What Is VVS Finance: Deep Dive Into Cronos’ Main DEX

VVS Finance, or Very Very Simple Finance, is an automated market maker (AMM) DEX and the largest project built on the Cronos blockchain, launched by Crypto.com in 2021.

VVS facilitates liquidity pools, swaps, and staking and offers an intuitive UI aiming to drive global adoption of DeFi.

Read on for a deep dive into the VVS Finance protocol and its key features.

Executive Summary

- VVS Finance is an AMM DEX that facilitates trading with no order books or intermediaries. It implements a smart contract that uses the assets and liquidity offered by liquidity providers.

- VVS Finance’s unique selling points (USPs) include Bling Swap, Liquidity Provision, Crystal Farming, Glitter Mining, Initial Gem Offerings (IGOs), and Analytics.

- VVS is the VVS Finance protocol’s utility, reward, and governance token.

What Is VVS Finance?

VVS Finance is a decentralized finance (DeFi) platform built on the Cronos blockchain. It was created to simplify the DeFi market for everyone and empower the masses to take control of their finances.

To make DeFi more accessible to billions of consumers worldwide, VVS Finance offers fast transactions, minimal charges, and high potential earnings. The DeFi platform also intends to create passive revenue streams for users through various options, such as yield farming.

Definition: Yield farming is an investment strategy allowing users to lend their digital assets in exchange for benefits like interest or a share of the platform’s transaction fees.

Based on the Cronos blockchain, VVS Finance enables users to swap cryptocurrencies or stake their digital assets to provide liquidity in different liquidity pools. In exchange, VVS Finance allows investors to receive two-thirds of the collected swap fees. Similarly, the platform permits users to collect liquidity awards in the form of 0.2% of trading transaction fees.

The use of the AMM protocol enables VVS Finance to provide incentives to users to ensure long-term sustainable growth. The platform focuses on making it simple for users to transfer tokens and receive dividends “while having fun.” VVS Finance emphasizes the “fun” aspect of DeFi to onboard as many users as possible, including those with little to no prior experience in blockchain and cryptocurrency. The VVS team believes the more users on the platform, the better value there will be for network participants.

Who Created VVS Finance?

The VVS Finance team calls its members the “Craftsmen” – “Coming from a deep product design background, a team of humble farmers got together, determined to build DeFi products for our aunts and neighbors, to bring amazing protocols to the masses.”

While staying anonymous, VVS Finance has successfully created several valuable partnerships with key strategic partners, such as the Crypto.org and Crypto.com ecosystems.

What makes VVS Finance Unique?

VVS Finance’s unique selling points (USPs) include the following:

Bling Swap

Bling Swap is an algorithmic routing system that enables users to swap tokens across several liquidity pools to obtain a better price for the requested pair. Users can swap tokens for a small fee of 0.3%.

Liquidity Provision

Users can become Liquidity-Providers (LPs) by adding tokens to a liquidity pool. As evidence of their share of the pool’s assets, each LP is given a CRC-20 pool token (LP token). To trade through their liquidity pools, users must pay swap fees to LPs.

- Liquidity providers get two-thirds of swap fees (0.2% of swap volume at launch);

- 0.1% of the swap volume at launch, or one-third of swap fees, is held in treasury.

The swap fees are kept in liquidity pools’ reserves. Users will receive their proportionate part in exchange for their share of the reserves when pool tokens are returned.

Before choosing to contribute to a liquidity pool, LPs are advised to weigh the risk of impermanent loss against the anticipated share of fees and income because they may experience impermanent loss if the tokens’ prices decrease.

