HYDRA DEX | Network Upgrade Proposal

3

1

HYDRA DEX | Network Upgrade (Proposal)

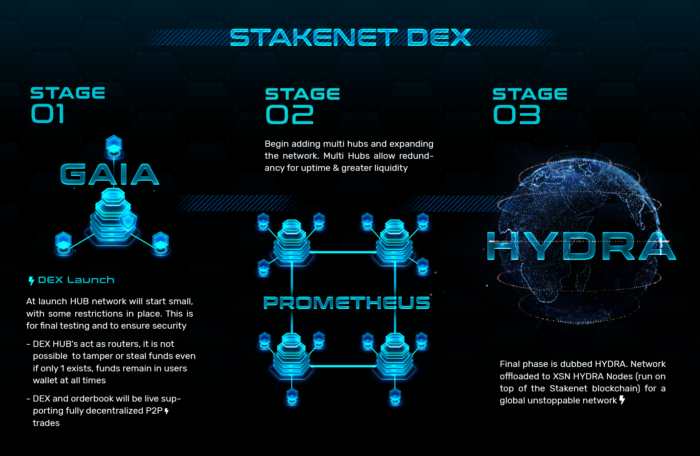

As our DEX begins to wrap up the final elements of Stage 1 and transition to Stage 2 “Prometheus”, our team has prepared initial architecture for the upcoming Stage 3 “Hydra” network upgrade.

NOTE: This Network Upgrade will require a Hard Fork. Current Masternode Governance/DAO will need to adopt the rules proposed. Changes to values and splits could be adjusted after launch via an on-chain governance vote.

In Stage 3, “Hydra”, a percentage of all trading fees from the DEX will go to the Masternode network running the DEX, as a commission payment for running infrastructure and the DEX/orderbook itself. We have been working with Liquidity Providers and Market Makers to come up with what we believe is a fair but industry-leading incentive model. We will dig into more details below.

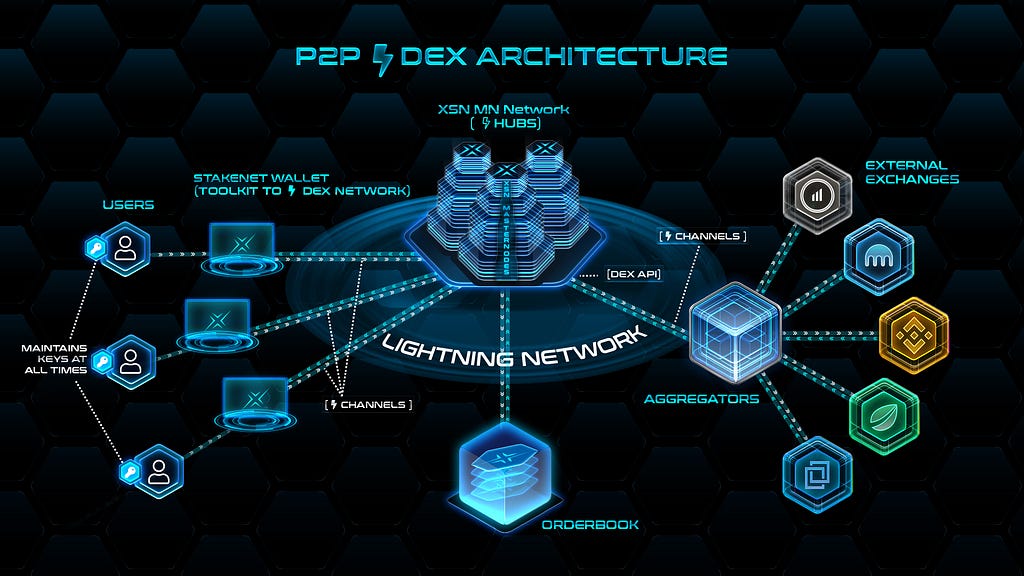

The DEX needs to be decentralized, thus hosted on the Masternode network, and it needs liquidity for users to trade. There are two types of liquidity in the DEX: Channel Liquidity (making up rentals and layer two routing infrastructure, provided by Masternodes) and Orderbook Liquidity (liquidity given to the orderbook itself, provided by Orderbook Liquidity Providers -OLPs).

