Solana Locks in $223M “Real Value,” Tops All Chains in Q3 2025

0

0

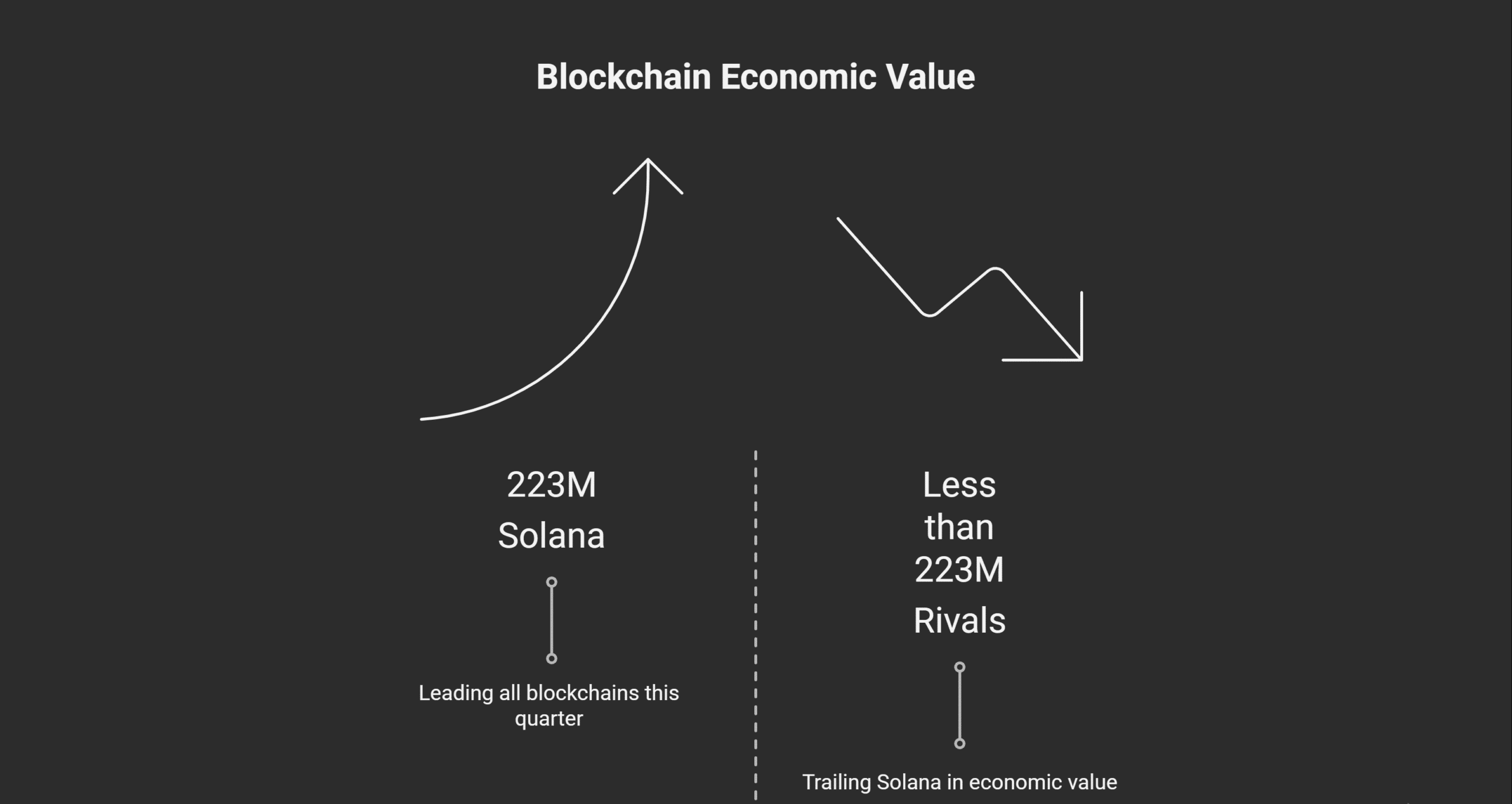

According to recent reports, Solana economic value surged to $223 million in Q3 2025, earning it the top rank among blockchains in on-chain activity. That figure reflects more than hype; it shows real usage and flow of value across the network. For crypto readers, that raises a key question: what drives that value, and how sustainable is it?

What the $223M Means

Solana economic value measures transactions, token transfers, and flow of real funds not speculative trades. The methodology filters out wash trading and inflated volumes. The number shows that people are moving real capital through Solana with practical intent.

One chart from ARK’s report highlights Solana leading all blockchains this quarter in that metric. In other words, its utility beat many rivals.

Also Read: Top Altcoin Predictions 2025–2027: Ethereum, BNB, XRP, Solana, and Tron Stay in Focus

Comparing to Other Chains

In ARK’s quarterly review of DeFi and blockchain metrics, several chains were benchmarked. While others saw bursts of activity, Solana stood out in consistency. In some chains, much of the value came from speculative trades. On Solana, value was more tied to genuine use.

For example, another report notes that Solana has now led in quarterly revenue for four straight quarters. That persistence matters: capturing high value one quarter is noise; doing it across periods suggests structural strength.

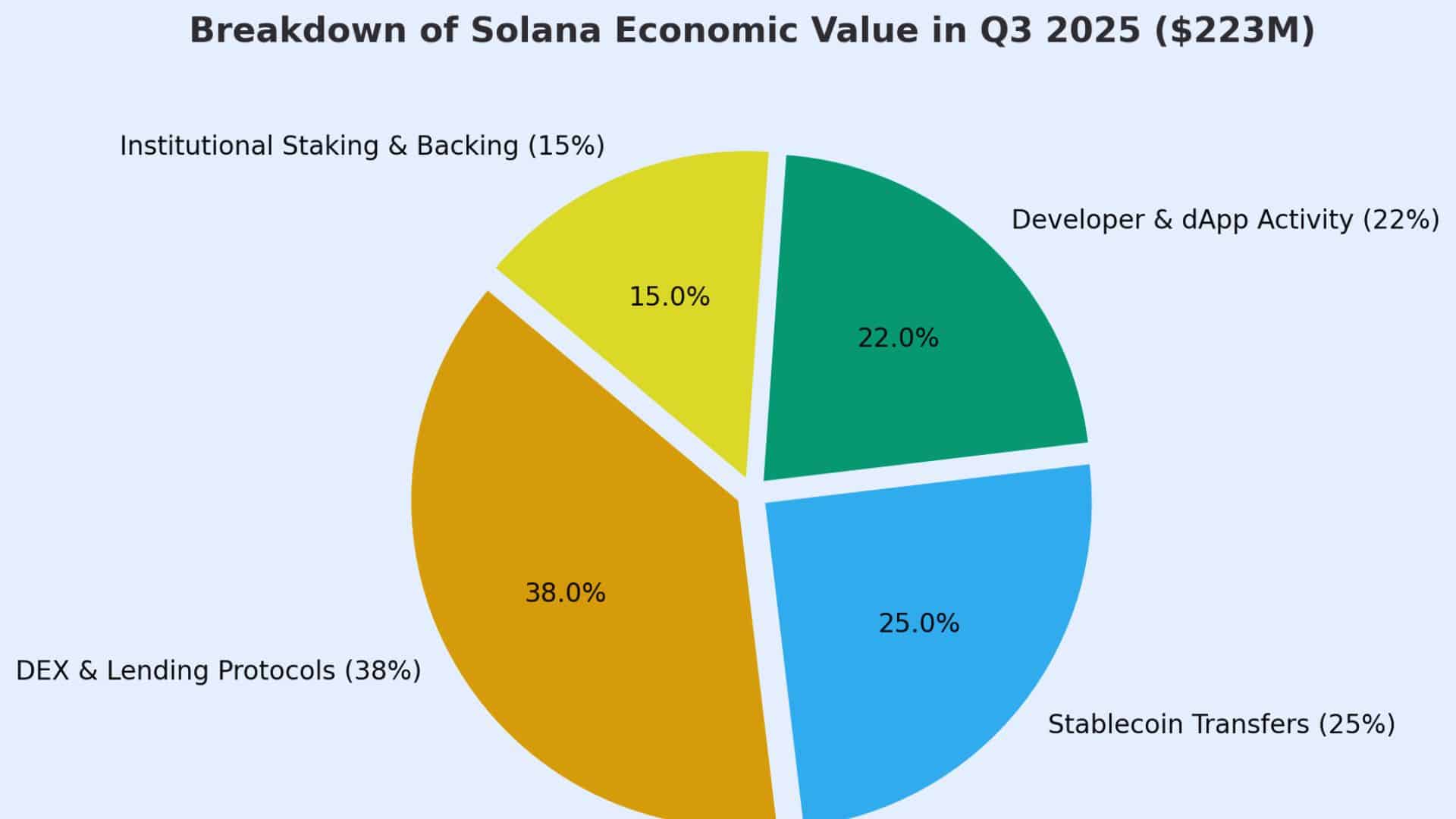

Drivers of Value

What pushed the value upward?

- Growth in decentralized exchanges and lending protocols

- Stablecoin transfers inside Solana’s ecosystem

- More developer activity and dApps are deploying on Solana

- Institutional backing and staking initiatives

Notably, ARK’s analysis says open data gives insights into which chains actually move money, not just volume.

Price Impact and Market

Solana’s price during this period responded, rising alongside the value metrics. The $223M reading reinforced confidence that the network isn’t just speculative noise.

Some institutional moves also give extra weight. ARK added exposure to staked Solana in some of its ETFs. That makes Solana economic value part of how big players judge whether to place capital there.

Still, risks remain: if DeFi momentum slows or competing chains improve, Solana must keep delivering value to maintain its edge.

Conclusion

Based on the latest research, Solana economic value proves more than a headline; it points to real traction. That $223 million in Q3 suggests the network is doing more than riding waves: it’s becoming a preferred route for genuine on-chain flows. Watch future quarters closely. If Solana economic value keeps rising, that’s a signal many in crypto may not ignore.

For expert insights and the latest crypto news, visit our platform.

Summary

Solana economic value reached $223 million in Q3 2025, leading all blockchains in real on-chain activity. The figure signals strong user engagement, developer momentum, and trust from institutions. As open data reshapes how value is tracked, Solana’s growth shows what genuine blockchain utility looks like beyond speculation.

Glossary of Key Terms

- Real economic value: A Measure of real capital moved on the chain after excluding wash trading

- On-chain activity: Transactions and flows recorded directly on the blockchain

- DEX: Decentralized exchange

- dApp: Decentralized application

- Staking: Locking tokens to support network security and earn rewards

FAQs About Solana Economic Value

Q: Why use “Solana economic value” rather than just “Solana”?

It emphasizes tangible activity and moves away from price speculation.

Q: Will the $223M hold next quarter?

That depends on continued usage, DeFi growth, and competition. No guarantee.

Q: Does this guarantee the SOL token price will go up?

Not always. Value and price correlate, but sentiment, macro factors, and regulation matter too.

Q: Can other chains match or beat it?

Yes: if they boost utility, scale, and low fees, they could challenge Solana’s economic value.

Read More: Solana Locks in $223M “Real Value,” Tops All Chains in Q3 2025">Solana Locks in $223M “Real Value,” Tops All Chains in Q3 2025

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.