see higher adoption and a rise in its price. Observers should expect traders and investors to keep an eye out for when prices break above resistance levels to continue upward momentum.

If the bulls keep holding above the key support zone, the Ethereum price could obliterate the $2698 resistance towards $2700. In a highly bullish case, the altcoin could rally towards $2858, opening the doors for further upside to $3000.

On the downside, if the bulls fail to overcome the $2698 level and the bears capitalize on the sell signal from the MACD indicator, the Ethereum price could drop. In such a scenario, the ETH price will retest the $2510 and $2452 support zones before the bulls ignite a strong leg up. Meanwhile, Ethereum follows important moments in crypto history due to treasury decisions and market trends, which show this rally may be better than many.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.