Crypto Prices Today: Why BTC, XRP, LINK, XMR Are Sliding

0

0

This article was first published on The Bit Journal.

Market slide sets the tone for crypto prices today

Risk appetite faded fast at the start of the week, and the tape looked more like a crowded exit than a calm pullback. Across majors, sellers kept control while leveraged traders absorbed the worst of the move, a familiar recipe when momentum turns and liquidity gets patchy. This is the kind of session where headlines matter less than positioning, because forced selling can make even solid charts look shaky in a hurry.

Total market cap and what it signals

The broader market moved lower with the global crypto market cap sitting around $2.54T, showing a clear day-over-day decline and a still-elevated 24-hour trading volume that points to active distribution rather than quiet drifting. When the market cap drops while volume stays heavy, it often reflects urgency, not patience, and that is a key backdrop for crypto prices today.

Leverage, liquidations, and sentiment

Derivatives data showed how quickly leverage became a problem. Liquidations climbed to about $520M over 24 hours, while open interest rose to roughly $108B, a combination that suggests traders kept adding exposure even as conditions worsened. In plain terms, positions stayed crowded, then got squeezed. At the same time, the Crypto Fear and Greed Index printed 14, an “extreme fear” reading that often appears when traders start protecting capital first and asking questions later.

Crypto prices today in focus: BTC, XRP, LINK, and XMR

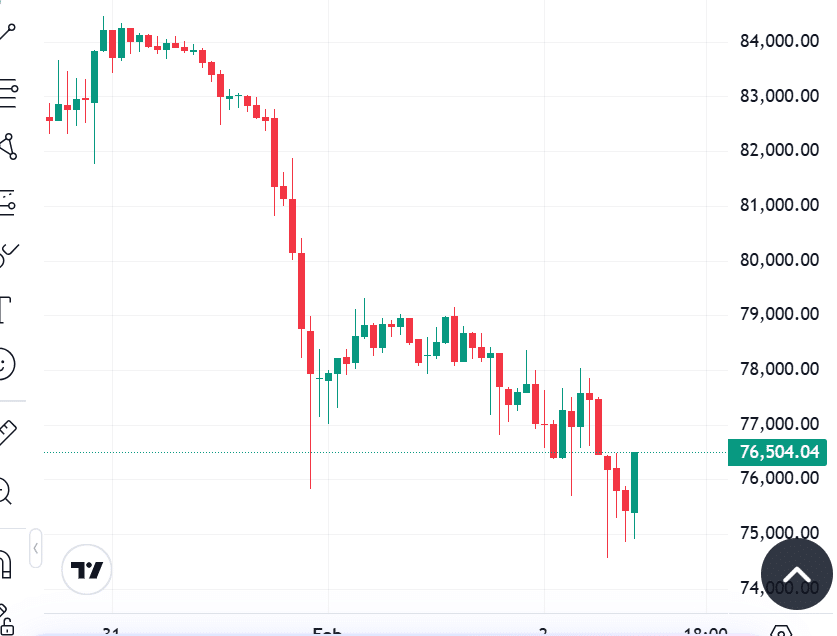

Bitcoin (BTC)

Bitcoin traded near $75,182, down on the day, and the chart narrative is straightforward: sellers defended rebounds and buyers looked cautious around prior support. In sessions like this, traders watch whether price can reclaim broken levels quickly, because a slow bounce tends to invite another round of selling. For crypto prices today, the practical tell is follow-through: if volume fades on a rebound, it can signal a relief rally rather than a trend change.

XRP (XRP)

XRP changed hands around $1.55 with a notable daily drop, and it continued to underperform Bitcoin, which usually means risk rotation is still underway. When a large-cap alt slips harder than BTC, it often reflects traders trimming higher beta exposure first. In the context of crypto prices today, XRP bulls typically want to see stabilization on rising spot volume, because bounces driven mainly by derivatives can fade quickly.

Chainlink (LINK)

Chainlink hovered near $9.56, also lower, and its setup fits a common late-selloff pattern: sharp downside moves followed by short, choppy consolidations.

LINK tends to respond well when the market moves from panic to selective buying, but that usually starts with cleaner candles and less intraday whipsaw. For crypto prices today, traders often track whether LINK can hold a base while BTC decides direction, since LINK strength without BTC support is harder to sustain.

Monero (XMR)

Monero traded around $393 and showed one of the steepest declines in this group. Big percentage moves in XMR can arrive fast, and when they do, the next phase often depends on whether sellers exhaust quickly or keep pressing into thin liquidity. In crypto prices today, XMR is the clearest reminder that drawdowns get amplified when stop orders and forced liquidations stack on top of one another.

Key indicators traders watch next

For the next 24 to 48 hours, the market’s “health check” is less about predictions and more about observable signals. Price action around prior support and resistance levels matters, but so do liquidations and open interest, because a second liquidation wave can restart the slide.

Volume is the honesty test, since real demand usually shows up as rising volume on green candles, not just a bounce on thin trading. Dominance also matters: if Bitcoin’s share rises while the market falls, it often signals defensiveness, which can keep pressure on alts even when BTC steadies. These indicators frame the next turn in crypto prices today.

Conclusion

This was a leverage-led drop with fear running high, not a quiet, orderly reset. BTC held the spotlight near $75K, while XRP and LINK reflected risk-off rotation, and XMR showed how quickly volatility can bite when liquidity thins. The next move will likely be decided by whether forced selling cools down and spot buyers return with conviction, because without that, crypto prices today can stay heavy even after a sharp dip.

FAQs

Glossary of key terms

Support is a price area where buyers have previously stepped in.

Resistance is a level where selling has often appeared.

Open interest is the total number of outstanding derivatives contracts, and rising open interest during a drop can signal crowded positioning.

Liquidations are forced position closures when margin is insufficient, which can accelerate losses.

RSI is a momentum oscillator traders use to gauge overbought or oversold conditions.

Market cap is the total value of a crypto asset or the entire market, calculated using price and circulating supply.

References

Read More: Crypto Prices Today: Why BTC, XRP, LINK, XMR Are Sliding">Crypto Prices Today: Why BTC, XRP, LINK, XMR Are Sliding

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.