CRYSTAL Farming

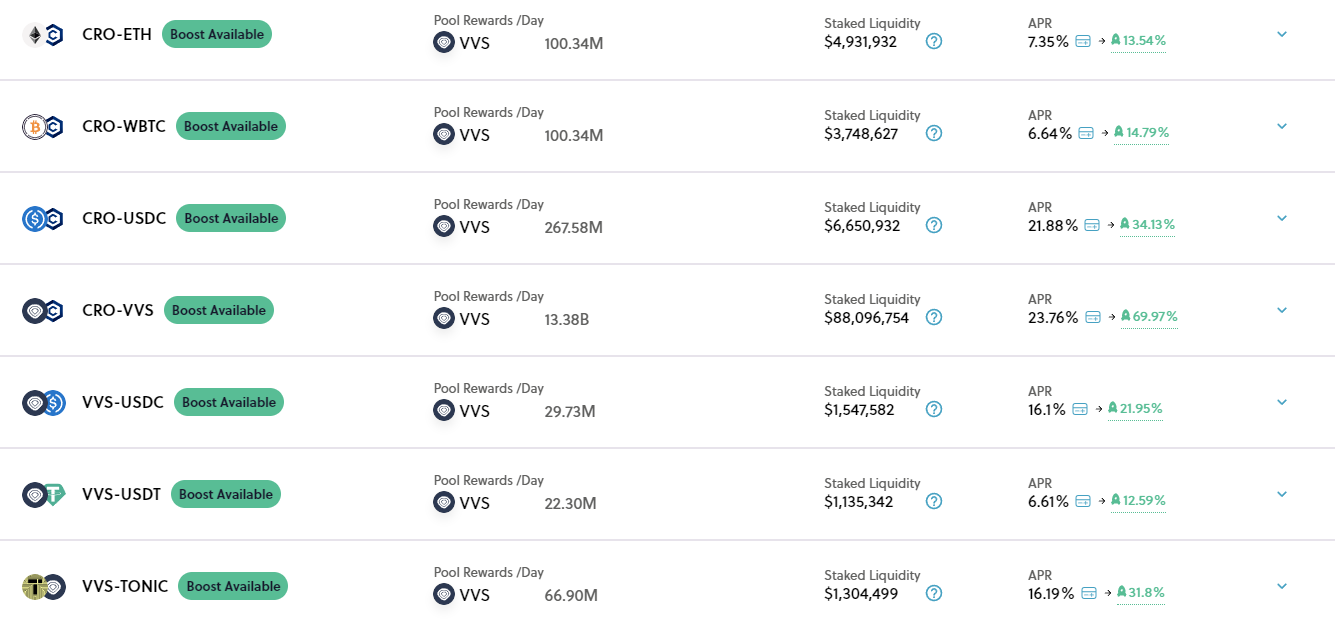

LPs can stake their LP tokens in “Crystal Farms” to get VVS tokens as rewards.

- View: Users can view the eligible pool, as well as the staked, earned, and APR percentages for each pool (accessible after Pioneer Farming Mode);

- Stake: Allows users to pay gas fees and quickly stake qualified LP tokens in a few clicks;

- Claim: Facilitates customers’ quick and easy claims of their accumulated VVS by paying gas fees;

- ROI calculator: Allows users to calculate their ROI by entering the stake amount, time frame, and compounding duration. (accessible after Pioneer Farming Mode).

Glitter Mining

The “Glitter Mine” allows non-LP users to stake VVS tokens and get VVS tokens or other partner tokens as rewards. In addition to the View, Stake, Claim, and ROI calculator features, users can also use auto-compounding, which allows users to activate the auto-compounding of staked VVS tokens for each user in the Auto VVS pool in exchange for VVS tokens.

Initial Gem Offerings (IGOs)

Users can benefit from larger rewards and early access to Cronos ecosystem’s new projects through the VVS Initial Gem Offerings. They can buy the new projects’ tokens using VVS-CRO LP tokens by participating in one of the two sale options: basic sale or unlimited sale. Let’s explore their characteristics.

Basic Sale

- Users can commit VVS-CRO tokens up to a maximum determined amount (differs for each project, e.g., $100, $500 worth)

- No participation fees

- If there’s an overflow in the subscription, any unspent LP token will be returned.

Unlimited Sale

- No cap on the amount of VVS-CRO to commit

- The participation fee will decline based on the percentage of overflow. The initial participation fee is set at 1%.

