Crypto prices today: Bitcoin stalls below $95K while DEEP and VIRTUAL lead altcoin rally

0

0

Bitcoin bulls continued to struggle with the $95,000 resistance level as investors awaited key economic data set for release in the coming week.

Meanwhile, the total crypto market cap barely moved, inching up just 0.13% to hover around the $3.05 trillion mark.

Sentiment also cooled off a bit, after spending most of the past week in ‘greed’ territory, the crypto fear and greed index has now slipped back to neutral, sitting at 51 at last check.

A handful of top altcoins posted small gains on the day, but most gave back some of the ground they had made last week, with market sentiment still largely focused on Bitcoin.

Why is Bitcoin stuck?

Bitcoin stayed rangebound between $92,953 and $95,490 as traders held back, waiting for a clearer picture from this week’s flood of economic data.

It’s shaping up to be a big week for US macro, with Q1 GDP numbers, nonfarm payrolls, and major tech earnings all on deck.

But the real spotlight is on the Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) index, due out on April 30.

With the PCE and GDP figures landing just before the monthly candle close, markets are bracing for a potential volatility spike across crypto and other risk assets.

Adding to the tension, ongoing US trade tariffs have already been stirring sharp swings in crypto, stocks, and commodities, keeping investors on edge.

Until the data drops and the inflation picture becomes clearer, Bitcoin looks set to stay trapped within the current range.

Some historical trends suggest Bitcoin may have hit a local top.

Over the past week, Bitcoin ETFs pulled in $3.06 billion in net inflows, the highest since December last year. Historically, a surge in inflows has often preceded local tops, such as in March and June 2024.

In March, Bitcoin hit a new all-time high of around $73,300 shortly after spot ETFs recorded over $1 billion in daily inflows.

Similarly, in early June, another spike in ETF inflows helped drive Bitcoin from $67,000 to around $72,000, before it dropped sharply by 25% to $53,000 in the weeks that followed.

According to market analytics firm FalconX, ETF inflows generally have short-term predictive power for price increases but are not always a signal for a broader reversal.

What’s next for Bitcoin?

Macro data is expected to play a key role in shaping Bitcoin’s short-term direction, but from a technical standpoint, BTC still needs to flip the $95,000 level into solid support to open the door for further upside.

According to crypto analyst Captain Faibik, Bitcoin was forming an ascending triangle on the 4-hour chart, typically seen as a bullish pattern.

He noted that bulls need to clear the $95,300 horizontal resistance to confirm the breakout, which could then set the stage for a push toward the $100,000 mark.

Popular trader CrypNuevo shared a similarly optimistic view, forecasting an “interesting week” ahead for Bitcoin.

He said momentum still looks intact and that BTC could see another leg up toward $97,000, where liquidity clusters are building.

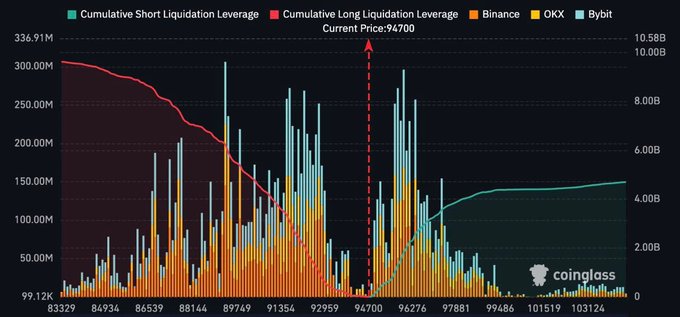

CoinGlass data highlights a dense pocket of liquidity between $97,000 and $100,000, suggesting Bitcoin might climb further to tap into these levels.

Analyst AlphaBTC agreed, saying that if Bitcoin breaks above the $95,000 resistance, it could push toward $100,000, but warned that a bigger pullback could follow soon after.

If Bitcoin manages to reach the $100,000 mark, around $5 billion worth of short positions could be liquidated. This short squeeze could add extra momentum to the move, but may also set the stage for increased volatility once the liquidity is cleared. See below.

On the flip side, fellow trader Johnny noted that Bitcoin still has an open CME gap around $92,000 that may need to be filled before any major upside move can continue.

CME gaps, created when Bitcoin futures close at one price and reopen at another, are often revisited by price action, meaning BTC could dip back toward $92,000 before making a fresh attempt at higher levels.

Bitcoin CME Futures. Source Johnny

Nevertheless, long-term predictions for Bitcoin range well above $100k.

In a note published on April 28, Standard Chartered’s Geoffrey Kendrick said he expects Bitcoin to reach $120,000 by the second quarter of 2025, before climbing toward $200,000 by year-end. He cited strong ETF inflows, rising whale accumulation, and a shift away from U.S. bonds as key drivers behind his bullish outlook.

On a similar note, Peter Chung from Presto predicted during an interview earlier today that Bitcoin could even hit $210,000 by year-end.

According to Chung, recent corrections have helped strengthen Bitcoin’s foundation, and he sees growing institutional adoption and rising global liquidity as key drivers for the next major rally.

At press time, BTC was $93,690, down 0.3% over the past day.

Altcoins see little action

The altcoin market struggled for direction alongside Bitcoin. According to CoinMarketCap data, the total altcoin market cap slipped from $1.19 trillion to $1.17 trillion over the past day, marking a 1.68% drop.

Meanwhile, the Altcoin Season Index remained deep in Bitcoin Season territory at 17, signalling that Bitcoin continues to dominate overall market momentum for now.

Gains were limited to small-cap cryptocurrencies, although a few of the top altcoins stood out among the broader slowdown:

DeepBook Protocol

DeepBook Protocol (DEEP) surged 20% in the last day, trading around $0.22 at the time of writing and pushing its market cap past $684 million. Its daily trading volume also spiked by 200%, hitting over $463 million.

The rally seems to be riding on the back of SUI’s growing presence in DeFi, with SUI’s TVL jumping nearly 44% over the past week and leading among the top 10 projects.

DEEP’s breakout also follows a month-long consolidation, where it had been stuck trading sideways before finally moving higher.

Virtuals Protocol

Over the past 24 hours, Virtual Protocol (VIRTUAL) gained 16%, bringing its market cap to over $800 million. Its daily trading volume was up 27% over the previous day, hovering over $373 million when writing.

Source: CoinMarketCap

Today’s gains came after VIRTUAL secured a listing on Binance.US, with deposits already open and withdrawals set to start tomorrow.

The rally also got a boost from a broader surge in AI-related tokens earlier today, sparked by excitement around NVIDIA’s launch of new NeMo microservices, which focus on helping companies build, run, and protect their custom AI models, including tools designed to prevent AI model theft and misuse.

Pudgy Penguins

Pudgy Penguins (PENGU) jumped nearly 15% over the past 24 hours, pushing its market cap above $740 million at the time of writing. The rally also came with a surge in trading volume, which doubled from yesterday to hit $583 million.

Source: CoinMarketCap

The gains seem to be fueled by a big spike in Pudgy Penguins NFT sales, which shot up 240% in the same period.

The project also recently teamed up with Ledger to launch a limited-edition Pudgy Penguins-themed Ledger hardware wallet and case.

The post Crypto prices today: Bitcoin stalls below $95K while DEEP and VIRTUAL lead altcoin rally appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.