How to Buy KuCoin Token [The Ultimate Guide 2023]

KuCoin, also known as People’s exchange, is a user-friendly and secure platform that provides several trading options to its six million users worldwide. It’s one of the most popular crypto trading platforms with its native cryptocurrency KuCoin Shares Token (KCS), based on the Ethereum blockchain (an ERC-20 token).

If you acquire its native KuCoin token (KCS), you will get significant discounts on trading fees. Additionally, KuCoin users receive a daily dividend, KCS Bonus, for holding over 6 KCS.

If you consider KuCoin as a possible investment, this KuCoin review will help you get started. Read on to learn everything you need to know about the KuCoin exchange and how to buy the KuCoin token in a few simple steps.

Let’s start by looking into the KuCoin token’s Pros and Cons.

Pros

- Rewards on KuCoin exchange

- It is linked to Kucoin Exchange, a stable, worldwide platform.

- No KYC is required for obtaining a KuCoin token

- Staking advantages

- Exclusive access to KuCoin Spotlight

- Discounts on trading fees.

Cons

- The unpredictability of the cryptocurrency market

- Limited pairs are available outside the native exchange.

KuCoin Exchange and KCS Features

Kucoin Exchange is based in Seychelles and licensed by the Seychelles regulator; however, the company’s main operational center is in Singapore. KuCoin has over 20 local communities across North America, Europe, Southeast Asia, and other regions.

The exchange was developed by a team of crypto and blockchain professionals, and its ICO (initial coin offering) sold 200 million KCS tokens. KuCoin went live in 2017 and has a roadmap for platform development until 2024, suggesting future upgrades, an increased user base, and more improvements. In the same year, KuCoin developed and released its native token – KuCoin Shares(KCS).

KuCoin exchange offers bank-level asset security, a slick interface, beginner-friendly UX, and a wide range of crypto services: margin and futures trading, a built-in P2P exchange, the ability to buy crypto using fiat currency, such as a credit or debit card, instant-exchange services, ability to earn interest on digital assets by crypto lending or staking via its Pool-X, IEO launchpad for crypto crowdfunding, non-custodial trading, and some of the lowest trading fees among crypto exchanges.

KuCoin Token, also known as KuCoin Shares (KCS), is an ERC20 token on the Ethereum blockchain. KCS offers its users certain privileges, like lower trading fees, bonuses, rewards, and other perks. The token is used to make purchases or reservations, pay trading fees, pay the staking rewards, bonuses, incentives, etc. What’s unique about KuCoin is that they share 50% of their overall trading fee revenue with users holding the KCS token.

How Does It Work

The KuCoin token is deflationary, with the exchange implementing token burn and removing assets from circulation corresponding to KuCoin’s long-term vision of making the supply constant at 100 million. The buy-back records are exposed through the blockchain explorer.

The KuCoin exchange features a Bonus Program, rewarding users for holding their KuCoin KCS on the exchange. The reward is determined by the user’s overall exchange activity and the number of KCS held.

KCS holders enjoy several benefits such as commission income, reduced trading commissions, and access to other special services. Besides, the KuCoin institutional investor program participants get significant trading fee discounts.

The cryptocurrency exchange has issued a plan for buyback disposal, which aims to keep a constant 100 million tokens on the market. According to KuCoin, the company will use 10% of each quarter’s net profit to buy KCS back and destroy it.

Traders can use the KuCoin token KCS to “activate” a 1% to 30% discount on all trades, proportional to the number of KuCoin shares held. Meanwhile, the exchange may adjust fees according to the market conditions.