- If there’s an overflow in the subscription, any unspent LP token will be returned.

Analytics

Analytics allows users to access the overall VVS Finance protocol’s per-token/pair data, including liquidity, trading volume, etc. Users can access the VVS protocol via a dedicated web interface and connect using the Crypto.com Wallet Extension or any mobile wallet that supports WalletConnect (available on the Crypto.com DeFi Wallet).

VVS Finance intends to provide native wallet integration with popular wallets and API access in the future.

Why Is VVS Finance Popular?

VVS Finance intends to simplify DeFi by offering a user-friendly interface, seamless swaps, liquidity pools, staking, fast and cheap transactions, etc.

A cryptocurrency project’s health is also evaluated according to the following criteria:

- Substantial market cap: In the first few months since its launch, VVS Finance’s market cap increased from $20 to $170 million and has mirrored the general market trend since then.

- Reasonable trading volume: VVS Finance’s trading volume has primarily stayed within 5 and 20% of its market capitalization range.

- Price action: The protocol’s VVS token’s price action is approximately as volatile as you would anticipate from a new DEX project and a new chain, but without strange pumps.

What Is VVS Token?

VVS is the VVS Finance protocol’s utility, reward, and governance token. The VVS token was created on the Cronos blockchain’s CRC-20 architecture. VVS adopts an emission model in which 50 trillion VVS will be created in the first year and half of that every year after that (for example, 25 trillion in the second year), and the per-block emission is based on the chain’s technological design.

VVS tokenomics is as follows:

- 30% to farms and liquidity mining

- 23% to the team

- 15% to the community wallet for future initiatives

- 13.5% for network security and maintenance

- 13.5% for ecosystem development

- 2.5% to traders and referrers

- 2.5% to market makers.

In addition to the Cronos blockchain’s core VVS and CRO tokens, the protocol also supports USDT, USDC, SHIB, ATOM, and other tokens.

The VVS Finance team makes the current governance decisions in consultation with the community feedback; however, to fully decentralize the protocol, VVS Finance intends to hand the project over to VVS token holders gradually.

Make sure to track your crypto, NFT, and DeFi investments with CoinStats, the top portfolio tracker on the market.

How Many VVS Tokens Are in Circulation?

VVS’s total circulating supply is 2.2 trillion. Its total supply is over 36 trillion, increasing to 100 trillion over ten years through its emissions schedule.

How Does VVS Finance Work?

VVS Finance focuses on tested and audited protocols. It provides a lucrative creative program supported by the native VVS Finance token (VVS).

The protocol offers liquidity pools, each consisting of two tokens. Tokens are added to the pool by liquidity providers and then traded amongst traders.

The methodology is based on a formula for producing a consistent product. To clarify, after a swap is carried out, the sum of the quantities of both tokens in a pool stays the same. Additionally, the price slippage from the swap may differ according to the total number and distribution of tokens in the pool.

The stakeholders can profit from VVS Finance’s underlying mechanisms in the following ways:

- Liquidity providers (LPs): LPs receive 2/3 of the individual pools’ transaction fees. You will get VVS incentives for staking valid LP tokens under the “Crystal Farm” tab.

- VVS stakers: Stakers are rewarded in VVS and partner tokens for staking VVS on the “Glitter Mine” page.

- Trading incentives: Rewards for trading tokens on VVS Finance are promised to users who swap tokens on the platform but have yet to be made public. Referral program: Users recommending others to trade on VVS Finance will receive benefits that have yet to be disclosed.

A sizable amount of the VVS supply is set aside for future community projects to ensure benefits for the VVS Finance contributors and users.

Bottom Line

VVS Finance is built on the Cronos blockchain that facilitates cheap and fast transactions and leverages proven and audited protocols. It also provides a rewarding incentive scheme powered by the VVS Finance token.

The VVS Finance price prediction anticipated steady growth, drawing inference from its market capitalization moving from $20 to $170 million and then to $350 million in early April. If VVS Finance continues its steady growth, the protocol could retain its large market share on the Cronos blockchain.