Top 7 DEX Screener Tools That Will Help You Navigate DeFi Successfuly

0

0

The DeFi (decentralized finance) ecosystem has grown to a size that was unimaginable just a few years ago. Even though almost all crypto market participants are familiar with DeFi today, the use of DeFi protocols was mostly limited to a small number of blockchain enthusiasts before 2020.

In 2020, we saw the phenomenon of “DeFi summer”, when Compound’s decision to reward tokens to its users sparked a massive wave of interest for DeFi. Protocols like Uniswap saw an unprecedented surge in popularity, and now secure billions of dollars worth of assets. At its peak in December 2021, the decentralized finance ecosystem as a whole had around $180 billion worth of assets.

While the DeFi ecosystem has come a long way, the fact remains that it’s still rather difficult to navigate. There’s countless decentralized exchanges, aggregators, lending protocols and even blockchains that users have to sift through in order to find the best opportunities.

Thankfully, there’s plenty of tools available that make it easy to understand what’s happening in DeFi and quickly identify what’s worth paying attention to. One of the most popular tools that provides a comprehensive overview of DeFi is DEX Screener, but there’s plenty of alternatives to choose from as well.

The top 7 DeFi tools similar to DEX Screener

In this article, we’ll be showing you the 7 best tools for exploring the DeFi ecosystem. The best feature of these tools is that they aggregate DeFi data under one roof, eliminating the need to jump between different websites and blockchain explorers.

