Licensing & Registration Are Not Equal to Regulation

1

0

Dan Burstein is the General Counsel and Chief Compliance Officer of Paxos

We are in the midst of a monumental shift of financial market infrastructure. The future of an open, digital economy rests on upgraded infrastructure replacing antiquated banking systems. At the heart of this transition is the adoption of stablecoins — digital dollars that are accessible to anyone at any time. At this key inflection point, it’s crucial for consumers, enterprises, service providers and regulators to fully understand the dynamics dictating prominent stablecoins’ operations, oversight (or lack thereof) and reserving practices.

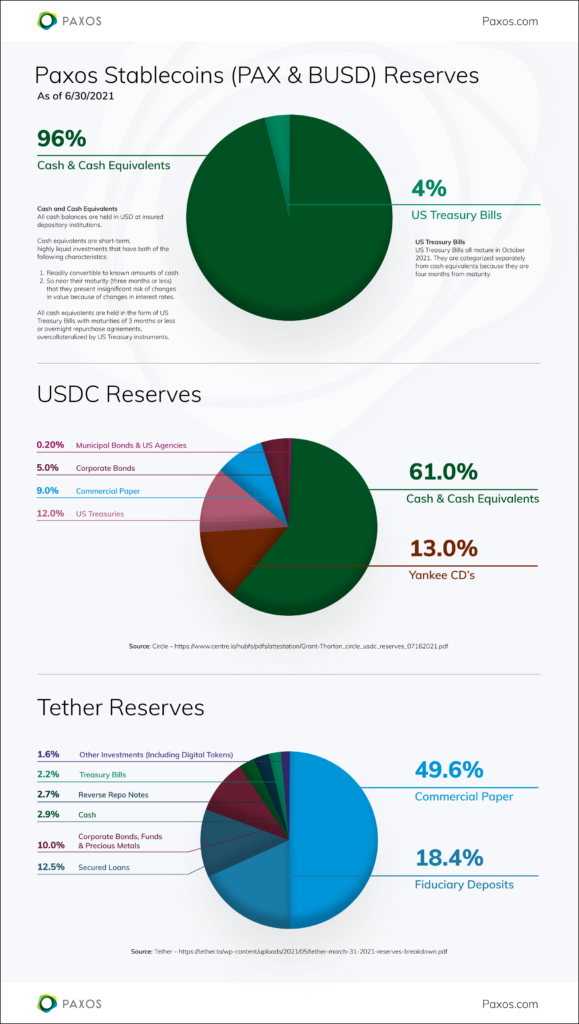

At Paxos, we believe the only way to establish and maintain safety and transparency for customers is through rigorous oversight from a prudential regulator. This thesis has unfortunately borne out in the reserve mix for both USDC and USDT (Tether). Both of these tokens’ reserves are backed by a significant amount of non-cash financial instruments. A prudential regulator is crucial to ensuring the integrity of products used in the crypto ecosystem, and neither USDC nor USDT has such a regulator.

A legitimate stablecoin must hold value through all economic cycles. Both USDC and Tether “stablecoins” are only stablecoins in good times. The USDC and Tether reserves are backed substantially by obligations with long maturities and by corporate issuers, which are subject to liquidity, credit and interest rate risk. The issuers of these tokens are prioritizing yield for themselves over stability and security of the reserves. Because neither token is regulated, the issuers are self-policing.

There is a critical difference between being licensed or registered and being regulated. An issuer that holds a state money transmitter license (like USDC’s issuer Circle) is required to adhere to specific state rules in order to offer its product to state residents. The state licensors provide certain supervision over the issuer but not over the stablecoin product nor over the issuer’s reserves. Without comprehensive regulatory oversight of its stablecoin reserves, the issuer can invest reserves however it sees fit. Paxos and Paxos-issued stablecoins (PAX and BUSD), however, are regulated. Both the issuer and the tokens are overseen by the NYDFS to ensure integrity and security for our customers.

Additionally, registration of the issuer does not equal regulation of the token. Like Paxos, both Circle and Tether are registered with FinCEN and are required to properly onboard customers and file Suspicious Activity Reports with the US government. FinCEN’s role in combating financial crime is an essential one, but FinCEN regulations do not mandate that reserve funds are secure or backed 1:1 with US dollars. It’s table stakes for any financial service provider to be registered with FinCEN. This registration is crucial; it demonstrates that the business is subject to rigorous anti-financial crime hygiene. But it does not amount to regulation of the digital asset itself.

Licensing and registration does not equal regulation. Before using any stablecoin, it’s critical to understand if the issuer is being held accountable by a prudential regulator. If not, your funds and consumer protections are at risk.

Licensing & Registration Are Not Equal to Regulation was originally published in Paxos on Medium, where people are continuing the conversation by highlighting and responding to this story.

1

0

Gestisci cripto, NFT e DeFi in un unico luogo

Gestisci cripto, NFT e DeFi in un unico luogoConnetti in sicurezza il portafoglio che usi per iniziare.