Bitcoin Price Decline Continues: BTC Risks Dropping Below $64,500

0

0

- Bitcoin remains trapped in a downtrend, dipping below the $65,000 mark.

- The primary support levels appear vulnerable to further bearish pressures.

- Technical patterns are indicating potential for continued declines.

Discover the latest trends in the crypto market and why Bitcoin might face tougher days ahead.

Bitcoin Price Continues to Slide

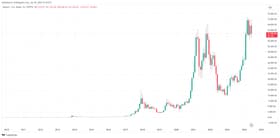

The price of Bitcoin has struggled to break above the $66,500 resistance level, continuing its recent bearish trend. Originating a fresh decline from a peak of $67,256, Bitcoin has since dropped below two critical support levels: $65,500 and $65,000, and currently teeters around the $64,600 mark. The price briefly rebounded above the $65,000 level, posting a minor rise to the 23.6% Fib retracement level of the downswing from $67,256 to $64,611. However, it remains beneath the $66,000 barrier and the 100-hourly Simple Moving Average.

Key Resistance Levels to Watch

Despite the bounce, Bitcoin faces significant resistance around $66,000. This is compounded by a trend line resistance pegged near $67,500 as observed on the hourly chart for the BTC/USD pair. Any attempt to rally would first have to overcome the $66,000 resistance, followed by critical levels at $66,250 and $66,500. A successful breach might propel Bitcoin upwards towards the $67,500 resistance, with a potential to reach as high as $68,500 in the near-term.

Bearish Trends and Support Levels

Should Bitcoin fail to mount a recovery above the $66,000 threshold, it’s likely to encounter further losses. Immediate support is anticipated near $65,000, but the principal support level is now positioned at $64,600. Another crucial support floor lies at $64,500, where a breach could trigger a deeper plunge towards $63,200.

Technical Indicators Highlight Worrying Signs

Current technical analyses suggest that bearish momentum is picking up. The MACD (Moving Average Convergence Divergence) indicator on the hourly chart is gaining negative pace, reinforcing the downtrend. Simultaneously, the RSI (Relative Strength Index) has slumped below the 50 mark, further signaling a bearish outlook. Major support levels sit at $65,000 and $64,500, while immediate resistances are pegged at $66,000 and $66,500.

Conclusion

Ethereum’s price continues to face downward pressure, making the next few days crucial for its market trajectory. Investors should keep an eye on key support and resistance levels and closely monitor any shifts in technical indicators, which could offer insights into potential price movements.

0

0