- DEX Screener - One of the best tools for analyzing decentralized exchanges

- DeFiLlama - A comprehensive overview of the DeFi ecosystem

- Defined.fi - Find trending tokens and NFTs

- Dex.guru - A DEX aggregator and analytics platform

- Dextools.io - A DEX analytics platform similar to DEX Screener

- Uniswap Info - Analytics for the Uniswap protocol

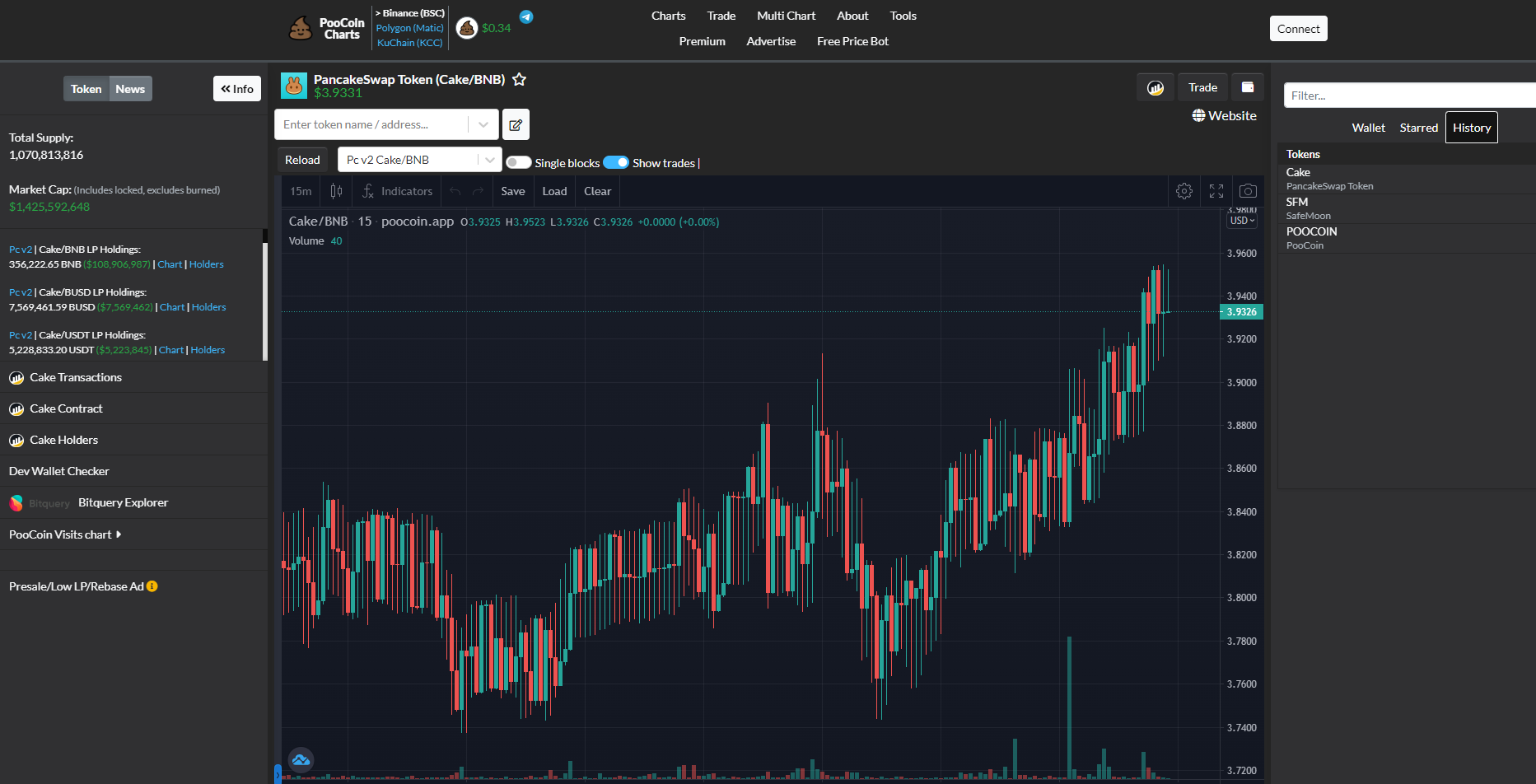

- Poocoin.app - Follow token price on Binance Chain DEXes

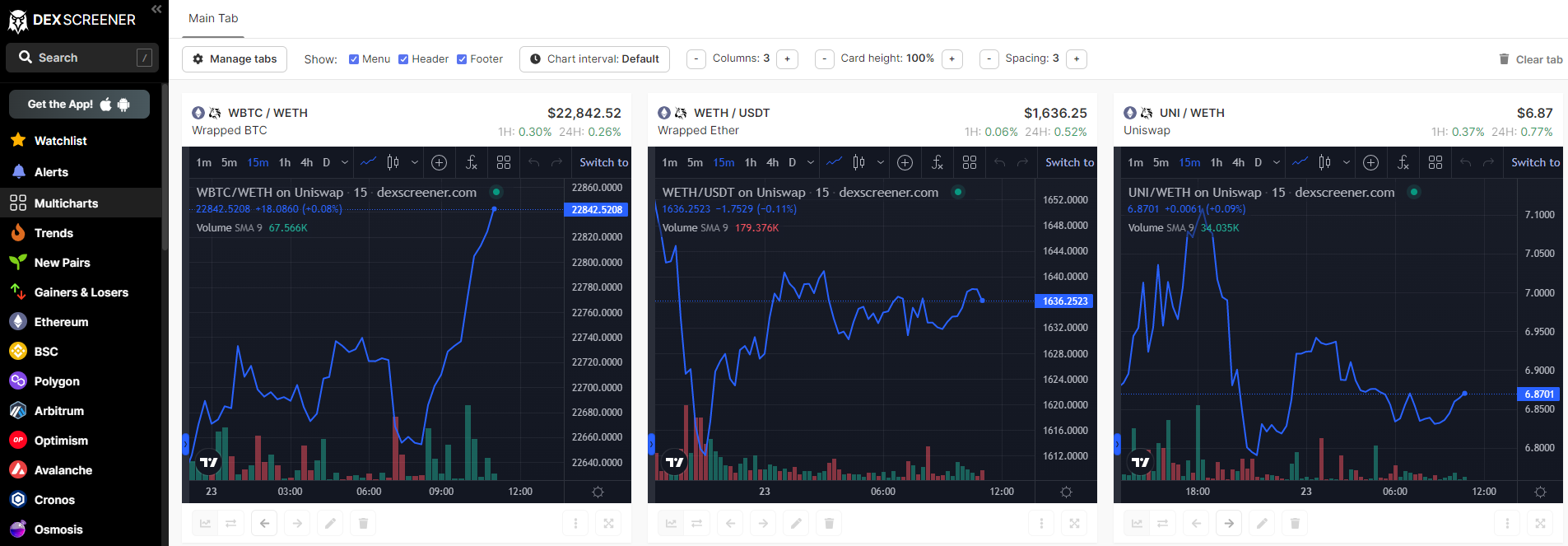

1. DEX Screener - One of the best tools for analyzing decentralized exchanges

DEX Screener is a DeFi analytics platform that allows users to track activity on decentralized cryptocurrency exchanges across a large number of blockchain networks. DEX Screener sports a clean user interface that makes it easy to use even if you’re not a DeFi wizard. There is also a DEX Screener app, allowing you to access the platform’s full functionality on your mobile device.

On DEX Screener, you can see the latest pairs that have been added to decentralized exchanges, the biggest gainers and losers in the DeFi ecosystem, as well as interesting trends that could lead you to your next big DeFi opportunity.

You can filter the data to specific blockchains and decentralized exchanges. Then, you can get even more specific and sort DEX trading pairs by the number of transactions, 24-hour trading volume, liquidity and more.

For example, if we want to know what’s currently the most active trading pair on the Uniswap protocol’s deployment on the Polygon blockchain, we can easily do so with DEX Screener.

The main downside of DEX Screener is that it’s limited to decentralized exchanges, and doesn’t show information about other kinds of DeFi protocols like Maker or Compound.In addition, the list of supported blockchain is not comprehensive—most notably, the site doesn’t provide information about decentralized exchanges on Solana.

