Grayscale Is Now Offering Staking Services for These Cryptos

1

0

Grayscale, the titan behind the largest spot Bitcoin exchange-traded fund (ETF), has unveiled the Grayscale Dynamic Income Fund (GDIF). This novel fund heralds a fresh era in crypto staking, an approach gaining momentum in the decentralized finance (DeFi) world.

Through GDIF, Grayscale ventures into new territory. It aims to offer investors a blend of growth potential and convenience in digital asset investment.

Grayscale Launches First Actively Managed Fund

The fund will initially support nine altcoins. This includes Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), Near (NEAR), Osmosis (OSMO), Polkadot (DOT), SEI Network (SEI), and Solana (SOL). Importantly, GDIF plans to distribute income in US dollars on a quarterly basis.

“GDIF seeks to optimize income in the form of staking rewards associated with proof-of-stake digital assets, with capital appreciation from such investments as a secondary goal,” Grayscale clarified.

Crypto staking is a core function within specific blockchains, distinct from Bitcoin’s proof-of-work model. In proof-of-stake networks, token holders can allocate their assets to support the network’s operations and, in return, earn income.

This practice has become increasingly popular, evidenced by innovations like EigenLayer, which boosts staking efficiency. Moreover, airdrop hunters are increasingly staking certain tokens to enhance their distribution chances.

Read more: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

Furthermore, Grayscale is broadening its product range, recently proposing a privacy-focused ETF to the US Securities and Exchange Commission (SEC). Aimed to mirror the performance of crucial privacy and cybersecurity sectors, this ETF includes pivotal technologies like blockchain, emphasizing digital currencies prioritizing encryption and user privacy, notably the Grayscale Zcash Trust (ZCSH).

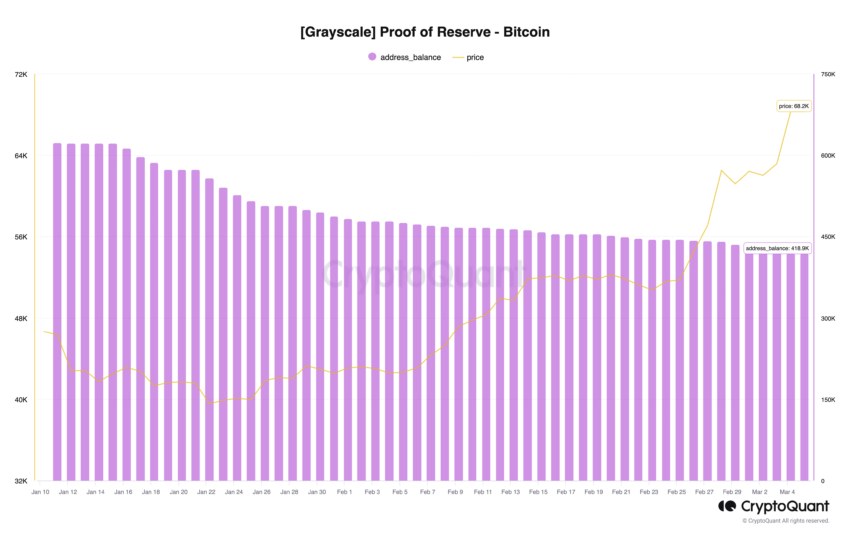

However, amidst these innovations, Grayscale’s Bitcoin Trust (GBTC) has encountered challenges, seeing nearly $10 billion in outflows since its ETF transformation. According to data from Farside Investors, there was an outflow of $332 million from GBTC on Tuesday as the Bitcoin hit an all-time high.

Grayscale Bitcoin Reserve Since ETF Conversion. Source: CryptoQuant

Grayscale Bitcoin Reserve Since ETF Conversion. Source: CryptoQuant

This trend aligns with rising investor interest in alternative exchange-traded products with lower fees, such as BlackRock’s iShares Bitcoin Trust, which significantly undercuts GBTC’s fees. This shift indicates a changing preference among investors towards more economical options in the digital asset market.

1

0