Therefore, the main entities on the DEX are:

- Masternodes: Hosts and L2 (channel) Liquidity Providers.

- Orderbook Liquidity Providers.

Channel liquidity is needed for all assets, not just XSN. Masternodes are needed to provide this liquidity by acting as L2 Liquidity Providers. They play a critical role, not only by hosting the DEX but also by joining liquidity channels of all assets through hubs/orderbooks for users to trade on.

1. Masternode Hosts / L2 Liquidity Providers

All Masternodes can be used if they choose to (opt-in) host the DEX, contributing to the network infrastructure and collecting a percentage of the trading fees for executing their functionalities. This is what we call a Masternode Host.

They also have the option to earn additional routing/rental fees if they choose to. Those would not only host the DEX but also act as L2 Liquidity Providers, by providing Channel Liquidity and becoming what we call a DEX Hub.

This gives extra benefits to Masternodes, as any channel liquidity for assets they support in their DEX Hub can also be used for trading/market making, giving a greater return for the extra services provided. Keep in mind Channel Liquidity is different from the 15000 XSN locked in Masternodes — those are still locked.

To opt-in to hosting the DEX, your Masternode will have to meet certain hardware requirements. There are currently two different types of requirements depending on if you just want your Masternode to host the DEX, or if you want to also provide channel liquidity as a DEX Hub.

As we go through testing in Stage 2 we will finalise the specs needed for Hydra. As a point of reference, the current specs from developers running DEX Hosts and DEX Hubs are as follows, however; these are subject to change:

Masternode DEX Host: 8 vCPUs / 16GB RAM / 50GB Disk

Masternode DEX Hub: 6 vCPUs / 16GB RAM / 320GB SSD

2. Orderbook Liquidity Providers (OLPs)

Any user with a wallet, even without owning a Masternode, can provide liquidity to the orderbook and collect a percentage of the taker fees (similar to Uniswap).

It is important to know that with every trade there is a Maker and a Taker. The Maker provides limit buy/sell orders to the orderbook, and the Taker is the person market buying/selling into them.

Our plan is to operate with a Taker pays Maker structure so market orders pay 0.25% and limit orders have negative fees. This is done by a 0% fee for Makers and 0.25% for Takers. The Maker will be paid between 45–67.5% of the fees from each trade made with them depending on the total DEX volume. This essentially makes negative trading rates for Makers, compared to at best 0% on a spot exchange giving a very strong incentive to trade on our DEX and provide liquidity over anywhere else.

During Stage 2 — Prometheus and working with our liquidity and market maker partners our Maker pays Taker model will be active and you will still be able to earn a % from P2P trading during this time. This is open to anyone who provides orderbook liquidity, if you place a Maker order on the DEX and someone buys it, you will earn a % of fees associated with that trade.

