Why Analyst Says This Is the Perfect Setup for Ethereum’s Run to $4K

0

0

ETH is currently hovering around $2,500 but some analysts think it might just be the calm before the storm. Crypto analyst Cyclop says the current setup for ETH is one of the best long entries he’s seen in years. He’s calling a big Ethereum price prediction to $4,000 due to historical patterns, macro trends and record short positions that could trigger a short squeeze.

Cyclop’s Bold Call: $4K Target in Play

In a recent post on X, Cyclop outlined his case: the market is in the same conditions as before past ETH rallies. He thinks the widespread bearishness, visible in all-time high short interest across all major derivatives platforms, is the perfect contrarian play.

“Most people doubt ETH and alts right now, I’m betting on $4,000 this summer” he wrote.

Besides sentiment, Cyclop points to three main catalysts: The first is Short Interest. A record high number of ETH shorts could backfire. If price moves up, these shorts will be forced to cover and we’ll see an aggressive move up. Another is the Pectra Upgrade. The recent upgrade improved transaction throughput, security and staking efficiency. This has brought back developer activity and user engagement.

He also mentioned Institutional Staking. There’s a big increase in ETH staking from institutions and corporations which means they are betting on the long term value of the network.

He noted that liquidity has been swept on both sides which means the next move could be violent and up. Cyclop also mentioned a bigger trend: Ethereum rallies precede altcoin booms.

Real-Time Metrics: The Setup Behind the Surge

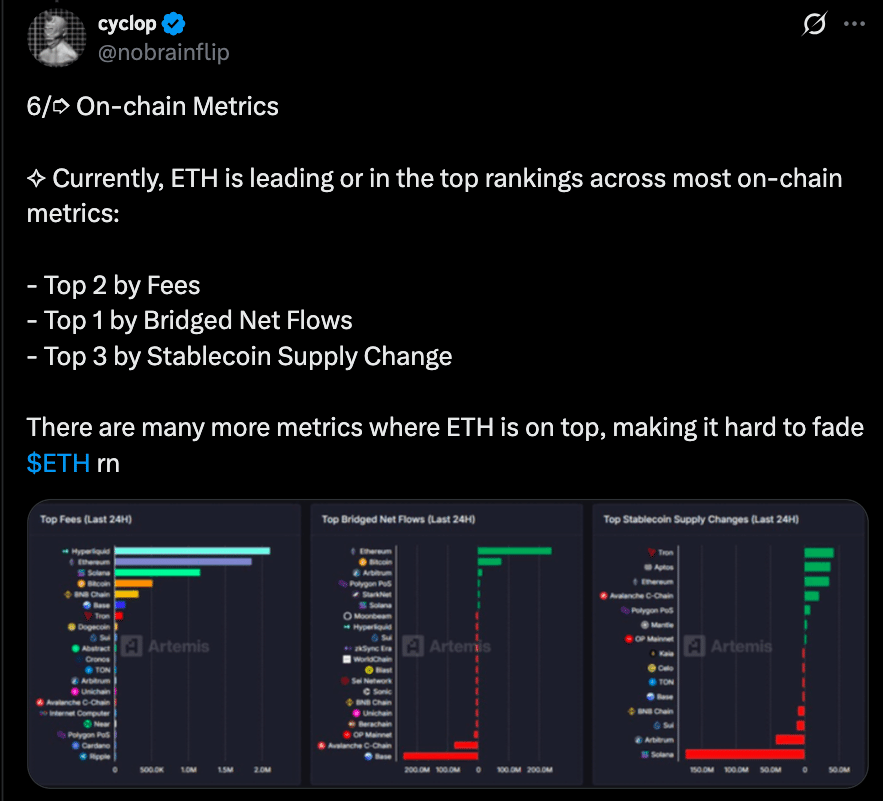

The data supports Cyclop’s argument. ETH on-chain and technicals are setup for a breakout. Here are the real-time metrics:

Ethereum Price Prediction Table (Summer 2025 Outlook)

| Metric | Current Status | Implication |

| Price | around $2,500 | Consolidation above key psychological level |

| Short Positions (CME, Binance) | All-time high | Potential for explosive short squeeze |

| Chart Pattern | Cup and handle formation | Target: $4,100 if breakout clears $2,750 resistance |

| Pectra Upgrade Impact | Enhanced staking & L2 activity | Boosts demand, supports valuation growth |

| ETH Bridged Net Flow | Among top 3 chains | Indicates robust DeFi and L2 activity |

| Institutional Staking | Increasing | Signals growing long-term confidence |

| Bitcoin Price (June 30) | above $106,000 | Historical ETH rallies follow BTC highs |

Technical Perspective: Cup-and-Handle Breakout?

As FXEmpire and on-chain analysts point out, Ethereum is forming a bullish cup-and-handle. This classic pattern often precedes big moves if the neckline (around $2,750) is broken with volume.

If Ethereum confirms the breakout, the target range for the pattern is $4,100, a 60% move from current levels. But if it can’t sustain above $2,750, ETH will be range-bound between $2,350 and $2,850.

This matches Cyclop’s forecast. He’s planning to sell out at $3,000, with staggered sell orders up to $6,000 depending on market action.

Other Analysts Weigh In

Cyclop isn’t the only one speculating a positive Ethereum price prediction. Other voices in the space are saying the same:

FXEmpire says if the cup-and-handle plays out, ETH could go to $4,000+ by summer.

Brave New Coin notes Ethereum’s Layer-2 ecosystem and renewed protocol activity are underappreciated in current price action, so there’s more upside.

Cointelegraph highlights rising institutional activity and net ETH outflows from exchanges as bullish signs, investor positioning ahead of a supply shock.

But not everyone is convinced about these Ethereum price predictions. Despite the optimism, analysts warn: If $2,750 resistance fails to flip into support, the bullish pattern will break down. Layer-1 competition is growing, with Solana and Avalanche getting developers and capital. Regulatory uncertainty in the US and other markets could still spook investors.

Even the skeptics agree Ethereum’s fundamentals are stronger than many altcoins in the same market cap tier.

Conclusion: Summer Setup for Ethereum?

Ethereum is at the precipice of a big move. Shorts are stacking up, bullish patterns are forming, and institutions are quietly buying more ETH. The stage is set for a big rally.

Cyclop’s $4,000 Ethereum price prediction is aggressive but not impossible if resistance is cleared and momentum builds. With the Pectra upgrade, rising institutional adoption and bullish on-chain flows, Ethereum could break out of its range and lead the market higher.

Summary

Ethereum is set for a summer rally to $4,000 with record-high short positions, a bullish cup-and-handle formation, and strong on-chain metrics. Analyst Cyclop says this is the best ETH long setup in years citing Pectra upgrade, institutional staking and market structure. Experts agree but risks if ETH doesn’t break $2,750. A breakout could also mean altseason as ETH often leads the broader market.

FAQs

Why is Ethereum going to $4,000?

Analysts say high short positions, bullish setups and staking after Pectra upgrade.

What’s the cup-and-handle pattern and why is it important?

Bullish chart formation that, once completed, can project big upside. ETH’s current structure is targeting $4,100 if confirmed.

What’s the role of the Pectra upgrade?

Pectra upgrade improved Ethereum’s scalability, security and staking efficiency, increasing network activity and long term utility.

Can Ethereum trigger altseason?

Historically ETH rallies often precede altcoin surges. Cyclop says ETH’s move could lead a run in undervalued alts.

What are the risks?

Failure to break $2,750, stronger Layer-1 competition or regulatory pressure could halt ETH’s upside.

Glossary

Short Squeeze: Price increase due to short sellers covering.

Cup and Handle: Bullish chart pattern.

Staking: Locking crypto to earn rewards and support network.

Layer-2s: Secondary frameworks on top of Ethereum.

Altseason: Period where alts outperform Bitcoin, often led by ETH.

Sources

Read More: Why Analyst Says This Is the Perfect Setup for Ethereum’s Run to $4K">Why Analyst Says This Is the Perfect Setup for Ethereum’s Run to $4K

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.