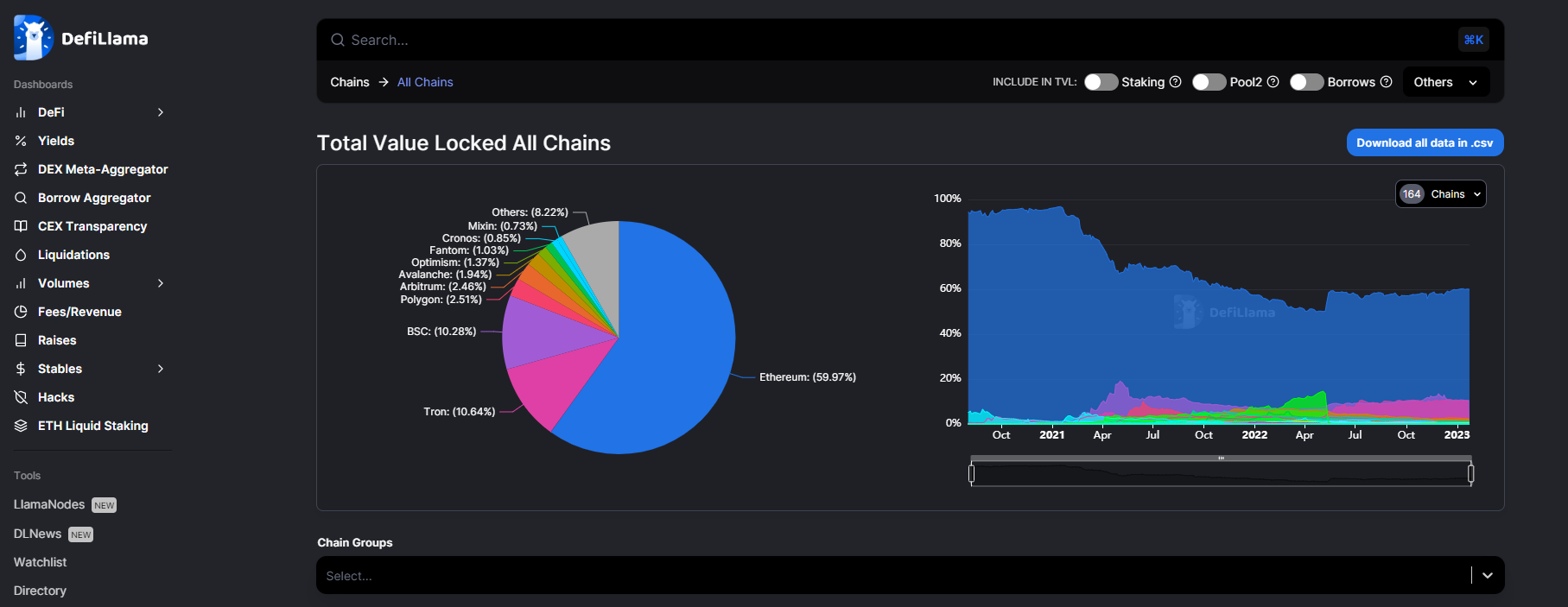

2. DeFiLlama - A comprehensive overview of the DeFi ecosystem

DeFiLlama is one of the best services if you need a comprehensive overview of the decentralized finance landscape.

One of the best things about DeFiLlama is that you can use it to track how different DeFi ecosystems are growing over time. While Ethereum continues to dominate DeFi, other blockchains are also seeing increased usage, and DeFi Llama makes it easy to see where DeFi is trending upwards and where it is on the decline.

In addition to tracking volume and TVL (total value locked) across various DeFi protocols and blockchains, DeFiLlama also provides information on DeFi yields. DeFiLlama also provides some off-chain data, for example holdings disclosures from centralized exchanges and information about funding rounds raised by DeFi projects.

While DeFiLlama is probably the best tool to compare different DeFi protocols and blockchains, the platform doesn’t provide detailed info about specific trading pairs on decentralized exchanges. If that’s what you need, consider using a tool like DEX Screener.

3. Defined.fi - Find trending tokens and NFTs

Defined.fi is an intuitive platform for tracking tokens on more than 40 different blockchain networks.

The Defined.fi platform is particularly good for finding trending and new tokens, but you can of course use it to view information about any token. When you’re looking at the newest tokens, you can set the minimum liquidity a token needs to have in order to be displayed. This is helpful, as it can help you ignore tokens with no liquidity and potential scams.

If you’re interested in information about a specific token, Defined.fi provides a list of the latest transactions, a detailed price chart, as well as helpful info such as total buys/sells and the number of unique buyers/sellers in the selected time period.

A bonus of Defined.fi is that it doesn’t just cover standard tokens, but also NFTs. The platform provides a ranking of trending NFTs across various blockchain networks. You can sort NFT collections by trading volume, number of trades, price floor appreciation and more.

4. Dex.guru - A DEX aggregator and analytics platform

Dex.guru is a decentralized exchange aggregator that can also be used as an analytics platform for decentralized exchanges. You can view the most active trading pools across a variety of decentralized exchanges, including Uniswap, PancakeSwap, SushiSwap, Balancer and more.

For each supported blockchain, you can also view a list of the most actively traded tokens and access data for price, liquidity, token supply and more.

The user interface of Dex.guru is filled to the brim with information, so the platform might not be the best choice for DeFi beginners. However, if you’re already well-versed in the world of decentralized finance, you’ll likely be able to get a lot of value from Dex.guru. The platform can also be used for trading tokens directly, as it provides DEX aggregation services.

