Potential BAYC NFT Liquidations Could Cause An Overall NFT Market Downturn

0

0

- Bored Ape NFT liquidation cascade is inevitable according to Web3 launchpad founder “DoubleQ”

- Many BAYC holders who deposited on BendDAO in exchange for $ETH are at risk of being liquidated.

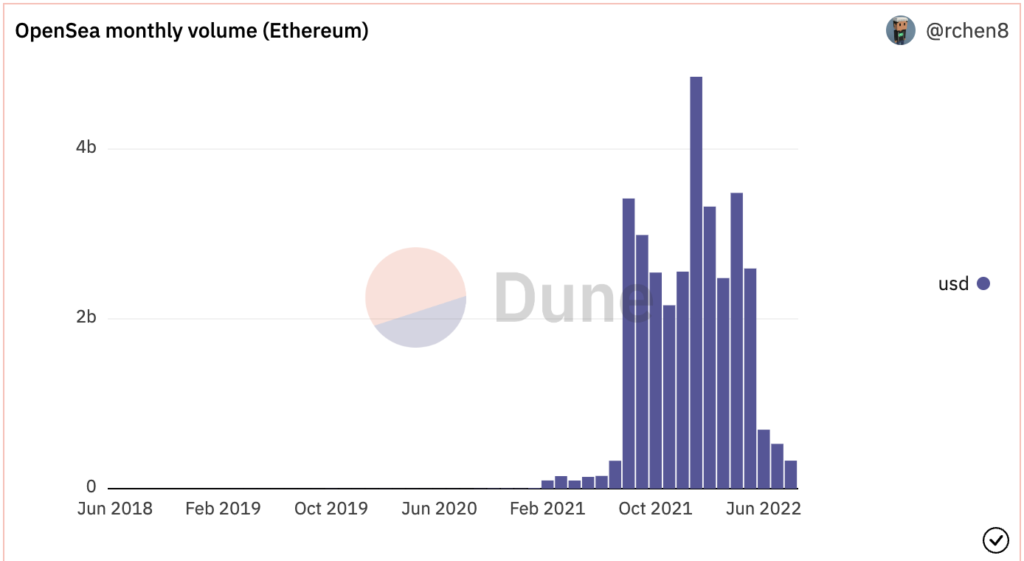

- OpenSea NFT volume is currently at its lowest point in the last 12 months.

The Bored Ape NFT holders are anything but bored right now as a potential cascade of liquidations looms over on NFT liquidity Pool BendDAO.

BAYC holders that deposited their NFTs on BendDAO in exchange for $ETH, are now at risk of being liquidated with a health factor of 1.01 as per data collected from BendDAO.

“DoubleQ,” the founder of Web3 launchpad DoubleStudio, claims on Twitter that this BAYC loan liquidation has the potential to nuke the entire NFT Market.

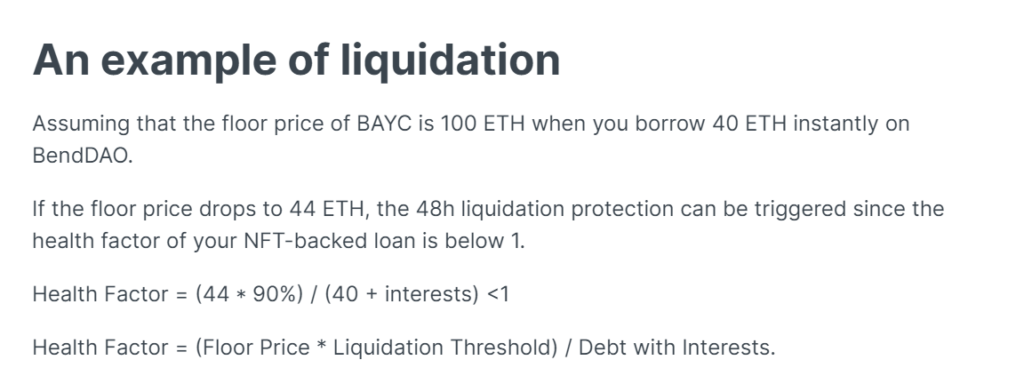

BendDao is an NFT lending protocol that offers 30%-40% of the NFT’s floor price as loans. This is usually used by market participants who need liquidity in ETH but do not want to sell their blue chip NFTs. However, in cases where the health factor is lower than 1, NFTs will get liquidated, as explained by the below example.

There are currently 20 BAYC, under 1.1 health factors and more and 1.2, which could set a liquidation of approximately $55m worth of NFTs.

Opensea NFT volume is currently at the lowest point it has ever been in the last 12 months, meaning there will not be enough volume to save these NFTs from liquidations. Borrowers will have 48 hours to repay the loans or their collateral will be liquidated.

DoubleQ, believes the following could be an excellent opportunity to buy the NFTs at a cheaper rate by either :

-bidding on loans and flipping them after

-waiting for the mass liquidations to have the best entry point to these NFTs.

0

0

Verwalten Sie alle Ihre Kryptowährungen, NFTs und DeFi an einem Ort

Verwalten Sie alle Ihre Kryptowährungen, NFTs und DeFi an einem OrtVerbinden Sie sicher das Portfolio, das Sie zu Beginn verwenden möchten.