How to Buy Kucoin KCS Tokens in 4 Quick Steps

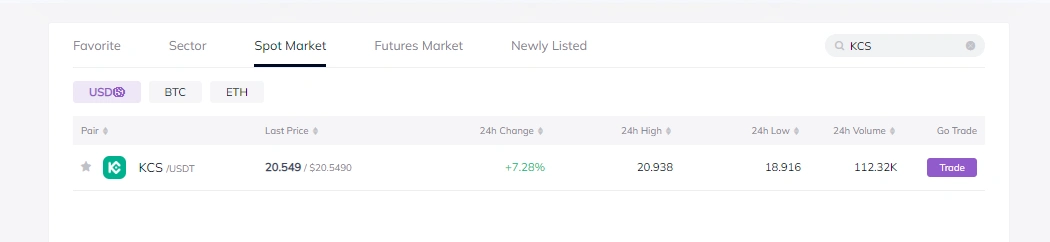

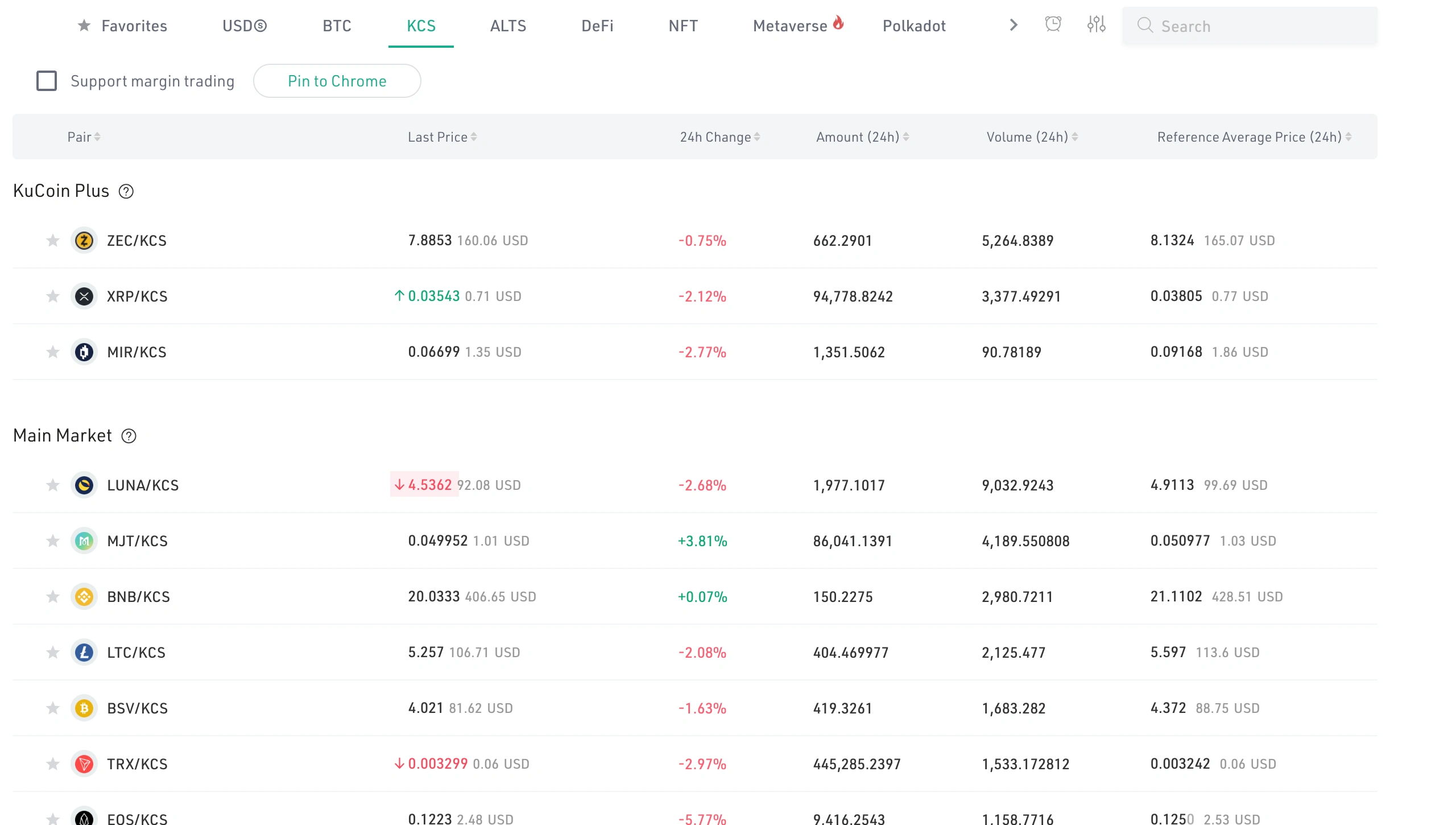

Commonly used cryptocurrency exchanges to buy the KuCoin token are KuCoin, BitMax, Probit, MXC, and Polonies. The platform with the most available trading pairs for KCS is KuCoin.

However, to buy KCS on major exchanges like Binance or Coinbase, you’ll need first to purchase a major cryptocurrency first and then use it to buy a KuCoin token.

Follow these easy steps to buy KuCoin token (KCS).

Step #1: Choose a Cryptocurrency Exchange

You must compare the cryptocurrency exchanges’ features before choosing the one that suits your investment needs best. Some of the factors to consider are supported deposit methods, trading fees, customer support, ease of use, and local requirements.

However, buying KuCoin’s native token on the KuCoin platform seems more intuitive. If you choose to put your trust in another platform for whatever reason, you can purchase KCS by swapping a stablecoin, for example, Tether USDT.

