What Are Crypto Loans and How They Work

The world of cryptocurrencies has come a long way from 2008 when it was envisioned by the mysterious creator, Satoshi Nakamoto, in the paper for Bitcoin.

The journey has been nothing short of astronomical, with cryptocurrencies giving financial freedom to people all across the globe.

Cryptocurrencies have gained a much broader adoption in the past 5 years, with thousands of altcoins, projects, technologies, etc., coming into the market. Crypto loans are among such financial innovations where users can access loans against their crypto assets.

Read on to learn everything you need to know about cryptocurrency-backed loans, the advantages and risks associated with them, and how to get loans against crypto.

What Is Crypto Loan

To understand what a crypto loan is, it’s essential to understand what a conventional loan is and how it works. Conventional loans can be: Secured or Unsecured. Secured loans require security or collateral against them as a hedge in the face of the loanee being unable to pay the loan back. Unsecured loans don’t need security or collateral; instead, they are given out based on the loanee’s CIBIL or credit scores.

A crypto loan is similar to a secured conventional loan, but the underlying security or collateral needed to secure the loan is a cryptocurrency asset, not a physical one. There is also another kind of crypto loan, known as a Flash Loan, that’s not secured by any asset and is operated on smart contracts. However, we refer to crypto secured loan when we speak of a crypto loan.

Many platforms act as a conduit for securing crypto loans, such as BlockFi, Celsius, Aave, Compound, and even centralized exchanges such as Binance.

Crypto Loan Advantages

The next big question that comes to mind is whether getting a crypto loan is a good idea. There are multiple options available to users who can choose to be either the borrower or the lender when it comes to cryptocurrency loans.

Let’s discuss the advantages and disadvantages of each below:

Earn Interest

There is a vast opportunity for lenders to earn interest on their loans. They can make a steady passive income by loaning out their crypto assets, stablecoins such as USDT, or cash.

