0

0

This article was first published on The Bit Journal.

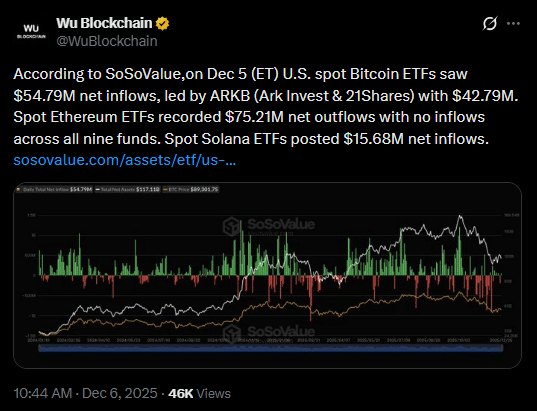

Market watchers followed institutional activity closely this week as Bitcoin ETF inflows drew fresh attention. US spot funds recorded a net $54.79 million move into BTC ETFs, marking one of the stronger shifts of the month.

According to the source, a single large fund accounted for $42.79 million of that total. In the same period, Ethereum ETFs saw $75.21 million in outflows, while Solana ETFs collected $15.68 million. These movements highlight how shifting capital flows continue to guide short-term sentiment in the crypto market.

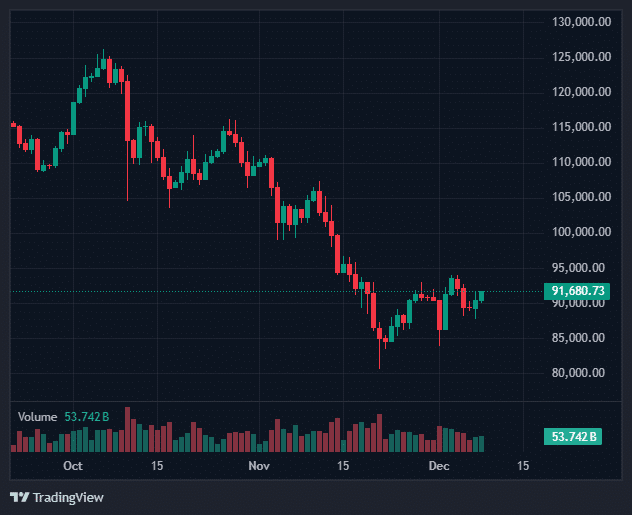

Bitcoin is trading at around $91,680 with the price chart showing solid footing despite broader market instability. Ethereum is at about $3,13c 3, and Solana sits near $135.

These levels show how the market continues to face sharp intraday swings. The contrasting ETF flows deepen this divide, with Bitcoin drawing fresh interest, Ethereum seeing hesitation, and Solana gaining quiet momentum.

The renewed inflows into Bitcoin show that many investors still view BTC as the anchor of crypto portfolios. Moving $54.79 million into spot BTC ETFs signals a strong belief in Bitcoin’s long-term value. The fact that a single fund accounted for most of these inflows underscores how individual vehicles can drive market sentiment.

Ethereum’s $75.21 million in outflows come at a time when ETH trades at just over $3,100. Among some investors, questions about future upgrades (which is to say, a fear of missing out) or competition from other blockchains or maybe even just what seems like the broader market confusion, might give them pause.

Without constant ETF inflows, it will take stronger on-chain activity or price catalysts to regain confidence.”

Solana, with $15.68 million in inflows, shows how some investors look beyond BTC and ETH. At $135 per token, SOL may attract those willing to accept more risk in search of growth. For them, SOL offers a lower-cost, more speculative alternative, with potential upside if its ecosystem holds up.

| Asset | Net Flow (USD) | Flow Direction |

|---|---|---|

| Bitcoin | + $54.79 million | Positive inflow |

| Ethereum | – $75.21 million | Strong outflow |

| Solana | + $15.68 million | Moderate inflow |

The surge in Bitcoin ETF inflows suggests BTC remains the default choice for many institutional and conservative investors. Steady interest in Solana could appeal to those seeking alternatives with growth potential. Ethereum’s outflows signal a pause in confidence, at least in the short term.

Traders and holders should keep an eye on upcoming ETF flow reports and the combination of chain data to determine if this rotation becomes a trend or just a blip.

For newcomers, this could be a chance to see how market tastes turn before taking the plunge. For long-term investors, this might be a time to reconsider your allocation.

Bitcoin ETF inflows reflect restored trust in BTC as a primary crypto position. At the same time, marginal inflows to Solana and outflows from Ethereum seem to indicate a shifting of capital.

These flow trends offer a useful compass for tracking investor sentiment. In a market full of noise, watching where money moves may prove more telling than watching price charts alone.

Not necessarily. Inflows signal demand, but prices depend on overall supply, broader market conditions, and sentiment.

That depends on risk tolerance. Solana inflows show interest but also carry a higher risk. Ethereum remains a major network with different strengths.

They come from publicly disclosed fund data. They are helpful indicators, but only one piece of a larger market puzzle.

The flows in and out of ETFs provide insight into where an institution or the average nation is making money, and what’s driving short-term momentum.

Read More: Bitcoin and Solana ETFs Post Gains Amid Weakness in Ethereum Products">Bitcoin and Solana ETFs Post Gains Amid Weakness in Ethereum Products

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.