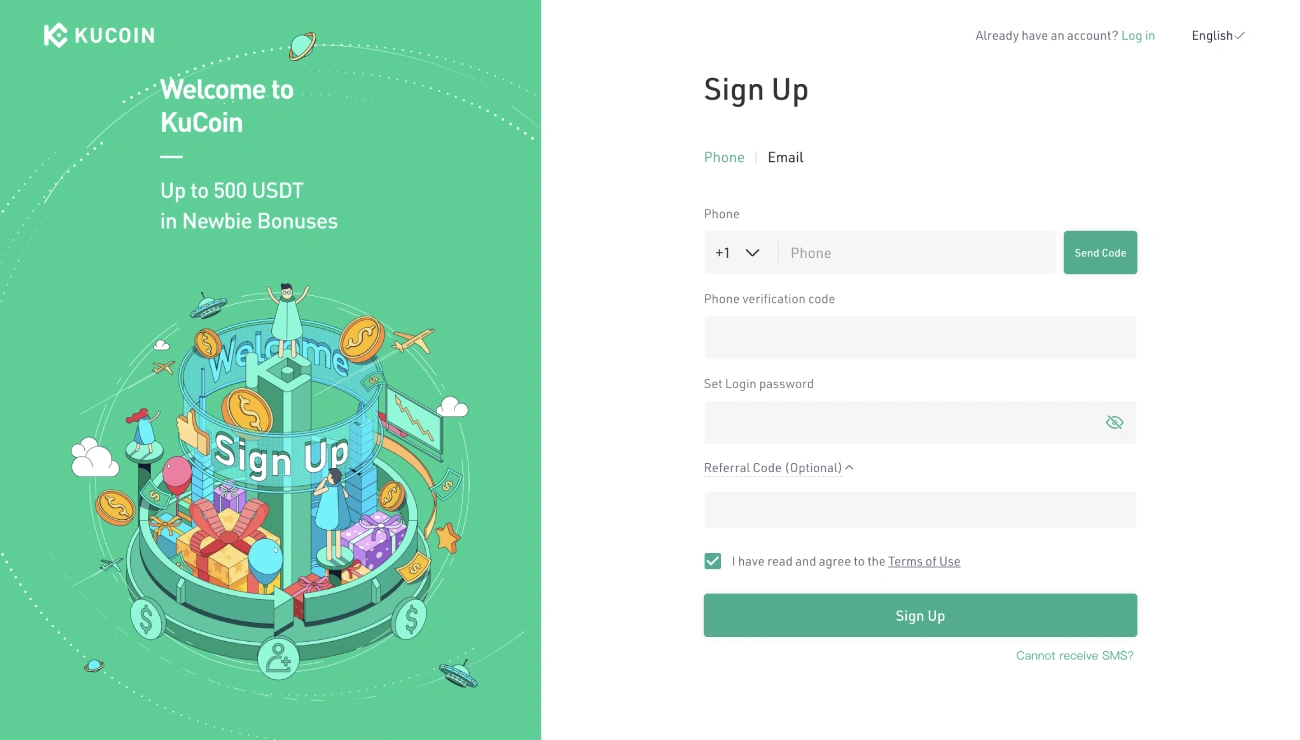

Step#2: Register an Account

To buy the KuCoin token on its own exchange, you’ll need to register a KuCoin account on kucoin.com. You can use either a valid email address or a phone number. The registration is quite straightforward and doesn’t require personal information or KYC (know your customer) verification. Input your e-mail address and click the “Send Code” button. Wait for the email verification code to be sent to your mailbox and enter the verification code you received. Then set the login password, read through and agree to the “Terms of Use,” click the “Sign Up” button to complete your registration. To register with a phone number, wait for the SMS verification code to be sent to your phone and enter the verification code you received.

