How to Buy Algorand (ALGO) | Where, How, and Why

Algorand is an open-source, decentralized blockchain network with a native cryptocurrency, ALGO, combining traditional and decentralized finance. It leverages a two-tiered structure and a unique variation of the Proof-of-Stake (PoS) consensus mechanism to provide immediate transaction finality.

Interested in Algorand (ALGO), but not sure what it’s all about? Read on to learn everything you need to know about the project, how to buy Algorand, and much more.

Let’s dive in.

Algorand: The Basics

Algorand is a decentralized open-source network built to solve the problem of achieving scalability, security, and decentralization in one blockchain network. It uses a unique Proof-of-Stake mechanism to enable complete decentralization with top security and scaling while achieving near-instant finality, i.e., processing over 1,000 transactions per second (TPS) and achieving transaction finality in less than five seconds.

Launched in June 2019 by computer scientist and MIT professor Silvio Micali, Algorand aims to provide the foundation for businesses in a decentralized economy. Algorand distributes validator rewards to all holders of its native ALGO cryptocurrency. The system is based on ALGO holders and ALGO block producers, i.e., node runners.

Algorand is capable of hosting decentralized application (dApp) development and providing scalability. It presents an alternative to Ethereum’s smart contract functions while offering more efficient scaling with Pure Proof-of-Stake. With the Algorand Standard Asset (ASA) feature, users can deploy new tokens to the network or transfer existing assets to the Algorand blockchain and enjoy much higher throughput and much lower transaction fees.

The Algorand network achieves security, scalability, and decentralization in one place by using a Pure Proof-of-Stake consensus mechanism (PPoS) that employs a Byzantine agreement protocol. So, in case of a hack, the staked ALGO balances owned by the network participants would be protected with unique keys created through automation.

The Algorand blockchain is secured through Pure Proof-of-Stake, where only users with most ALGO staked can try to perform malicious activity. The network automates tolerance to several malicious users as long as most users are honest and work in favor of the Algorand blockchain.

Malicious activities don’t pay off because even if a majority holder decides to engage in malicious activities, ALGO value will deteriorate, and the users’ funds will be devalued.

The transactions are final and instant due to ALGO’s efficient scaling. The total supply is limited to regulate the supply and add an anti-inflation mechanism to the decentralized economy.

Use Cases of Algorand

Various organizations, such as fintech, startups, financial services, institutions, and DeFi, are currently building on the Algorand blockchain.

Find some of the practical cases using the platform below.

Tether has joined Algorand – it integrated ASA Algorand 2.0 technology and launched the first stablecoin based on the blockchain. After switching to the Algorand blockchain, Tether became suitable for micropayments, offering instant transactions with low fees.

Algorand also partnered with the renowned company Circle to provide enterprise-grade solutions to facilitate the conversion of USD Coin (USDC) -based stablecoins to fiat currency.

Reason to Buy ALGO

There are several reasons to buy ALGO: its innovative technology and functions, network utility factors, and finite supply. Algorand has a limited supply of 10 billion ALGO, which was minted at the inception of Algorand. These funds are distributed as participation rewards to node runners, end-user grants, and the Algorand Foundation.

Users of the platform must keep a balance of at least 1 ALGO to earn a share of the new cryptocurrency the software generates every time a block is added to the blockchain. That is striking, as, over time, nearly 20% (1.75 billion) of the 10 billion ALGO ever to be created are to be awarded to those who help operate the network.

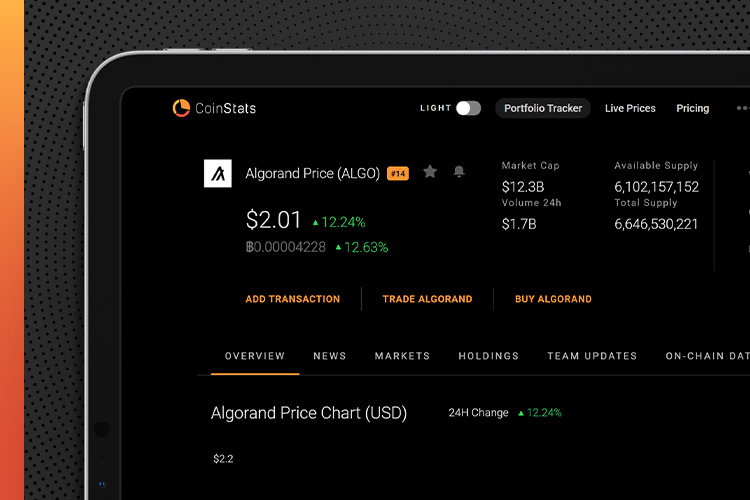

Where to Buy ALGO

Algorand is available on most popular cryptocurrency exchanges, such as Binance, OKEx, Huobi, and KuCoin.

How to Buy Algorand

To buy ALGO, you will first need to choose a secure and trustworthy exchange. You can buy Algorand via Credit or Debit card, or Bank Transfer directly on the exchange. Follow our step-by-step guide for buying ALGO:

- Open an online account. You’ll need to open a brokerage account before you can buy Algorand. After opening your account, you will get a trading platform that you can use to buy and sell cryptocurrencies.

- Buy a wallet (optional). Hardware wallets and software wallets help you store your tokens and coins more securely. A hardware wallet stores your investments in offline “cold storage,” while a software wallet is a computer or mobile application that stores your tokens online. Consider the Algorand Wallet, providing users with top-level security for their ALGO. It comes with a unique, streamlined setup that will provide you with your own set of keys in as little as a few minutes.

- Make your purchase. Now, you’re all set to buy Algorand. Ensure that your account has full trading capabilities and is already funded with a linked bank account, credit, or debit card.

You are finally ready to place a buy order. Two of the most common types of orders include:

Market orders: A market order tells your broker that you want to buy a set number of ALGO at the current market price.

Limit orders: A limit order tells your broker that you want to buy a set number of ALGO at or below a specific price.

Where to Keep ALGO

Several wallets support ALGO cryptocurrency.

You can store your ALGO in hardware wallets or cold wallets, like Ledger or Trezor, which are among the most popular and secure options for Algorand hardware storage. These wallets use the highest possible security features, and you can add up to 100 unique applications onto a single device.

If you prefer a software wallet with top-level security for your ALGO, your best choice will be the Algorand Wallet, Algorand’s proprietary software wallet option. MyALGO wallet is another common choice among Algorand users.

To ensure that it’s the right time for investing in ALGO, check out the Algorand price and always do your research before putting your funds into any project.

Final Thoughts

Algorand is a powerful platform that enables scaling, security, and complete decentralization due to the use of PoS. It offers vital tech innovation, a highly equitable coin rewards structure, developer support, and real-world use cases. With the ability to process 1,000 transactions per second, Algorand is also one of the fastest blockchain networks on the market.

Algorand could become a valuable asset despite its volatility due to its finite supply, technical features, and scaling capacity.