Trump-Xi Meeting May Shape 2026 Market Direction

0

0

This Article Was First Published on The Bit Journal.

According to the source, the Trump-Xi summit has lifted cryptocurrency markets after early signs of easing trade tensions between the United States and China. President Donald Trump confirmed plans to meet Chinese President Xi Jinping at the Asia-Pacific Economic Cooperation (APEC) summit in Seoul on October 31.

The announcement revived optimism among traders who expect improved relations to support digital assets in the short term.

Market Responds to Summit Announcement

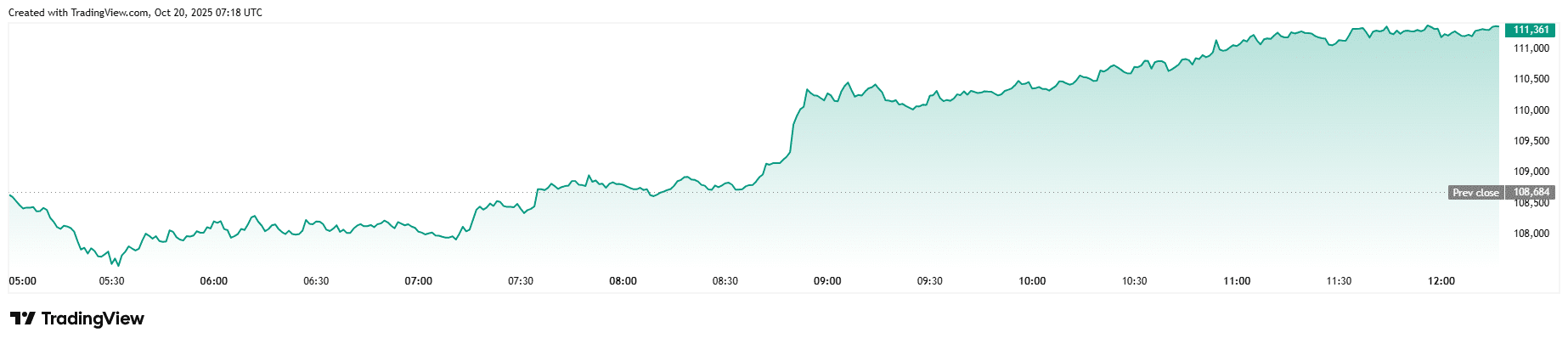

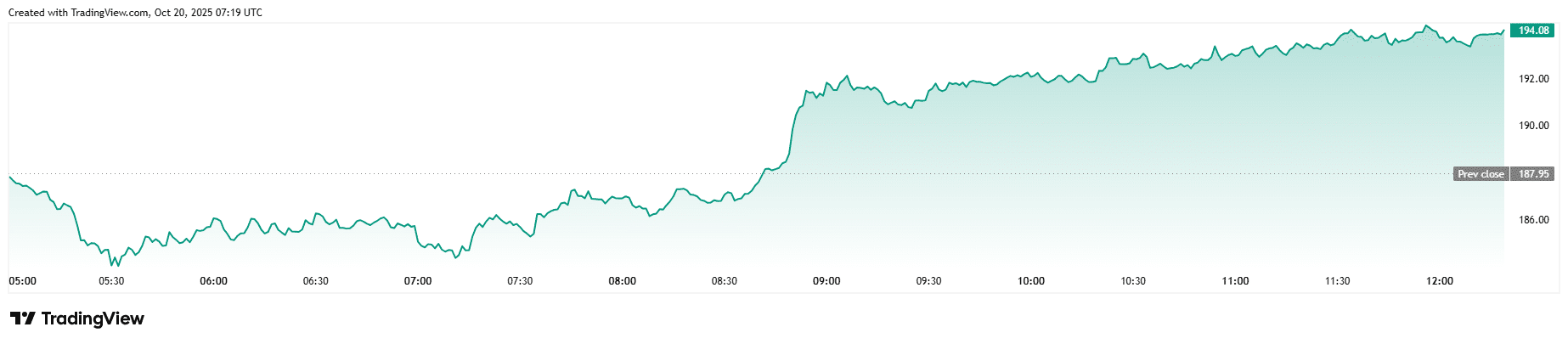

Bitcoin rose 1.9% to $111,361, Ethereum gained 3.4% to $4,074, and Solana added 4% to $194.08. The Trump-Xi summit became a trending topic across trading platforms as investors linked the diplomatic thaw to renewed risk appetite.

The global crypto market cap climbed to $3.87 trillion, the highest since August. Analysts say the rebound shows how closely Bitcoin and altcoins still mirror global sentiment. Many view this development as a stabilizing moment after several weeks of volatility.

Analysts Link Market Gains to Trade Easing

Analysts say the Trump-Xi summit has eased tension following a shaky month for global markets. One economist said markets are “reacting to optimism more than policy,” but confidence is returning. Trump called Xi “a strong leader” and said both sides want a “fair deal,” comments that spread quickly across the media and lifted expectations for progress.

Just a few weeks ago, the introduction of new tariffs caused the liquidation of nearly $20 billion worth of cryptocurrencies, which marked the largest single-day sell-off in the recent past.

However, the warmer attitudes of the two nations have subsequently enabled price recovery, but experts are still cautioning that the lack of a solid trade agreement could result in the re-emergence of volatility in the market.

What the Summit Could Mean for Crypto

The Trump-Xi summit could steer risk sentiment globally. A productive outcome may bring institutional inflows into Bitcoin and top altcoins, while setbacks could trigger a quick correction.

| Scenario | Expected Market Reaction |

|---|---|

| Positive trade progress | Bullish move for Bitcoin and altcoins |

| Neutral outcome | Range-bound market |

| Renewed tariff pressure | Short-term pullback likely |

Traders are cautious, tightening stop-loss orders and sticking with liquid assets ahead of the meeting. Social media trends show a mix of optimism and skepticism about the outcome.

Conclusion

Based on the latest research, the Trump Xi summit could become a defining event for crypto investors. A cooperative tone between Washington and Beijing may extend the recovery, while renewed friction might reverse gains. Investors are keeping a close eye on both charts and statements as the world’s two largest economies prepare to meet.

Glossary

- Leverage: The process of borrowing money to increase the size of the trade.

- Risk-on: Market phase favoring high-return assets.

- Safe Haven: Asset that holds value during uncertainty.

- Trade War: Economic conflict involving tariffs and trade barriers.

FAQs About the Trump Xi Summit

Q1. What is the Trump Xi summit?

It refers to the upcoming meeting between U.S. President Trump and China’s Xi Jinping at the APEC summit, expected to affect global and crypto markets.

Q2. Why did crypto prices rise after the announcement?

The crypto prices were regarded by the traders as a signal of the reduction of the tension which resulted in the improvement of the sentiment towards Bitcoin and Ethereum.

Q3. Will the summit have lasting effects?

In case it results in trade stability, then Bitcoin and altcoins have the potential to grow in value in the long run.

Q4. What should investors watch next?

The official announcements and price trends that follow the Trump Xi summit will determine where the market will go.

Read More: Trump-Xi Meeting May Shape 2026 Market Direction">Trump-Xi Meeting May Shape 2026 Market Direction

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.