Apollo Global Backs Morpho in $90M Governance Token Plan

0

0

This article was first published on The Bit Journal.

Apollo Morpho partnership represents a clear step by Apollo Global Management Inc. into decentralized lending, as the firm has entered a structured cooperation arrangement with Morpho to support on-chain credit systems and gain governance exposure within the protocol. The update was shared on February 13, 2026, by the Morpho Association, which stated that affiliates connected to Apollo are participating in the agreement.

The arrangement sets clear limits on token acquisitions and includes safeguards designed to manage ownership and transfer conditions over time. Together, the two sides aim to strengthen lending activity on the Morpho network, positioning the collaboration as a long-term infrastructure-focused effort rather than a short-term or speculative initiative.

What does the Apollo Morpho partnership involve in practical terms?

The Apollo Morpho partnership is built around a cooperation framework that links governance involvement with hands-on collaboration at the protocol level. As part of the agreement, Apollo or its affiliates are allowed to purchase up to 90 million MORPHO governance tokens over a period of 48 months.

This allocation equals 9% of the total fixed supply of 1 billion MORPHO tokens. The Morpho Association explained that these purchases can be made through open-market trades, over-the-counter deals, or other structured arrangements, all operating under defined ownership limits and transfer and trading restrictions.

Why is Apollo expanding into decentralized lending now?

The Apollo Morpho partnership highlights a steady expansion by Apollo into blockchain-focused financial infrastructure rather than an abrupt change in strategy. Apollo Global Management Inc., which oversees close to $940 billion in assets, has been building exposure to crypto and tokenization through targeted initiatives over time.

In the previous year, the firm worked with Coinbase on stablecoin-based credit strategies and made an undisclosed investment in Plume to back real-world asset tokenization efforts. Market participants say that working directly with a lending protocol gives Apollo a practical view of how onchain credit systems function at their core.

How does the Apollo Morpho partnership affect Morpho as a protocol?

The Apollo Morpho partnership brings added institutional credibility to Morpho while keeping its decentralized governance structure intact. Morpho functions as an open onchain lending network, providing permissionless markets and curated vaults that allow users to earn yield. The protocol ranks as the sixth-largest DeFi platform by total value locked, with $5.8 billion secured on the network, based on figures from DeFi Llama.

Control of the protocol continues to rest with MORPHO token holders, and the Morpho Association said the cooperation is focused on strengthening lending markets rather than changing governance. Galaxy Digital UK Limited acted as Morpho’s exclusive financial adviser for the agreement.

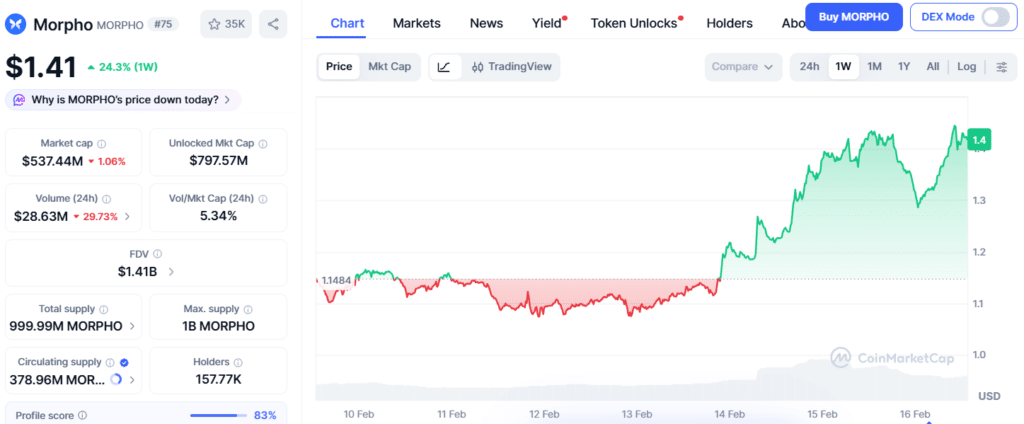

What price reaction followed the Apollo Morpho partnership announcement?

The Apollo Morpho partnership led to a noticeable but measured reaction in the MORPHO token market. Following the announcement, MORPHO gained 17% over the weekend, and it is currently trading around $1.42, down 0.46% in the past 24 hours but up 24.53% over the past week.

Despite these short-term gains, the token remains down 38% over the past year, reflecting continued pressure across the broader digital asset market. Traders noted that while institutional participation can boost short-term sentiment, sustained price performance will depend on ongoing lending activity and wider user adoption.

How does this deal build on Morpho’s recent partnerships?

The Apollo Morpho partnership continues a trend of growing institutional involvement with the protocol. Earlier this year, digital asset manager Bitwise introduced curated vaults on Morpho targeting a 6% annual yield.

More recently, Bitcoin-focused DeFi project Lombard selected Morpho as an initial liquidity partner for its Bitcoin Smart Accounts program. These collaborations have strengthened Morpho’s role as a backend infrastructure provider for onchain lending, rather than a platform aimed primarily at retail users.

What does the Apollo Morpho partnership suggest about institutional DeFi trends?

The Apollo Morpho partnership highlights a wider trend of major asset managers engaging directly with decentralized protocols. Analysts say there is rising interest in using onchain infrastructure as a complement to traditional financial systems, rather than a replacement.

Comparable moves by firms like BlackRock indicate that institutional adoption is advancing carefully, focusing on clear governance, risk management, and long-term strategic options. This cautious approach reflects the need for stability while exploring the potential of decentralized finance.

Conclusion

The Apollo Morpho partnership represents a careful collaboration between traditional financial capital and decentralized lending infrastructure. For Apollo, it provides a structured way to gain exposure to onchain credit systems through its affiliated entities.

For Morpho, it introduces institutional participation while maintaining its open governance model. As Apollo acquires tokens over the next four years, the agreement will act as a real-world example of how institutional finance and DeFi lending markets can operate together within clear, defined limits.

Glossary

Apollo Global Management: A top finance firm with $940B in assets.

Morpho: A DeFi platform for lending, borrowing, and earning on blockchain.

OTC Deals: Private token trades done outside public exchanges.

TVL: Total funds secured in a DeFi protocol; Morpho has $5.8B.

On-chain Lending: Lending and borrowing directly on the blockchain.

Frequently Asked Questions About Apollo Morpho Partnership

How many MORPHO tokens will Apollo buy?

Apollo or its affiliates can buy up to 90 million MORPHO tokens over 48 months.

What percentage of MORPHO tokens does 90 million represent?

It represents 9% of the total 1 billion MORPHO token supply.

How will Apollo buy the tokens?

Apollo can buy tokens through open-market trades, OTC deals, or other structured arrangements under set rules.

Why is Apollo entering decentralized lending?

Apollo wants to expand into blockchain finance and gain experience with onchain lending systems.

How did MORPHO’s price react to the announcement?

The token went up 17.8% over the weekend after the partnership news.

Sources

Read More: Apollo Global Backs Morpho in $90M Governance Token Plan">Apollo Global Backs Morpho in $90M Governance Token Plan

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.