MicroStrategy’s stocks turn green for the first time in 9 quarters after the BTC rally

0

1

MicroStrategy, the leading business analytics firm, has finally seen a ray of hope in its financial results after nine quarters of consecutive losses. The company has reported profits for the first quarter of 2023, all thanks to the recent Bitcoin rally that has pushed the price of the crypto to new highs.

MicroStrategy has been a vocal advocate of Bitcoin for quite some time now. The company started investing in Bitcoin back in 2020. Despite facing criticism from some investors and analysts, Saylor has remained steadfast in his belief that Bitcoin is a better store of value than traditional assets like gold or real estate.

MicroStrategy goes green amid the bull run

MicroStrategy, the largest public holder of Bitcoin, posted a profit for the first time in nine quarters due to a substantial increase in the price of BTC, which allowed the company to take advantage of a tax benefit.

Due to losses on its Bitcoin holdings, the company was required to take a tax-related impairment charge. These losses are documented as an expense on the income statement, thereby reducing the company’s reported earnings. However, things changed as Bitcoin concluded the first quarter of 2023 with an impressive 70% gain.

The company reported an impairment loss of $18.9 million for the quarter, a decrease from the previous quarter’s reported loss of $197.6 million.

MicroStrategy was able to repay its $205 million Bitcoin-backed loan with Silvergate Bank thanks to the profits.

The company’s holdings increased by 7,500 BTC during the first quarter of 2023, bringing the total to 140,000 BTC. The average cost to acquire its Bitcoin hoard is $29,803.

This allowed MicroStrategy to access a $453,4 million one-time tax benefit. In the first quarter of 2023, the company posted a net income of $461 million, compared to a net loss of $249.7 million in the fourth quarter of 2022.

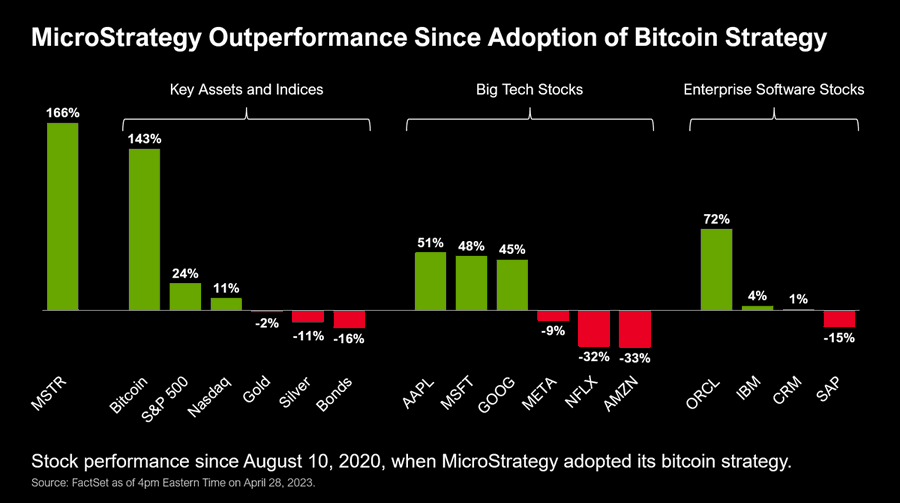

Michael Saylor, a Bitcoin proponent and co-founder of MicroStrategy, stated yesterday that the company had outperformed its competitors and large tech companies by a significant margin since implementing a Bitcoin strategy. The MSTR stock price is up 117% year-to-date.

How the BTC bull run affects companies investing in crypto

Bitcoin has been the talk of the financial industry since its inception in 2009. Since then, it has gone through several market cycles, with some being more bullish than others. The 2023 Bitcoin bull run has been one of the most exciting times for investors, with prices recovering and companies investing in crypto taking advantage of the trend.

The 2023 bull run has been characterized by a surge in Bitcoin prices. This has resulted in a renewed interest in crypto, with more companies investing in crypto to take advantage of the trend. The impact of the bull run on these companies has been significant, with many reaping huge profits.

One of the main ways the 2023 Bitcoin bull run has affected companies investing in crypto is by increasing their profits. Many companies that have invested in Bitcoin or other cryptocurrencies have seen their investment portfolios grow significantly. MicroStrategy invested heavily in Bitcoin and also reported huge profits.

Apart from increasing profits, the 2023 Bitcoin bull run has also brought about a surge in interest in cryptocurrencies from retail and institutional investors. This has led to a surge in demand for crypto-related products and services, which has been a boon for companies investing in crypto.

The 2023 Bitcoin bull run has also brought about increased regulatory scrutiny of crypto. Governments and regulatory bodies have become more interested in regulating crypto due to their increasing popularity and their potential impact on financial stability. This has affected companies investing in crypto, as they have had to navigate new regulations and requirements to remain compliant. For instance, in the United States, the SEC has been more active in regulating crypto, and companies investing in crypto have had to comply with new requirements and guidelines.

Finally, the 2023 Bitcoin bull run has highlighted the need for companies investing in crypto to have a solid risk management strategy. Cryptocurrencies are notoriously volatile, and prices can fluctuate significantly within a short period. This means that companies investing in crypto need to have a solid risk management strategy in place to mitigate potential losses. Companies that have failed to do this have been left vulnerable to market fluctuations and may have suffered significant losses. As Bitcoin and other cryptocurrencies continue to grow in popularity, companies investing in crypto will need to adapt to new challenges and opportunities to remain competitive and profitable.

0

1

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.