How to Buy Frax | Where, How, and Why

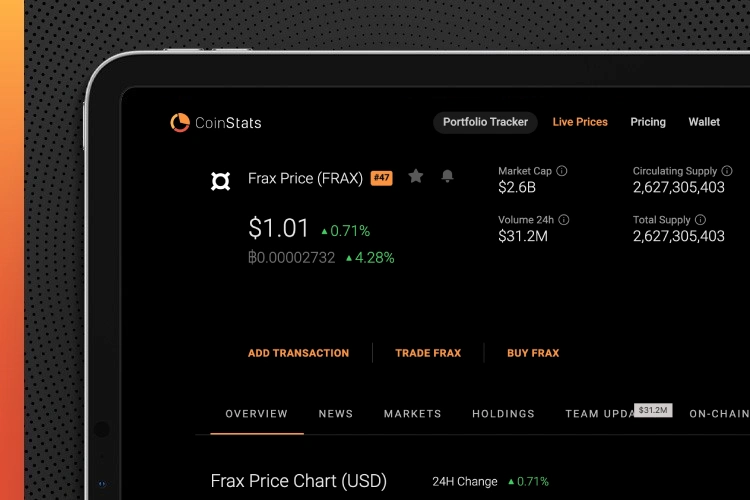

Frax protocol is the first fractional algorithmic stablecoin system designed to provide scalable and decentralized algorithmic money in place of fixed-supply digital assets.

The Frax system offers fast transactions, ultra-low fees, and the ability to trade directly with other cryptocurrencies.

Frax Share is the governance token of the Frax protocol.

Read on for our deep dive into the Frax protocol and the Frax Share token, and learn how to buy Frax cryptocurrency in a few simple steps.

Let’s jump right in!

Creators of Frax

Sam Kazemian, an American software developer, came up with the idea of a fractional-algorithmic stablecoin in 2019 and founded the Frax Protocol.

The Frax team includes Travis Moore and Jason Huan, two of the company’s leading engineers.

Sam Kazemian came up with the concept when he noticed that the number of stablecoins was rapidly increasing, but none of them combined algorithmic monetary policy with collateralization. Algorithmic monetary policy projects had either failed or been shut down because of a lack of traction in the real world. So, Frax was created to gauge the market’s confidence in a stablecoin that is both partially algorithmic and partially collateralized.

What Is Frax

Frax is the first stablecoin system that uses a fractional algorithm and the only stablecoin with parts of its supply backed by collateral and parts of the supply algorithmic. The ratio of collateralized and algorithmic depends on the market’s pricing of the FRAX stablecoin.

Frax is an open-source, permissionless protocol that runs exclusively on the blockchain. The Frax protocol’s objective is to create highly scalable, decentralized, algorithmic money in lieu of fixed-supply digital assets such as Bitcoin.

Stablecoins were previously classified into three categories:

- Collateralized with fiat

- Overcollateralized with cryptocurrency

- Algorithmic (did not require any collateral).

With Frax, the fourth and unique category of stablecoin, with parts of its supply backed by collateral and parts of the supply algorithmic, is officially introduced.

The supply of Frax stablecoin is constantly changing due to its fractional-algorithmic monetary policy. This means that the price of the stablecoin always stays at $1. FXS tokens have had a hard cap of 100 million at the start of the protocol, and there is no way to add more tokens in the future.

The Frax protocol is a two-token system encompassing a stablecoin, Frax (FRAX), and a governance token, Frax Shares (FXS). FXS is a financial investment and governance asset, whereas Frax is a cryptocurrency-tokenized currency.

The process of minting and redeeming FRAX tokens helps maintain the price stability of the stablecoin. Accordingly, the more people use the protocol, the more stable the FRAX token becomes. Furthermore, the demand for FRAX tokens influences the price of the FRAX token and can create arbitrage opportunities.

FXS token holders can vote on proposals, including the addition of new collateral pools, proposals to make changes to fee structures, and “the rate of the collateral ratio.”

The veFXS token model is a “vesting and yield system,” and by locking up FXS tokens, holders receive veFSX in return. The number of veFXS tokens that a staker receives is proportional to the duration of their stake. The veFXS token is non-transferable and cannot be traded on liquid markets, instead, it aims to encourage long-term staking.

The project’s vision is to become the first crypto native consumer price index (CPI), which FXS token holders will govern. Currently, the FRAX token is price-pegged to the US dollar. However, the project aims to support multiple currencies and become a worldwide permissionless unit of account in the future.

Where to Buy Frax

You can only buy Frax on decentralized exchanges with another cryptocurrency. To buy Frax Share, you’ll need first to purchase Ethereum (ETH), and then use ETH to buy Frax. For this, you’ll need a self-custody crypto wallet. The top six self-custody wallets today are:

- Coinbase wallet – the best wallet for beginners.

- Trust wallet – with the best backup system.

- Electrum –the best one for Bitcoin.

- Mycelium – the best choice for mobile applications.

- Ledger Nano X – the best offline cryptocurrency wallet currently available.

- Exodus – the best one on the desktop.

For the time being, the most popular cryptocurrency exchanges for trading Frax are Binance, CoinW, HitBTC, Pionex, Gate.io, Curve Finance, Uniswap (V2), Uniswap (V3), Pancakeswap, and Hotbit.