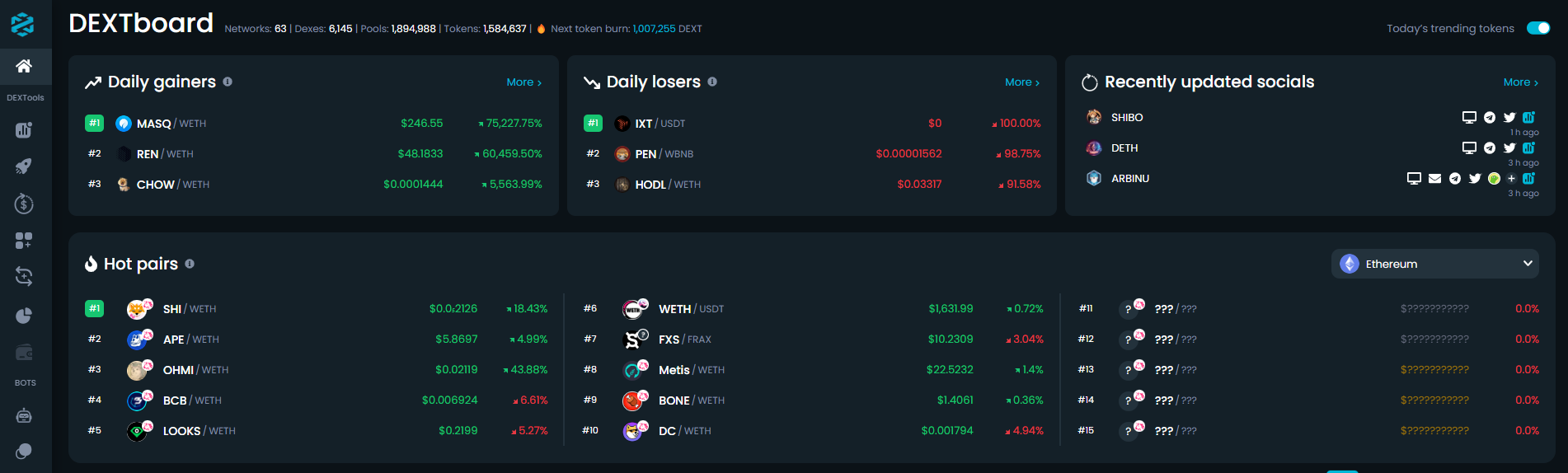

5. Dextools.io - A DEX analytics platform similar to DEX Screener

Dextools.io is a platform similar to DEX Screener that allows you to explore tokens and trading pairs across a variety of decentralized exchanges. By using Dextools.io, you can easily find the most popular DEX trading pairs by trading volume, number of swaps, liquidity and more.

Dextools.io can also be used to find the newest tokens listed on decentralized exchanges, allowing users to potentially identify new opportunities. A good feature of Dextools.io is that it also provides information about smart contracts, including warnings about potentially suspicious smart contracts.

The functionality of Dextools.io has quite a bit of overlap with DEX Screener. The choice of which to use will simply come down to which platform you find the most comfortable to use.

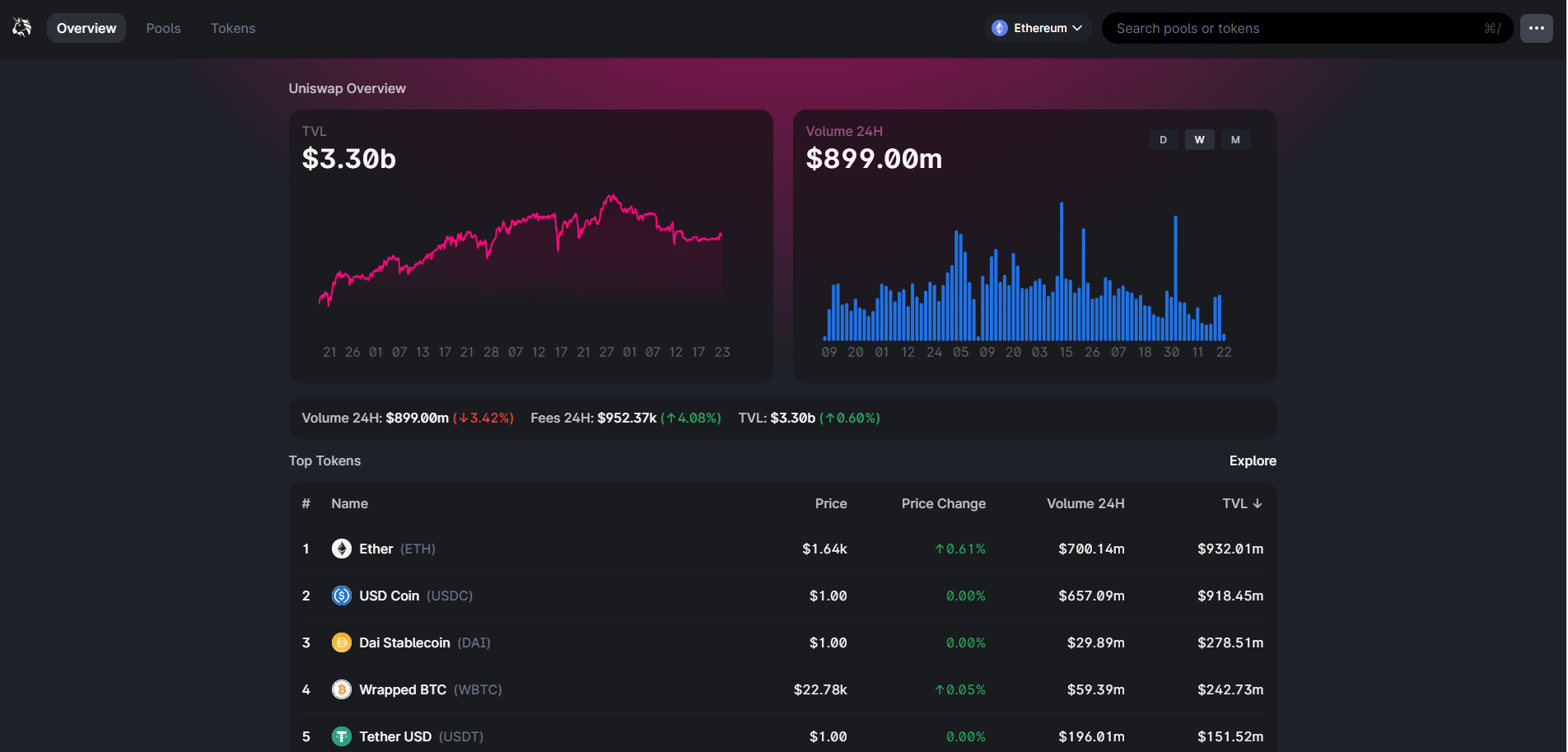

6. Uniswap Info - Analytics for the Uniswap protocol

For many people in the decentralized finance space, Uniswap is the only decentralized exchange they use. If that description fits you, it’s worth checking out Uniswap Info, a platform aggregating information from the Uniswap protocol and displaying it in an intuitive package.

Uniswap Info provides an overview of all token swaps handled by the Uniswap protocol, as well as a ranking of the most actively traded tokens and pools. If you’re looking for a specific pool or token, you can find detailed information about it on Uniswap Info.

The main downside of Uniswap Info is that it is only limited to the Uniswap protocol, so you’re out of luck if you’re using any Uniswap alternatives. In addition, its price charting functionality is very limited - it will suffice for a quick look at the price, but don’t expect any detailed technical analysis tools.

Still, if you want to know what’s happening on the Uniswap protocol, Uniswap Info provides a clean and easy-to-navigate platform that will allow you to find just what you need.

7. Poocoin.app - Follow token price on Binance Chain DEXes

Poocoin.app is a simple platform geared towards Binance Chain users. You can use it to view price charts for tokens sourced from various decentralized exchanges on the Binance Chain blockchain. If you want more convenience, you can also connect your Binance Chain wallet to Poocoin, and the platform will automatically display price charts for the tokens you hold in your wallet.

The platform features price charts powered by TradingView, which gives you access to technical indicators such as moving averages and RSI.

Poocoin.app is not as feature-packed as the other tools we’ve highlighted in our list. However, if you’re a Binance Chain users and you’re just looking to quickly check the price movements of your tokens, the platform is worth having a look at.

The bottom line - You can analyze the DeFi ecosystem with DEX Screener and a host of other tools

Since the DeFi markets move so fast, the key to finding success in DeFi is to stay informed about exactly what is happening in the market. Platforms like DEX Screener will help you identify trending tokens on decentralized exchanges, while other tools such as DeFi Llama will provide you with a big picture overview of the DeFi sector. Familiarizing yourself with these tools will help you gain an edge in the highly competitive DeFi space.

Here, we should also note that all of the platforms we’ve highlighted in our article are free to use. However, some of them have premium features that can be unlocked for a price, or by holding certain tokens.

If you’re interested in tracking the price of tokens related to DeFi protocols, you can stay right here on CoinCodex. Check out our DeFi sector overview to stay on top of the markets for DeFi tokens.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.