Decentralized Finance DeFi is an umbrella term for a collection of financial products which rely on smart contracts and blockchains to enable peer-to-peer (P2P) financial services. It is one of the essential blockchain technology innovations and has brought a sweeping change in the global economy.

DeFi redefines traditional financial services such as lending, trading, investment, payment, insurance, etc., by disrupting the role of intermediaries and enabling permissionless, decentralized, and borderless services such as staking, efficient stablecoin trading, decentralized lending or Yield Farming, DEX (Decentralized exchanges), DeFi insurance, liquidity mining, etc.

To get an in-depth understanding of the DeFi system and how to make the most of the DeFi sector, read our detailed guide “What Is DeFi.”

DeFi staking is a rewards-type system that involves locking crypto assets in your cryptocurrency wallet for a specific period to verify blockchain transactions and contribute to the performance and safety of the blockchain network and earn rewards in the form of additional coins or tokens. Many DeFi protocols offer excellent incentives to crypto owners staking their cryptocurrency tokens and locking them into risky smart contracts by providing interest on investment and governance tokens.

In this article, we’re diving deep into DeFi staking, how it works, how to earn passive income with DeFi staking platforms, etc., so join us in our quest to find answers to questions like “What is DeFi staking,” “Why is DeFi staking used in the crypto world,” and more.

Let’s get right to it!

DeFi Staking Basics

Decentralized finance DeFi uses DApps and distributed ledger technology (DLT) to allow permissionless financial operations to be conducted within a peer-to-peer network. DeFi products are primarily owned by their users and give them complete control and visibility over their money. These products open financial services to anyone with an internet connection and expose users to global markets.

In DeFi, a smart contract replaces the financial institution in the transaction. DeFi staking ensures that only legitimate data and transactions are added to a blockchain. DeFi staking refers to users locking a certain amount of crypto assets for a set period in a wallet to ensure the optimal performance of a blockchain network in exchange for a reward.

The DeFi staking process requires a party wishing to support the blockchain to validate a blockchain block by staking cryptocurrency as a form of insurance. If they validate genuine transactions and data, they earn crypto as a reward; instead, if they improperly validate flawed or fraudulent data, they may lose their stake as a penalty.

How Does DeFi Staking Work?

Public blockchains operate as self-regulating systems without central authority through millions of participants globally who verify and authenticate transactions occurring on the blockchain. To ensure that all the transactions occurring on the network are correct, legitimate and that all participants agree on a consensus on the status of the ledger, these publicly shared ledgers need an efficient, fair, real-time, functional, reliable, and secure mechanism. This important task is performed by the consensus mechanism, which refers to a set of rules used to achieve agreement, trust, and security across a decentralized computer network.

Proof-of-Work (PoW) and Proof-of-Stake (PoS) are two of the most prevalent consensus mechanism algorithms, each of which works on different principles.

DeFi staking only applies to a blockchain network that uses the Proof-of-Stake (PoS) consensus mechanism, in which staking is used to validate transactions. In the Proof of Stake mechanism, a participant node is allocated the responsibility to maintain the public ledger. The right to verify transactions is algorithmically assigned to users. So, staking involves locking a set amount of crypto assets to participate in validation, i.e., verify transactions as needed and earn staking rewards.

Users staking digital assets in a PoS blockchain for an agreed-upon period to generate passive income in return are called validators. PoS validators provide value to the network and are selected based on the higher number of staked assets.

A Proof-of-Stake blockchain requires staking coins as collateral to validate blocks and verify transactions, which is less power-consuming and presents less centralization risk, and, therefore, solves scalability issues faced by a Proof-of-Work. The required processing power is much lower in a PoS blockchain because miners don’t need to solve complex puzzles to prove their work. As such, many in the industry have begun exploring PoS as an energy-efficient alternative in response to growing environmental awareness. In a PoW blockchain, miners have to compete to solve complex mathematical problems to verify and process transactions and add them as a new block in the blockchain. Staking on the PoW chain causes double computing power usage, used to store and run contracts and generate new blocks based on contract interactions.

Got crypto?

Make it work for you

How to Participate in DeFi Staking?

DeFi staking involves securing crypto assets into smart contracts to verify blockchain transactions and become a block validator for a specific DeFi protocol. To participate in staking within the crypto ecosystem and receive staking rewards, you can become a validator or join a staking pool.

1. Run a Validator Node

You can run a node by yourself on the internet and validate transactions by participating in the consensus of the selected blockchain. To become a validator and receive rewards, you must have a large amount of staked tokens. However, running your own node can be complicated and requires technical knowledge and to be connected to the internet at all times. The number of tokens you must stake to become a validator varies depending on the network.

2. Staking Services

You can assign several service providers to run a validator node on your behalf for a small fee on a monthly basis. It’s less complicated but requires a certain level of trust in the service provider.

3. Staking Pools

A staking pool offers staking opportunities to individual investors allowing them to join other crypto investors to raise staking capital to participate in various staking platforms and earn rewards. To run the node, staking pools collect a small amount of staked assets from different users and charge a small fee. The protocol rewards are distributed amongst the users that have staked their crypto assets in proportion to how much digital assets are staked.

4. Liquid Staking

In liquid staking, users who lock up funds to earn rewards still have access to the funds, as their staked assets are “wrapped” into new tokens with an equivalent value. The new tokens are fully transferable and can be used to generate yield.

Types of DeFi Staking

In addition to DeFi staking, there are some other popular DeFi activities highlighted below:

Staking in a DeFi Protocol

Users can lock their tokens in a DeFi protocol in exchange for rewards in the form of yield. DeFi protocols comprise lending and borrowing platforms like Aave or a decentralized exchanges (DEXs) like Uniswap or SushiSwap, etc.

Yield Farming

In yield farming, crypto investors deposit their funds into liquidity pools to provide liquidity to other users and become liquidity providers (LPs). Other users can borrow, loan, or trade the deposited tokens on a decentralized exchange powered by a particular pool. Platform fees are then distributed to liquidity providers in proportion to their percentage ownership of the liquidity pool.

LPs can move their crypto assets across different DeFi staking platforms to maximize passive income. DeFi tokens locked in yield farming are used to provide liquidity to decentralized exchanges.

Yield farming on DeFi platforms is conducted using automated market makers (AMM).

Unlike traditional markets, yield farming is available to users 24/7 without having to depend on any central authority or intermediaries.

To learn more about the differences between staking and yield farming, visit our “Staking vs. Yield Farming” guide.

Liquidity Mining

Yield farming and liquidity mining share some similarities. Liquidity mining involves locking a pair of crypto assets in liquidity pools to provide liquidity to DeFi platforms and earning passive income generated from the fees paid by users, who swap tokens using the provided liquidity. A typical liquidity pool consists of the two assets that make up a particular trading pair and uses an algorithm to ensure that the value of one of the assets is always equal to the value of the other.

Different liquidity providers are rewarded in proportion to how much liquidity they provide to the DEX. Moreover, liquidity mining is based on the basic staking concept that the more an LP contributes to a liquidity pool, the more significant portion of the profit they receive.

A decentralized exchange (DEX) uses an Automated Market Maker (AMM)to maintain liquidity in the exchange. AMMs incentivize users to become liquidity providers in exchange for a share of transaction fees and free tokens. To understand how liquidity mining works, let’s suppose you want to trade ETH/USDT on a DEX, where the price of ETH can equal 1,000 USDT. In most cases, liquidity providers must deposit an equal value of ETH and USDT to the liquidity pool, so someone depositing 1 ETH would have to match it with 1,000 USDT.

The liquidity in the pool means that when someone wants to trade ETH for USDT, they can do so based on the funds deposited. When LPs make a deposit, they receive a new token representing their stake, such as USDTETH.

Trading fees for swapping tokens paid by users are distributed to all LPs proportionate to their staked tokens. So if the USDC-ETH pool trading fees are 0.3%, and an LP has contributed 10% of the pool, they’ll get 10% of 0.3% of the total value of all trades.

Users must burn their pool tokens when they want to withdraw their stake in the liquidity pool.

DeFi Staking Advantages

Some of the DeFi staking advantages are as follows:

- DeFi staking gives users who don’t actively trade cryptocurrencies an opportunity to earn a substantial return on their holdings. DeFi staking is like depositing money in a traditional savings account, but instead of earning little to no interest, you can earn passive income with DeFi.

- Staking tokens for validating transactions on the blockchain is more environmentally friendly and less energy-consuming than mining. The required processing power is much lower in a PoS blockchain because miners don’t need to solve complex puzzles to prove their work.

- The staking process is secure, as it involves locking up the validator’s crypto in a smart contract.

- Providing liquidity to a liquidity pool offers a relatively stable trading opportunity to the DEX users and helps the DEX grow.

- A large amount of staked native tokens delivers the necessary liquidity to help prevent the cryptocurrency price from dropping excessively.

DeFi Staking Disadvantages

Some of the DeFi staking disadvantages are:

- Since cryptocurrency prices are highly volatile, if the price of your staked asset falls drastically, it might result in an impermanent loss. Liquidity pool impermanent loss happens when the price of a token increases or decreases after you deposit them in a liquidity pool. This change is considered a loss when the dollar value of your token at the time of your withdrawal becomes less than its amount at the time of deposit.

- The high gas fees for transactions on the Ethereum blockchain can be a hindrance when it comes to earning interest through DeFi staking.

Where to Stake DeFi Tokens?

Users can stake their crypto assets across different staking platforms ranging from decentralized to centralized exchanges. You can stake coins on a Layer 1 blockchain network such as Solana or on a DeFi protocol. While most staking pools are centralized and control your staked assets, decentralized staking protocols such as Yield.finance empowers you to stake your assets in a decentralized manner. The benefit of decentralized staking is that it gives you more control over your staked tokens. These platforms also offer “wrapped” tokens that can be used in the DeFi ecosystem for activities such as getting a loan, earning yield, trading, etc.

Staking rewards vary from one DeFi platform to another and depend upon the staked crypto asset, the number of staked crypto assets, the staking period, etc. It’s essential to choose a DeFi protocol with high security, a wide range of supported assets, and a decent annual percentage yield (APY) from the staking service providers available to you.

