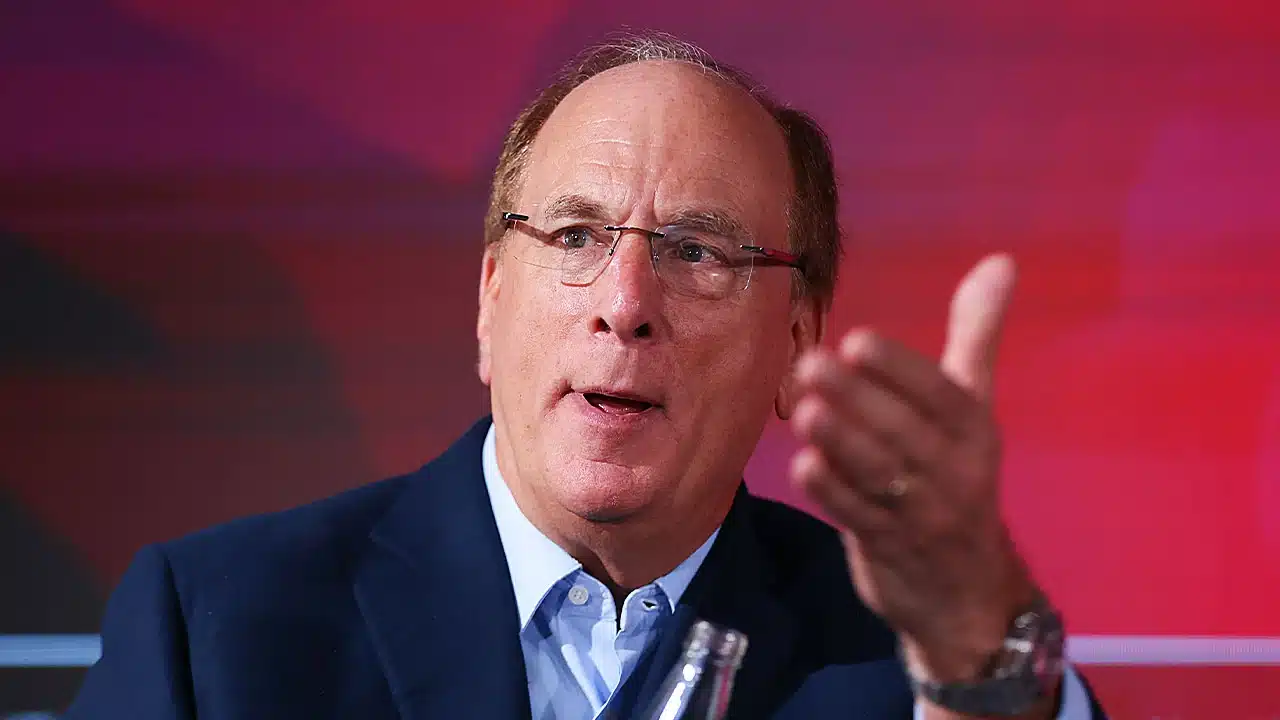

BlackRock CEO Larry Fink Hails Bitcoin as ‘Fear Currency’ and Digital Gold

0

0

- Larry Fink calls Bitcoin a fear currency and digital gold.

- BlackRock’s ETF surpasses major exchanges with massive Bitcoin holdings.

- Market supply squeeze strengthens Bitcoin’s price floor amid rising demand.

BlackRock CEO Larry Fink has doubled down on his support for Bitcoin, calling it a “fear currency” and a digital version of gold. According to his remarks at Legends Live @Citi, Fink underlined that Bitcoin serves as a safe store of value during periods of uncertainty.

Fink, in his new remarks, has gone a long way in his earlier scepticism. In 2017, he called Bitcoin the currency of money launderers and thieves. His opinion was transformed during the COVID era when he did research on the asset and encountered people utilizing it in unorthodox ways. He wrote about the example of a woman in Afghanistan who employed workers using Bitcoin to get around Taliban controls, which convinced him of its usefulness.

Also Read: Cardano Poised for Explosive Breakout as Ethereum’s Record Rally Heats Up

BlackRock’s Bitcoin Trust Accelerates Growth

The BlackRock chief made clear he does not believe Bitcoin will replace traditional currencies. Instead, he sees its role as a hedge against instability and depreciation. In his case, Bitcoin is attractive because it is similar to gold as a safe asset in times of economic or political tension.

This position has been strengthened by BlackRock’s large presence in the market. The iShares Bitcoin Trust, launched in January 2024, is a product of the company and has become the second-largest Bitcoin holder in the world. According to the data from the CryptoQuant resource, the trust controls more than 781,000 BTC, or about $88 billion at current prices.

That position is higher than Coinbase, Binance, and Strategy, leaving only the creator of Bitcoin, Satoshi Nakamoto, higher. The trend has been remarkable, and BlackRock has surpassed Strategy within 18 months despite the five-year lead.

Unlike the reserves held by exchanges to facilitate trading, the holdings of ETFs remove Bitcoin from circulation. This supply crunch, coupled with investors’ high demand, has made the market have a more solid price floor. Analysts observe that BlackRock’s increase in share has exacerbated this trend because it has concentrated much of the assets in its hands.

Larry Fink’s shift from critic to advocate underscores how Bitcoin has gained recognition in traditional finance. With BlackRock’s ETF now holding more Bitcoin than most exchanges, its view of it as “fear currency” and digital gold carries growing influence.

Also Read: Gemini XRP Credit Card Finally Launches – Here’s What XRP Holders Stand to Benefit

The post BlackRock CEO Larry Fink Hails Bitcoin as ‘Fear Currency’ and Digital Gold appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.

BREAKING:

BREAKING: