XRP Price Slips 1% as Gemini Launches XRP Credit Card – Analyst Predicts a Rally to $3.70

0

0

Highlights:

- XRP price slips 1% to $2.95, as trading volume skyrockets 128%.

- Gemini launches an XRP Credit card with up to 4% cash back.

- Analyst predicts a rally to $3.70 as Q4 nears.

XRP price has flipped below the $3 level, down 1.75% to $2.95. Despite the drop, its daily trading volume has spiked 128% to $7.97 billion, indicating increased investor confidence. XRP remains in the red zone, having dropped 0.97% over the past week and 6% over the past month. Recently, XRP caused ripples in the cryptocurrency world, as the official XRP Credit Card by Gemini was launched. This credit card enables users to earn up to 4% XRP cash back on every purchase, presenting a great incentive to devote to real-world spending with cryptocurrency.

BREAKING: The $XRP Credit Card is live

I’ve been talking about real-world adoption, now it’s happening

Up to 4% back in XRP, no annual fee

This isn’t theory anymore. You can literally stack XRP by spending.

Mass adoption isn’t coming. It’s here. pic.twitter.com/lbNtwXoHK8

— X Finance Bull (@Xfinancebull) August 25, 2025

It is a virtual card issued by WebBank and part of the Mastercard network, and is the first of its kind to reward holders with XRP. It has no annual fee and gives its users various categories within which they may spend to receive rewards, including 4% back on gas and transit, 3% on dining, and 2% on groceries. This signals a growing trend in the integration of crypto assets into the global financial system, enabling their use as a form of currency.

XRP Price Consolidates Within a Symmetrical Triangle

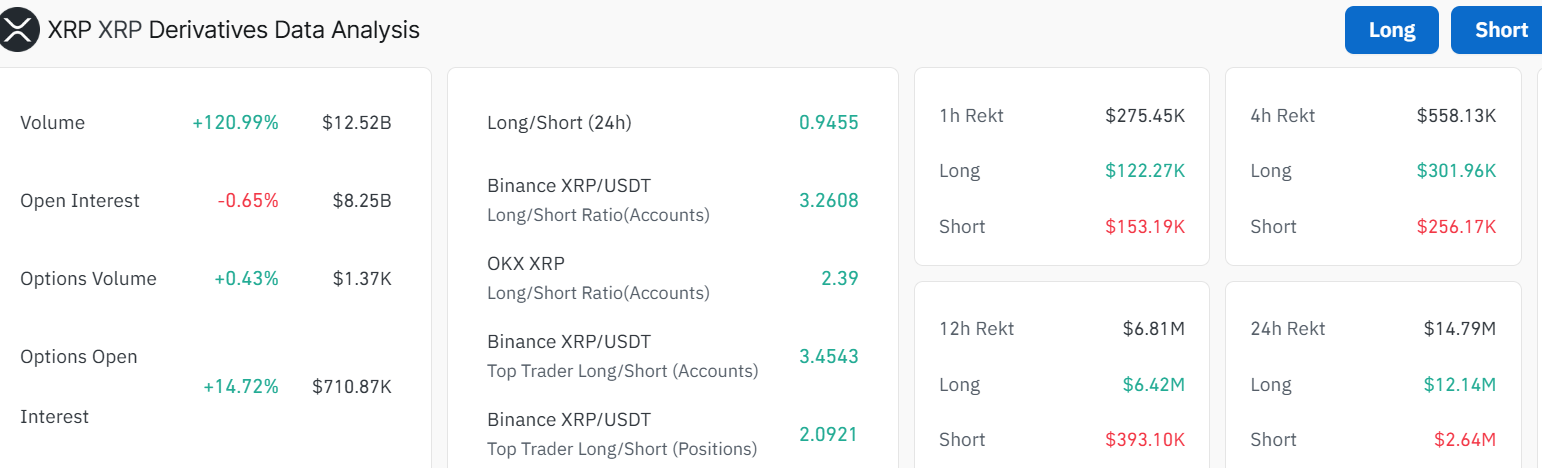

As part of market dynamics, XRP has been experiencing increased trading volume and significant volatility. As the latest derivatives data reveals, the volume of XRP has increased by 120.99% to $12.52 billion. Open interest has, however, dropped by 0.65% indicating that despite the increase in volume, many traders are not willing to keep long positions on XRP.

The derivatives data is also trading with a high long/short ratio. This suggests that more investors are betting on XRP moving higher rather than dipping. In the daily chart outlook, the XRP price has been consolidating within a symmetrical triangle. However, following the weekend shake-up, XRP price plunged below the $3 level, towards the $2.95 level. The bears have established a strong resistance around $3.04 mark (50-day SMA). Meanwhile, the immediate support at $2.46 (200-day SMA) gives the bulls wings to bounce back above the $3 mark.

Using the Relative Strength Index (RSI), XRP sits at 46.30, indicating neutral momentum in the market. However, its position below the 50-mean level tends to tilt the odds towards the bears. Also, the MACD indicator exhibits a negative momentum as a bearish crossover is evident in the market. This cautions that selling pressure may mount in the XRP market if the bulls don’t regain strength.

Can XRP Rebound Above $3 Soon?

Looking ahead, the altcoin season speculation, fueled by broader market optimism, could push the XRP price above $3-$3.04 resistance soon. Historical patterns indicate that September may bring significant gains in altcoins. Moreover, Ali Martinez speculates that XRP may quickly rally to $3.70.

It won't take long before $XRP is back at $3.70! pic.twitter.com/egSX6vcwgC

— Ali (@ali_charts) August 25, 2025

However, if Bitcoin continues to pull back, XRP could face a correction to $2.85. For the next quarter, a conservative target is $3.50, but if the price breaks upward with conviction, $3.70 isn’t off the table by Q4 2025.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.