Low-Interest Rate

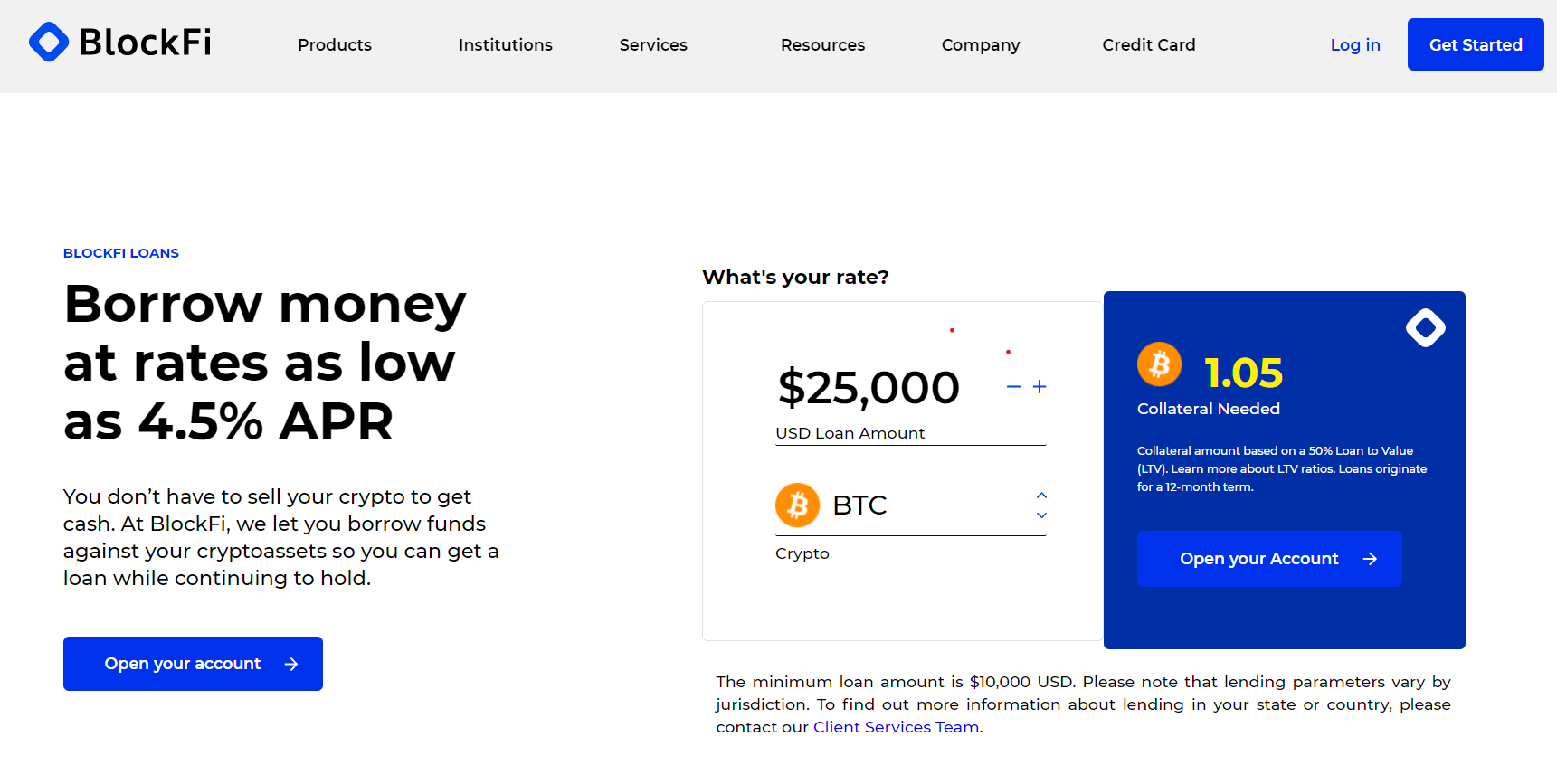

Crypto collateral loans serve as a lucrative prospect for borrowers as the interest rates are meager. E.g., BlockFi offers a 4.5 percent APR (Annual Percentage Rate) on loans. Many other platforms also have a very low-interest rate on cryptocurrency loans secured for the long term.

No Need for Banks

Cryptocurrency loans empower people in a way when the power of approval or denial of loans is taken away from banks and other financial institutions. Although the amount of the majority of crypto-asset-backed loans is usually above $10000, they are still very lucrative and give people access to funds much easier than through conventional methods.

Fast and Secure

The main issue with conventional loans is that they are very time-consuming, and not everyone can be assured of securing a loan. With cryptocurrency loans, the time needed to get a loan is minimal, and almost everyone can get one.

Ownership of Crypto assets

If someone holds many crypto assets and needs cash, they don’t need to sell their crypto assets. Instead, they can secure cash loans by keeping their crypto assets as collateral and get them back after repaying the loan.

Crypto Loan Disadvantages

While cryptocurrency loans might seem very lucrative, there are some inherent disadvantages associated with them. Some of these disadvantages are:

High Minimum Loan Amount

When it comes to cryptocurrency loans, the loan amount is usually high, making it much riskier for people to get one. Moreover, to secure a cryptocurrency loan worth $10000, platforms such as BlockFi, require a crypto-asset holding worth a minimum of $20000 to get approval for the loan.

Short Repayment Period

Most cryptocurrency loans have a short repayment period ranging anywhere between 12 months to 3 years.

Compared to conventional loans, this period is shorter and puts much more pressure on the borrower.

Volatile Nature of Crypto Prices

The crypto assets against which a loan is secured can go through massive volatility in their prices throughout a loan period.

If the price of the crypto assets drops below the threshold level set by the lender, there is a risk of a Margin Call. When a margin call occurs, the borrower might need to deposit more of that asset to fulfill the loan requirements. Failing to do so might result in the platform selling the borrower’s assets to recuperate its losses.

Crypto Assets Are Locked

Once a loan is secured against crypto assets, they are locked in for the entire loan duration, and the borrower can no longer access them for trading or other purposes.

If the price of the assets goes to the moon, the borrower won’t be able to sell them or, likewise, if the price drops substantially, they won’t be able to sell them to cut short their losses.

Conclusion

Cryptocurrency loans are very easy to secure and have a lot of inherent advantages, among them granting financial liberation to people across the globe. However, the mechanisms and the platforms remain nascent.

Moreover, the volatile nature of crypto assets that are the backbone of cryptocurrency loans makes a crypto loan a very risky endeavor.

For lenders who want to earn interest by lending crypto assets, holding their assets on CoinStats Wallet and earning interest on their holdings is better.

And, on top of that, you can manage all your crypto assets across different platforms using the CoinStats Wallet and App.