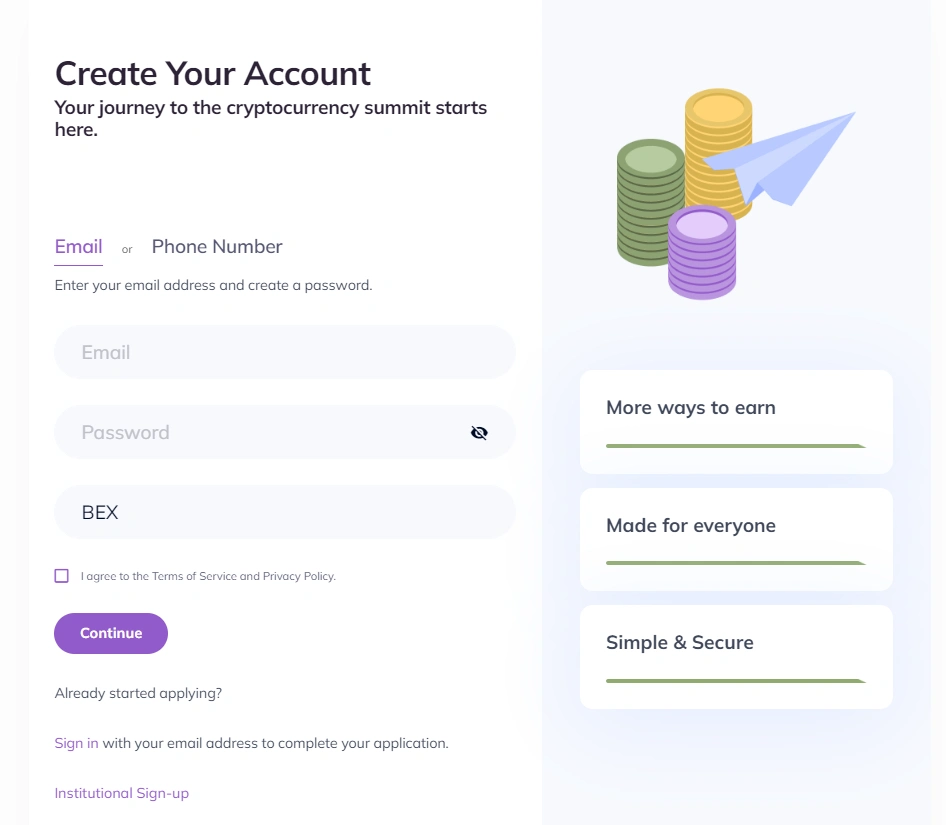

You can also use your email address or phone number to purchase the KuCoin token on another platform. Ensure to follow the platform’s requirements.

Step #3: Deposit Funds

After setting up your account, the next step would involve depositing funds to purchase KCS and other cryptocurrencies. On KuCoin, you can trade KCS against any major crypto, including Bitcoin (BTC), Ethereum (ETH), or USDT. You can fast buy USDT with fiat currency through a credit or debit card directly on KuCoin’s exchange; purchase it directly from verified holders or through a 3rd party using a payment channel.

The platform doesn’t support direct wire transfers, but it’s possible to buy crypto with fiat currencies through a third-party app. Additionally, the platform supports credit or debit cards, Apple Pay, Google Pay, etc., but the fees can be rather steep.

Your KCS purchase will be hassle-free and fast if you already have a crypto wallet. Several KCS trading pairs are available on the KuCoin exchange, but you might have fewer trading options on other platforms.

Once you select the most convenient payment method, it’s high time to buy KuCoin token KCS.

Get started by checking the current KuCoin price, but note that the current price does not indicate a future trajectory.

Step #4: Buy KuCoin KCS Token

If you’re a KuCoin exchange user, you can enjoy a wide selection of trading pairs.

Once you have purchased USDT, navigate to the USDT/KCS pair. Enter the amount of USDT you would like to swap and execute the trade. Congratulations on your purchase of KCS!

Now that you’re a proud owner of your personal KuCoin let’s look into different options to use your coins and decide which one suits your needs best.

What to Do With KuCoin Tokens

There are several ways you can put your KCS to good use. However, remember that the cryptocurrency market is volatile, and the high risk/high reward strategy might not be best for everyone. Do your own research before considering an investment, as this review doesn’t constitute financial advice or any other kind of advice.

1. Stake

Staking is a popular option, where your crypto funds don’t just lay around but bring you idle profit. Many cryptocurrencies offer a staking option, but not all traders are familiar with the process. Staking means making the coins “work for you” and earning you rewards in return for locking them temporarily and letting the platform use them for its needs. In short, the process resembles owning a savings account. There’s a trust element involved, just like you trust the bank to govern your assets while you hold them “locked” in a savings account, and they provide you with yield in return. Staking is locking a certain amount of coins on your KuCoin account to get annual yields.

2. HODL

Holding on to your crypto funds is a viable option if you believe they will rocket in price someday. However, for cryptos that have been around for years, a triple-digit surge becomes less and less likely. Meanwhile, an incremental price increase could be expected.

If you wish to buy KuCoin token KCS and store them away, the important part is to do it safely, minimizing the risk of anyone getting hold of the assets without your permission. We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets, the latter being a more secure choice.

Hardware Wallets

A hardware wallet or a cold wallet is a device that stores the private keys you need to receive or send crypto. Hardware wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks.

Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your KCS tokens.

If you believe storing your KuCoin will earn you high rewards, this is the way to go.

3. Sell

You can follow the same process to cash out your KCS coins with the same exchange you bought them through. You can sell it on an altcoin exchange for Bitcoin, Ethereum, or USDT and then cash out to fiat currency.

In any case, remember to do your independent research, obtain your own advice, and only invest what you can afford to lose.

Hopefully, this review helped answer some of your questions about the KuCoin exchange and how to buy KuCoin token KCS.