You can also use DeFi staking aggregators that aggregate several other liquidity pools and protocols — such as Ethereum and Binance Smart Chain — in a single location to maximize users’ profits. Note that Binance CEO Changpeng “CZ” Zhao invented the acronym CeDeFi, a combination of centralized and decentralized finance when the company debuted its Binance Smart Chain.

Users can also stake stablecoins on platforms like Stargate, Compound, Aave, dYdX, etc., to minimize the crypto market’s volatility. Here, users can borrow stablecoins against other crypto-assets like ETH, BTC, LTC, etc.

Synthetic Token staking platforms, such as the Synthetix platform, issue synthetic assets representing physical assets like stocks, bonds, fiat, etc., and allow investors to trade these using crypto.

Additionally, many Startups and enterprises are interested in DeFi staking platform development to attract users to their platforms with lucrative rewards.

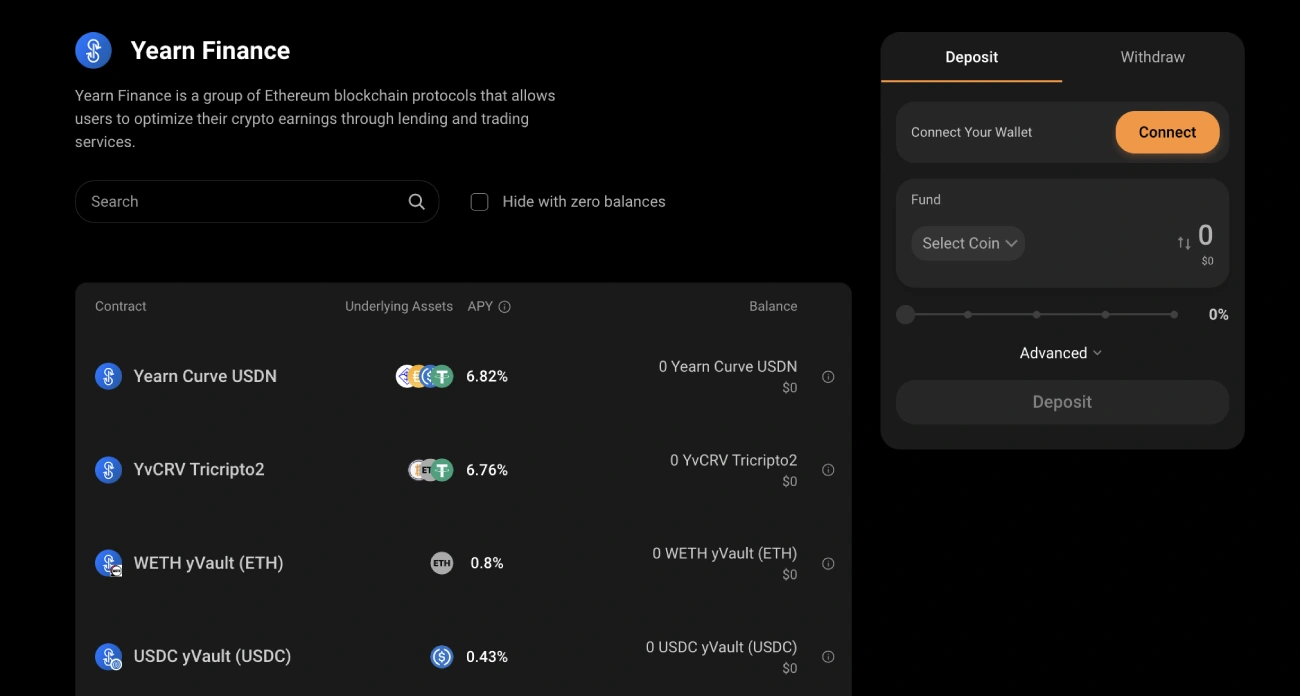

DeFi Staking on CoinStats

CoinStats provides users with essential tools, including a robust portfolio management dashboard, military-grade encryption, and staking. CoinStats Earn allows you to earn up to 20% APY by staking.

Some of the advantages of CoinStats Earn include:

High-Interest Rates

CoinStats Earn allows you to earn up to 20% APY by staking.

Low Fees

CoinStats charges minimal fees for DeFi staking compared to other DeFi staking platforms. CoinStats offers only the best hand-picked DeFi projects, with fees varying from protocol to protocol.

Intuitive Interface

CoinStats offers an easy-to-navigate and sleek interface, allowing you to start earning with your favorite DeFi project in minutes.

Security

CoinStats is highly safe, using multiple military-grade security measures to ensure that user investments are protected. Also, CoinStats never asks for your private keys; therefore, all your assets in your wallet are entirely under your control.

Yield Calculator

The CoinStats Yield Calculator allows you to calculate the interest you’ll earn from staking before staking your assets on CoinStats Earn. This will help you make a well-informed decision about the staking asset, amount, and staking period.

As you can see, CoinStats Earn offers you all the best tools for a great and secure DeFi staking experience.