Estimated Masternode rewards

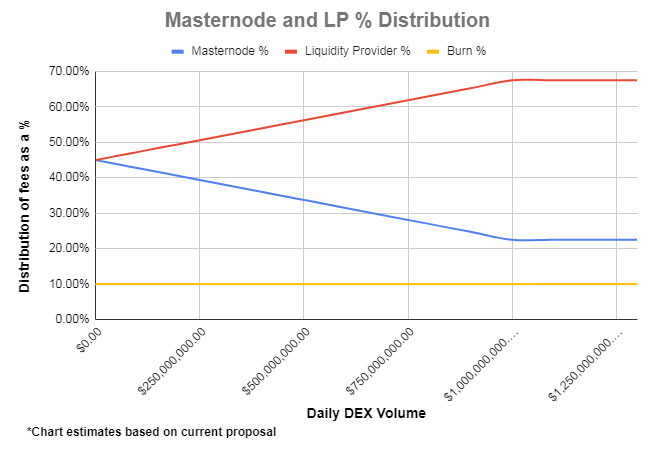

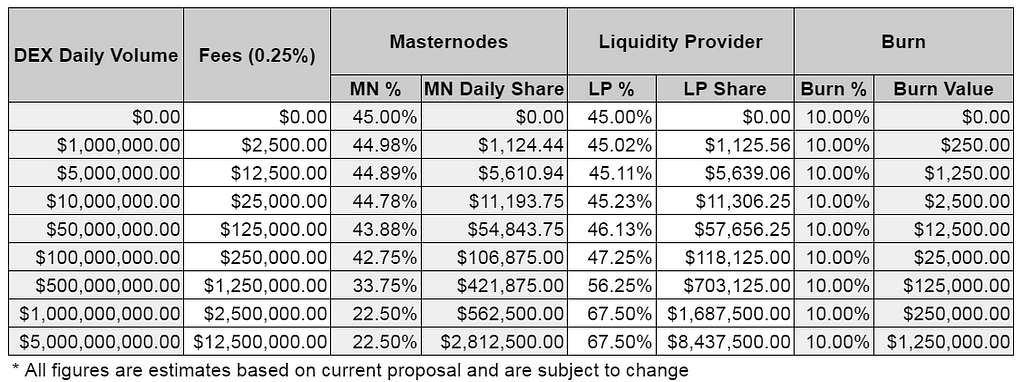

The following is a Masternode reward structure we feel will provide strength and scale with the network based on increasing volume (estimated at a 2800 node count with everyone opting in, trading fees dynamically adjusted between 22.5–45% to Masternodes Hosts based on volume).

We propose the following equation to balance the rewards between Orderbook Liquidity providers (OLP) and Masternodes Hosts. In any case, 10% of trading fees will be utilized to buy back and burn XSN.

y = 45 - 0.0225x

z = 90 - y

where:

x = daily volume of the DEX in million dollars.

y = % share of the Masternodes Hosts from trading fees.

z = % share of the OLP’s from trading fees.

This equation gives almost an equal share to Masternodes Hosts and Orderbook Liquidity Providers for low DEX volumes. And as the volume increases and OLPs put more liquidity on the DEX, their share increases due to their increased exposure to the market.

The Masternodes Hosts share from trading fees will be fixed at 22.5% above $1B daily volume.

To clarify, below are some rough estimations of what one Masternode Host could earn daily from DEX trading fees (estimated at a 2800 MN count of all running the DEX):

$1M daily volume, average daily fees to 1 MN ~ $0.40 (45%)

$10M daily volume, average daily fees to 1 MN ~ $3.99 (44.78%)

$200M daily volume, average daily fees to 1 MN ~ $72.32 (40.5%)

$400M daily volume, average daily fees to 1 MN ~ $128.57 (36%)

$800M daily volume, average daily fees to 1 MN ~ $192.85 (27%)

$1B daily volume, average daily fees to 1 MN ~ $200.89 (22.5%)

This would be paid in XSN to the Masternodes hosting the DEX and would create constant market buy pressure for XSN, in addition to the 10% already being market bought from the trading fees to burn.

These rewards above would serve as additional rewards on top of the 45% block rewards that go to the Masternodes for providing their node services. Currently, Masternodes yield ~15% APY on block rewards as is, without the HYDRA DEX service being live or any of the other services Masternodes will be able to provide, such as TPoS contracts.

How does liquidity providing work/what's the purpose?

Over 90% of trades on CEXs aren’t done by a normal user — most of the time you are trading against bots: market makers algorithms, arbitrage algorithms, exchange algorithms, etc. As traders don’t like to trade at illiquid exchanges, you have to set up liquidity to attract users.

One unique aspect about our DEX is that it is one of the very first DEX’s able to make instant (layer 2) trades comparable to a CEX. So an OLP can utilize our DEX with a high degree of confidence for arbitrage, for example: to buy a coin at a CEX, while selling from their user-controlled wallet on our DEX.

This will bring liquidity, volume, and fees to both exchanges, while the arbitrage bot/OLP makes some profit and continues the service.

Join us on Discord and follow us on Twitter to stay up-to-date with our latest news and developments.

HYDRA DEX | Network Upgrade Proposal was originally published in Stakenet (XSN) on Medium, where people are continuing the conversation by highlighting and responding to this story.

3

1