Crypto: ConsenSys Challenges the SEC to Defend Ethereum’s Status

1

0

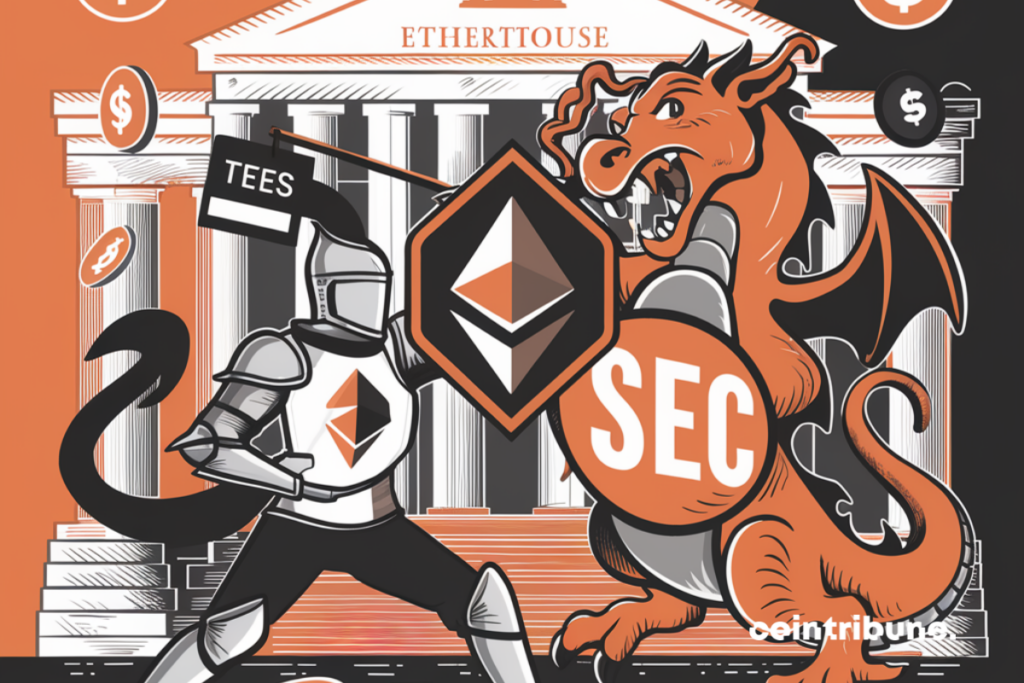

In a bold legal move, ConsenSys, a leading company in the Ethereum ecosystem, is taking on the SEC, accusing it of overstepping its regulatory powers. The stakes: determining whether the cryptocurrency Ether should be considered a security.

ConsenSys Takes on the SEC

The blockchain pioneer, ConsenSys has filed a 34-page lawsuit in a federal court in Texas, denouncing what it calls “illegal seizure of authority” by the SEC over Ethereum.

According to ConsenSys, the regulator’s efforts to assert jurisdiction over this smart contract blockchain threaten not only the company but also the entire crypto ecosystem.

As reported by Fortune Crypto, this action aims to prevent an imminent SEC lawsuit regarding MetaMask. It also demands a court decision affirming that ETH is not a financial security, contrary to the regulator’s assumed position.

For ConsenSys, the SEC’s attempts to extend its authority over Ethereum are illegal and threaten the entire blockchain ecosystem. “Every ETH holder, including ConsenSys, would fear violating the securities laws if they were to transfer ETH across the network,” the complaint emphasizes, warning that such a situation “would paralyze the use of the Ethereum blockchain in the United States”.

The SEC Goes to War

This lawsuit comes in a tense context, as Gary Gensler, the chairman of the SEC, intensifies his offensives against major players in the crypto assets industry. Companies like Uniswap Labs have thus been targeted by a spate of subpoenas.

Many experts criticize the SEC’s approach, deeming it opaque and unsuited to the specificities of blockchain technology.

The status of ETH is at the heart of the controversy. Previously, the SEC considered that Ethereum tokens, like Bitcoin, were not financial securities. However, according to Joe Lubin, founder of ConsenSys, the SEC would now attempt to use Ethereum staking as a precedent for continuing its crackdown on crypto assets.

The ConsenSys complaint reveals that the SEC issued a Wells notice in early April, threatening to sue over MetaMask’s role in the staking of ETH, a consensus mechanism introduced in September 2022.

This legal battle echoes ConsenSys’ efforts to promote the approval of an Ethereum spot ETF, highlighting the security and environmental advantages of Ethereum over Bitcoin. Nevertheless, the SEC has recently postponed its decision on the Ethereum ETF proposals by Grayscale and Franklin Templeton.

The outcome of this trial will have significant repercussions on the future of crypto regulation in the United States. A clarification of the legal framework is more necessary than ever to foster innovation and adoption of this disruptive technology.

1

0