What Is Crypto Staking: How to Start

Bitcoin and Ethereum, two of the world’s leading digital assets by market capitalization, reached their record highs. Their gains followed investments from larger institutions, amid fears that the US Federal Reserve’s expansionary policies, including near-zero interest rates and a $120bn monthly asset purchase program, would lead to higher inflation. Investors also went beyond the concept of holding Bitcoin and Ethereum as their long-term hedging bets to seek alternative investment opportunities across the crypto sphere.

How to Stake Crypto?

Based on the information provided above, one can break the process of staking cryptocurrencies into five points.

- Choose a Coin to Stake

Choose among Tezos (XTZ), Cosmos (ATOM), Cardano (ADA), Polkadot (DOT), Synthetix Network (SNX), Ethereum (ETH), and many others.

- Download the Wallet

A wallet (hardware/software) is essential to store funds that users want to stake. Just download it from the official website of the token you wish to bet.

- Check Minimum Staking Requirements

Some PoS networks have a minimum staking cap.

For example, Ethereum requires 32 ETH to set up a node while Tezos seeks 10,000 XTZ. Meanwhile, projects like Cosmos and Cardano have no minimum staking requirements. - Decide Which Crypto Staking Service to Use

If you want to set up the PoS node by yourself, be prepared to get a machine connected to the network 24/7 via uninterrupted internet access.

Ideally, a personal computer would be sufficient. Alternatively, a raspberry pi would also do the job with lesser power requirements.

Else, deposit tokens into staking pools or exchanges to support their node and receive rewards after deducting fees. That ensures no maintenance hassles. - Start Staking

Let the machines/services do their job while you receive rewards into your hardware/software crypto wallets.

The Background

Bitcoin and similar digital currencies promise to send value from one party to another without permission from centralized authorities (such as banks and financial institutions).

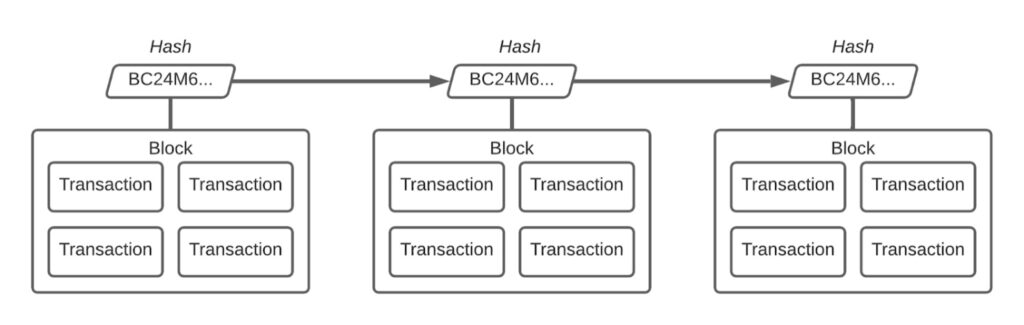

Initially, the solution to managing a blockchain — a ledger of balances not controlled by any single entity — was done through mining.

In simple terms, one can consider mining as a game in which powerful computers race against one another to find a solution for a complex mathematical problem.

Whoever finds the answer first earns the right to write the next page of transactions — also known as a block — into the ledger.

Therefore, the more powerful your computer is, the more attempts it can make to find a solution, increasing your chances of winning the race. It is doubtful that a single person or a group will gain a monopoly over updating the ledger. And that is how blockchains maintain their decentralization.

Mining’s Technical Term Is Proof-Of-Work

Simply put, miners prove they have worked hard by providing the right solution as there is no other way to find one aside from using computing power.

Proof-of-work, or PoW, is a consensus mechanism because it is designed to create an agreement as to who gets to update a ledger among a group of miners that don’t know each other and have no other basis for working together.

Thereby, a PoW solution, such as the one used by Bitcoin, has emerged as a reliable and secure solution to managing a decentralized ledger.

But There’s an Environmental Glitch

Despite its genius, PoW also comes with a set of its problems. One of them is its resource intensiveness.

Running supercomputers across the planet to guess a solution takes up a lot of electricity. Because of such disadvantages, blockchain developers have come up with alternative consensus mechanisms throughout the years. One of the most popular alternatives is Proof-of-Stake or PoS.

Simply put, a PoS mechanism replaces the need for committing powerful computers to run a blockchain network with a staking requirement.

In doing so, users get to confirm and add blocks on a public ledger by staking their actual crypto assets.

How Does Crypto Staking Work?

Users lock a certain amount of their crypto funds (stake) on an everyday computer (node) connected to the network.

Once users’ stake is in place, they participate in the contest of which node will get to mine the next block.

In a way, stakers forge BLOCKS; they don’t MINE them.

A PoS network considers several factors before choosing which node would add the following block on its blockchain.

For instance, it matters how much money a node has staked, for how much time, and randomization so that no single entity gains monopoly over forging.

Therefore, whoever wins the contest gets to forget the next block of transactions. In return, it receives rewards in crypto for its contribution to the PoS network.

For the same reason, crypto staking has become a common practice among users looking to earn passive income.

Many blockchain projects use proof-of-stake, such as Cosmos, Tezos, and Cardano. Each of them has separate rules for how they calculate and distribute rewards.

Meanwhile, Ethereum, a proof-of-work blockchain otherwise, will switch entirely into a proof-of-stake blockchain sometime in 2022 through a series of upgrades.

Types of Crypto Staking Mechanisms

In most cases, users will stake their cryptocurrencies directly from their cold wallet, such as Trust Wallet.

However, they can also choose popular crypto exchanges like Binance and Coinbase or crypto staking pools for their staking requirements.

Here’s a difference between different kinds of staking mechanisms.

Exchange-Based Staking

In exchange staking, a trading platform takes up the role of a node for specific blockchains. It attracts funds from its users and locks them into the network.

In return, the exchange pays its users a portion of crypto rewards it earns by validating and adding blocks to the PoS blockchain.

Exchange stakings are ideal for users who want to cut through the hassles of complicated node setups. User interfaces of many independent pools are typically complex.

But to stake via a cryptocurrency exchange, one only needs to buy the necessary amount of a specific currency and store it for a certain period.

Staking Pools

The biggest drawback of using an exchange is overhead fees.

In the meanwhile, staking via pools — a group of people combining their funds to afford node setup — requires significant research from the users’ end. Simply put, they would need to study them for their reward mechanism.

Generally, staking rewards earned via pools turn out to be lower than its alternatives, such as individual-run nodes.

Nevertheless, they are ideal for users who do not want to go through the technical hassle of running a node. They also have a substantial minimum balance requirement to stake.

Cold Staking

Cold staking refers to a mechanism in which users stake cryptocurrencies via their offline hardware wallets or an air-gapped software wallet.

It is worth noting that users would stop receiving rewards if they move their tokens out of their cold storage.

Such staking is ideal for institutional stakeholders who want to support the network while ensuring maximum protection of their cryptos.

But before one locks their cryptos, he/she should understand how much staking rewards they would earn in total. Every proof-of-stake blockchain offers a unique reward mechanism to its users. For instance, some projects adjust their tips on a block-by-block basis, taking into account the following factors:

- how many coins the validator is staking

- how long the validator has been actively staking

- how many coins are staked on the network in total

- the inflation rate

- other factors

In the meanwhile, some networks offer fixed-percentage returns to users on their crypto deposits as compensation for inflation. For instance, Algorand (ALGO) adds new tokens to their network at a rate determined by the protocol. It then distributes those tokens to holders as rewards.

With this model, users can calculate how much premium they will receive.

A predictable reward mechanism may look attractive over a probabilistic one. And since this is public information, it might incentivize more participants to get involved in staking.

To simplify things, there are dedicated staking calculators available online that one can use to determine their rewards based on specific amounts they would like to lock with the concerned network.

Which Staking Platform to Choose?

It is VERY crucial for users to spot red flags even in the most genuine staking platform. Choosing the wrong service could have people lose their rewards and stakes altogether. That does not mean the market lacks a good staking platform, but in many cases, the platforms hurt the users back with awkward terms and conditions or, in the worst-case scenario, an exit scam.

Here are some recommended practices when it comes to choosing a crypto staking platform/service.

- When you spot a new DeFi platform offering higher staking yields, don’t trust their offers blindly. It is recommended that users go over social media platforms, such as Facebook, Reddit, and Twitter, to see what other, genuine-looking people are saying about the staking service. Dev users usually spot inconsistencies and report them to the community. Therefore, other, non-technical users should keep their eyes open.

- Don’t fall prey to bigger annualized percentage yields, or APY, promises. It is advised to always prioritize a platform’s age and reputation (who is the founder; what’s his professional background, etc.) over its returns.

- Before staking, read the terms and conditions that govern the staking process. The rules may require users to keep their wallets connected to the internet 24/7 or to keep coins through a cooling period after users decide to withdraw them. Also, focus on a minimum stalking amount.

Risks

Crypto staking is not always a rosy affair. Be prepared to face the following risks while locking your crypto funds to run a blockchain network.

Price Volatility

You may stake your cryptocurrencies to earn, say, 10% rewards. But if the asset drops in value, the dollar-quoted value of your locked funds and returns would also fall in tandem.

Lock-up Periods

You’ll be forced to keep your assets locked with networks that require do not allow withdrawals up to a specific period. If the price of the staked asset drops, it would affect your holdings.

Hacks

Technical glitches in staking pools could lead to the loss of staked assets.

Project Failures

Staking in PoS projects that promise higher yields but fail midway could lead to the staked coins’ wipeout.