US government tightens its DeFi net with raft of rule proposals

1

0

A version of this story appeared in our The Guidance newsletter on February 12. Sign up here.

DeFi is becoming enmeshed with the rest of the financial markets — leaving US regulators concerned about new risks.

Their fears?

That DeFi endangers consumers and the financial system at large, facilitates financial crime, and is being used to fund terrorist groups and America’s enemies.

Just last week, the Securities and Exchange Commission adopted a rule that DeFi lobbyists fear will force liquidity providers to shoulder a heavy compliance burden.

Let’s take a look at some of the newest regulatory proposals.

DEXs pulled into SEC’s orbit

The SEC has consulted on rules to widen the definition of “exchange.”

If approved, the new definition would force any electronic platform connecting buyers and sellers of securities to register with the regulator.

DeFi advocates say that could push the front ends of decentralised exchanges under the SEC’s authority.

That rule change isn’t final yet. Washington insiders say it’s been delayed by other priorities.

But it’s ready to go whenever the SEC gets around to adopting it.

Taxman comes for crypto

In August, the US tax authority proposed reporting rules that will force so-called “digital asset middlemen” — like DeFi and non-custodial wallet projects — to report the personal information of their customers.

The Internal Revenue Service is currently considering the deluge of comments it got from the public during its consultation process, which closed at the end of October.

Treasury cracks down on crypto mixers

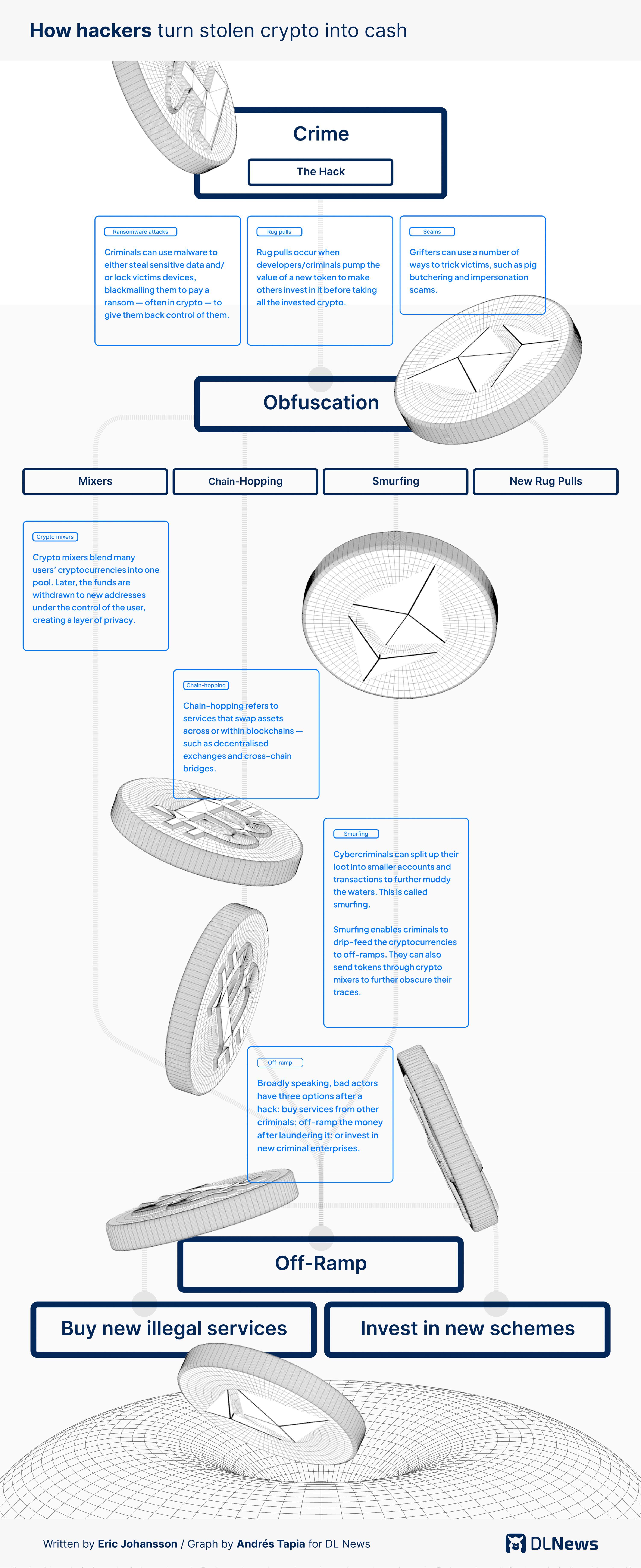

In October, the Treasury under its Patriot Act powers proposed regulation to restrict the use of crypto mixers like Tornado Cash.

Financial institutions that interact with blenders must file reports about suspicious transactions, including wallet details and customers’ personal information, if the rules are adopted.

The Treasury is currently digesting comments received from the public on this proposal.

Law enforcement agencies have tied the use of mixers to money laundering and as a way for cybercriminals to get away with stolen funds.

The CFPB strikes

Even the US’s financial product watchdog the Consumer Financial Protection Bureau has turned up the heat.

It recently proposed to regulate crypto wallet providers under the same framework as large banks.

Culture clash

All this activity points to how the government is getting to grips with DeFi.

But there’s a culture clash.

DeFi promoters say their users value privacy, and ordering them to supply personal information to authorities is constitutional overreach.

Even more fundamentally, they say, it’s impossible for decentralised projects to comply even if they wanted to, as regulation always assumes the existence of an intermediary.

Regulators counter that most DeFi projects aren’t very decentralised.

There’s almost always someone — investors, promoters, developers — reaping the rewards or making the decisions, and they can be held accountable for compliance breaches.

Polygon Labs Chief Legal Officer Rebecca Rettig recently published a paper in which she and her co-authors present a model for how DeFi could be regulated to prevent illicit financing.

The industry is realising regulation is inevitable and is getting out in front of how it could develop.

Email me joanna@dlnews.com, or Telegram @joannallama.

1

0