Additionally, the Frax Shares, or the FXS tokens, are available on various exchanges and are as liquid as the Frax stablecoins. Investors interested in acquiring governance rights to the world’s first stablecoin protocol should consider purchasing Frax Shares (FXS).

The purchase of the Frax token is recommended for those interested in price stability through the use of a fractional-algorithmic stablecoin.

How to Buy Frax

Your first step is to find a cryptocurrency platform offering some of the lowest transaction fees in the industry to trade, buy, and sell Frax. You should also compare the security, reputation, deposit methods, supported fiat currencies of the platforms to choose the one that best suits your needs.

Frax Can Be Purchased Using Cryptocurrency

If you already have different digital tokens in an external wallet, you can use them to purchase Frax. All you have to do is deposit the coins into your Trust Wallet or Coinbase wallet, for example, and exchange them for Frax using a DEX (decentralized exchange) such as Uniswap or Pancakeswap. After that, you can withdraw Frax to an external ERC-20 wallet.

- Download and set up the self-custody wallet you prefer (Coinbase, Trust, Ledger Nano, etc.).

- Consider Ethereum network fees, which vary according to how busy the network is and depending on the complexity and the speed of the transaction.

- Buy and transfer ETH to your self-custody wallet.

- Use your ETH to buy Frax.

Frax Can Be Purchased Using a Debit or Credit Card

If you wish to purchase Frax using your debit or credit card, you can do so through either a centralized or decentralized exchange. A centralized exchange makes it possible to purchase Frax directly by first purchasing another digital token and then exchanging it for Frax. It’s possible to purchase cryptocurrencies with your debit or credit card through a self-custody wallet.

It’s worth noting that you must go through a “Know Your Customer” (KYC) verification process to trade with fiat currency.

Is It Possible to Purchase FXS Using Cash

There is no direct way to purchase FXS with cash at this time. However, you can use marketplaces such as LocalBitcoins to first purchase bitcoin (BTC) and then complete the rest of the process by moving your bitcoin to the appropriate AltCoin exchange.

LocalBitcoins is a Bitcoin exchange that operates on a peer-to-peer basis. A Bitcoin exchange is a marketplace where users can purchase and sell bitcoins directly. Users referred to as traders post adverts on the internet with the price and payment method they wish to offer. You can choose to buy from merchants in a specific neighboring region based on your preferences on the platform. The downside is that costs on this site are typically higher, and you must proceed cautiously to avoid being defrauded.

Pros and Cons of Buying Frax

To buy or not to buy? That is the question. There are many benefits to investing in Frax, but there are also some downsides that you need to consider before making your decision. Before you buy Frax and add it to your cryptocurrency portfolio, you should consider the following factors:

- Frax is a stablecoin soft-pegged to the US dollar, so the token’s supply is volatile and keeps altering according to the fractional algorithmic strategy to keep an asset’s price at $1.

- The governance token for the Frax ecosystem is FXS (Frax Shares). Excess collateral value, accrued fees, and seigniorage revenue are all generated through this mechanism.

- The ratio of collateralized and algorithmic depends on the market’s pricing of the FRAX stablecoin. There is less collateral at higher prices, while at lower prices, there is more collateral required.

- Frax relies on reserves and is under-collateralized. According to the governance protocol, it’s fully backed by assets. If USDC or USDT accounts for 40% of the total, FSX must account for the remaining 60%.

- In addition, the stablecoin is supported by FXS.

- USD Coin (USDC) and USD Tether are two potential stablecoins that would provide some of the necessary support for this coin.

- Network data is accessed through the use of oracles in this protocol. Chainlink and Uniswap are used to calculate the time-weighted average prices for ETH, USDT, and USDC.

To avoid losing money when purchasing Frax, you should research the risks associated with it. Like other digital assets, the significant risk is the volatility of its value in the cryptocurrency market. If you cash out when the price falls below the amount you bought, you will lose money.

This is why you should invest in Frax with caution:

- Maintain a respectable level of stakes.

- Purchase Frax in small yet frequent dosages. This is referred to as the dollar-cost averaging technique.

- Invest in additional Defi coins to diversify your digital token holdings.

Conclusion

In the cryptocurrency market, Frax is an innovative cryptocurrency that has taken the industry by storm. Fast transfers, low costs, and the ability to trade directly with other cryptocurrencies are all features of the Frax system.

The Frax team will be deploying their protocol to Moonbeam so that their stablecoin can be minted natively on Polkadot. This integration will allow users and teams in the Polkadot and Moonbeam ecosystems to access highly scalable, stable, and on-chain money.

We have explained how to buy Frax and why it might be a good investment in this post. Remember that it’s only possible to trade Frax on decentralized exchanges because it’s a cryptocurrency tokenized currency.

The Frax token, also known as the FXS token, is traded on numerous exchanges and is available in a liquid state.

The token supply of Frax, a stablecoin that is softly tied to the US dollar, fluctuates. In the bitcoin market, Frax’s value goes up and down, which is one of the biggest downsides.

Obtain your own advice, and consider your own circumstances before relying on the information in this article.

Verify the nature of any service or product (including its relevant regulatory requirements and legal status) and review the relevant regulators’ websites before making any investment decisions.

You can also check our blog for additional informative articles about wallets, crypto exchanges, and tokens, including How to buy Gala and several other cryptocurrencies.